The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Oil is trading near all-time highs these days. It has reached the two-year high last week. Indeed, the demand for fossil fuels is strong, and the uptrend is likely to remain.

Credible banks have bullish forecasts on oil. Bank of America predicts oil prices will hit the $100 level next year. If crude gets back to triple digits, it will be the first time since 2014! Citi believes oil prices might surge above $80 this summer. Goldman Sachs ranks Canadian oil producers as the most promising because they see oil will grow further. Indeed, the travel bans will be eased and people will start using their private cars more. Thus, the consumption and thus demand will rise.

Such optimistic forecasts add pressure on the OPEC+ members to increase oil output. By the way, they will meet next week on Thursday. If you are interested in trading oil, follow this event to know the outcome as it will influence oil prices. Check our economic calendar to know all the impactful events.

The new president has been elected in Iran. His name is Ebrahim Raisi, and he is subject to US sanctions. Iran insists on removing these sanctions to revive the pact: Iran will limit its nuclear activities in return for sanctions relief. Iran re-started prohibited nuclear work after Donald Trump broke the rule and re-imposed sanctions on Iran. The question is who will make a first move: Biden or Raisi. A deal could lead to Iran exporting an extra 1 million barrels per day, equals to 1% of global supply, for more than six months. After Iran’s president was elected, the US and Iran took 10 days of pause in their talks. Follow the news further.

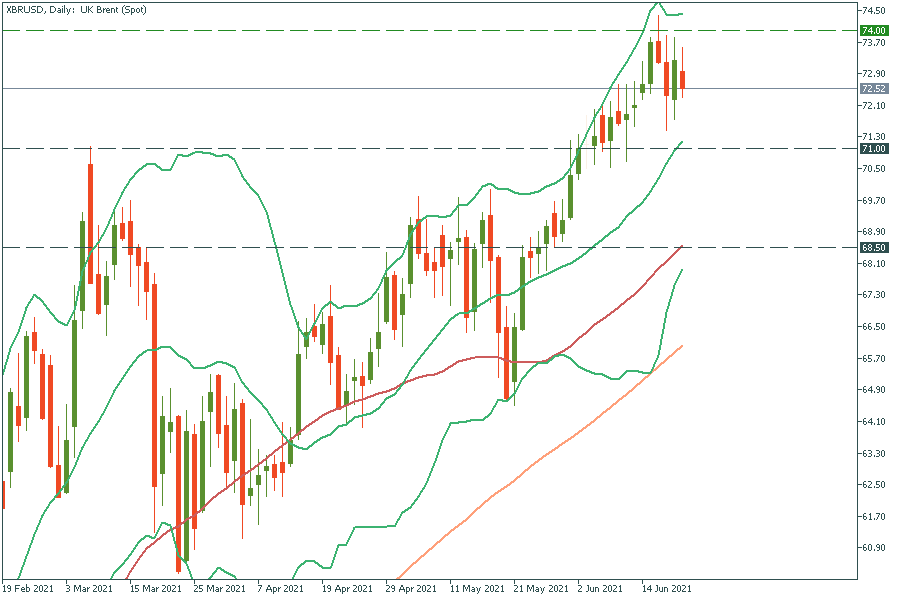

XBR/USD (Brent oil) keeps attacking the upper line of Bollinger Bands. It has been moving sideways just below $74.00 a barrel for the last few days. The breakout above this resistance level will open the doors to the next round number of $75.00 and then for the long-term price target of $80.00. Support levels are at the midline of Bollinger Bands at $71.00 and the 50-day moving average of $68.50.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later