The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

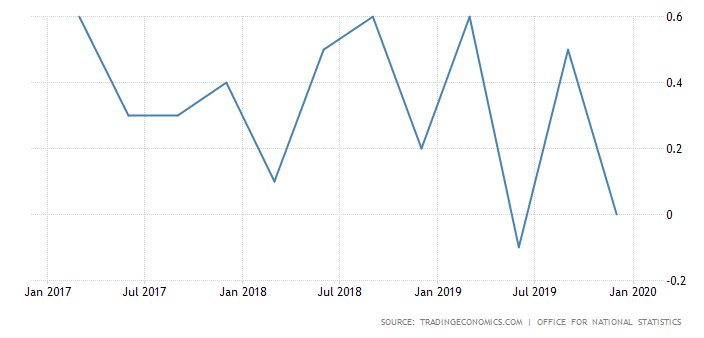

Today, the Bank of England made an emergency cut of its interest rate. The regulator shifted the interest rate by 50 basis points to 0.25%. The action was driven by a slowdown of the British GDP growth for January (0% vs. 0.2% expected) and the global uncertainties amid the coronavirus outbreak.

UK GDP growth rate

Source: Trading economics

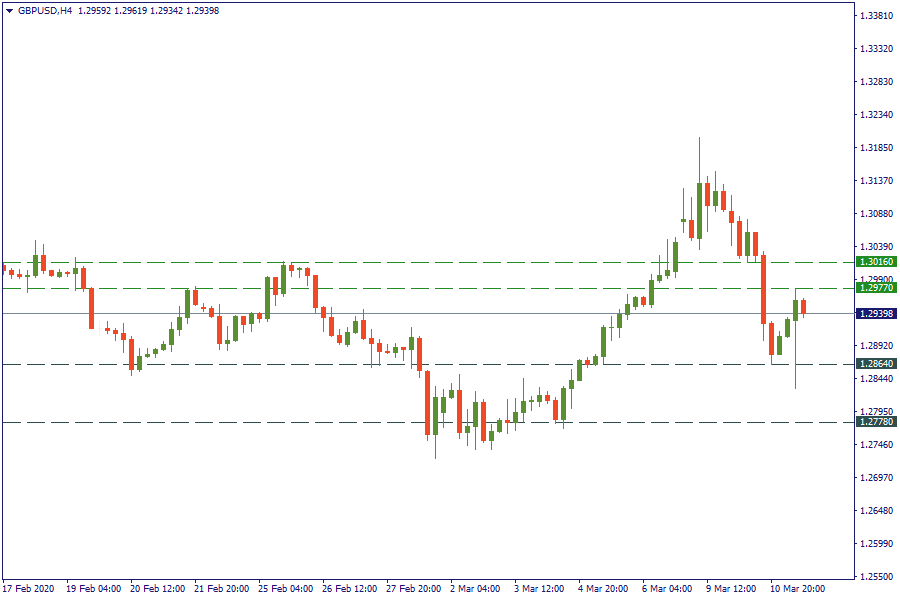

But there is some optimistic news as well. During the press conference, the BOE governor acknowledged the economic shock caused by the virus, but, at the same time, expressed confidence about its temporary effect. Thus, the weakness of the GBP was short-lived, as bulls took over the market on the Mr. Carney’s beliefs.

Even though GBP/USD plunged below the 1.2864 level, buyers managed to push it higher and help it to retest the 1.2977 level.

If you’re the GBP trader there is no time to relax today. The upcoming UK budget update at 14:30 MT time will contain stimulus measures, which are expected to support the economy and businesses. Follow the updates, as they may have an impact on the GBP.

The market presents a wide range of opportunities today. Besides GBP/USD, take a look at the EUR/GBP. This pair may be a good choice for those who don’t want to deal with the USD volatility expected on the US inflation release at 14:30 MT time.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later