The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Fed Chair Jerome Powell’s comments on the Jackson Hole Symposium resulted in the worst weekly candle in US500 since June. Most risky assets experienced severe drawdowns, and EURUSD returned to the above-parity area. However, a positive CB Consumer Confidence release (103.2 actual vs. 97.6 expected) dumped the pair by 450 points because it indirectly shows rising prices.

Eurostat released its CPI Flash Estimate data. It shows that prices rose by 9.1% annually due to the energy crisis. For example, the cost of gas in Europe exceeded $3600 per metric ton, almost touching the all-time high for the commodity. The week’s most significant release is Non-Farm Payrolls, which turned out to be higher than expected (315K actual vs. 295K forecast). As a result, gold soared by 900 points.

Below are the key events to trade on from September 5 to 9.

September 6, 07:30 GMT+3

The Reserve Bank of Australia (RBA) will release its Cash Rate change on Tuesday, September 6, 07:30 GMT+3. This is the rate charged on overnight loans between banks and other financial institutions.

Australia has a chance of entering stagflation (price growth and economic slowdown). As inflation continues to be the key economic risk, consumption growth is also slowing down. The RBA wants to apply moderate rate changes to take inflation under control. We expect the bank to hike the rate by 50 basis points in September.

Last time, the bank made a 50-basis-point hike, coinciding with the expectations. Traders consider it insufficiently hawkish action; AUDUSD lost 1310 points that day.

Instruments to trade: AUDUSD, AUDJPY, EURAUD.

September 7, 17:00 GMT+3.

The Bank of Canada (BOC) will release its Overnight Rate change on Wednesday, September 7, 17:00 GMT+3. It tells at which rate major financial institutions borrow and lend funds.

Short-term interest rates are the paramount factor in currency valuation; traders look at other indicators to predict how rates will change. The rate decision comes with the BOC rate statement, which focuses on the future. Usually, volatility spikes follow the event. Inflation growth in the US is slowing down. Thus, the chances of a 75-basis-point hike are lowering, and the event should be noteworthy.

Last time, the BOC surprised markets with a 100-basis-point move the bank described as “front-loading.” The CADJPY pair soared 1540 points on the release day.

Instruments to trade: CADJPY, USDCAD, EURCAD.

September 8, 15:15 GMT+3.

The European Central Bank (ECB) will release its Main Refinancing Rate change on Thursday, September 8, 15:15 GMT+3. This rate is a primary measure of the union’s monetary policy that shows how the EU deals with the current economic and geopolitical challenges.

The ECB has little choice but to continue tightening even if Europe’s economy tips into recession. The last is getting more and more likely. Bank’s policymakers lean toward a 75-basis-point hike in September, the biggest since 2006. Markets are pricing the possible rate hike by keeping the EURUSD pair near parity (1.0000). Later, the ECB will release a future-oriented monetary policy statement that will add fuel to the fire.

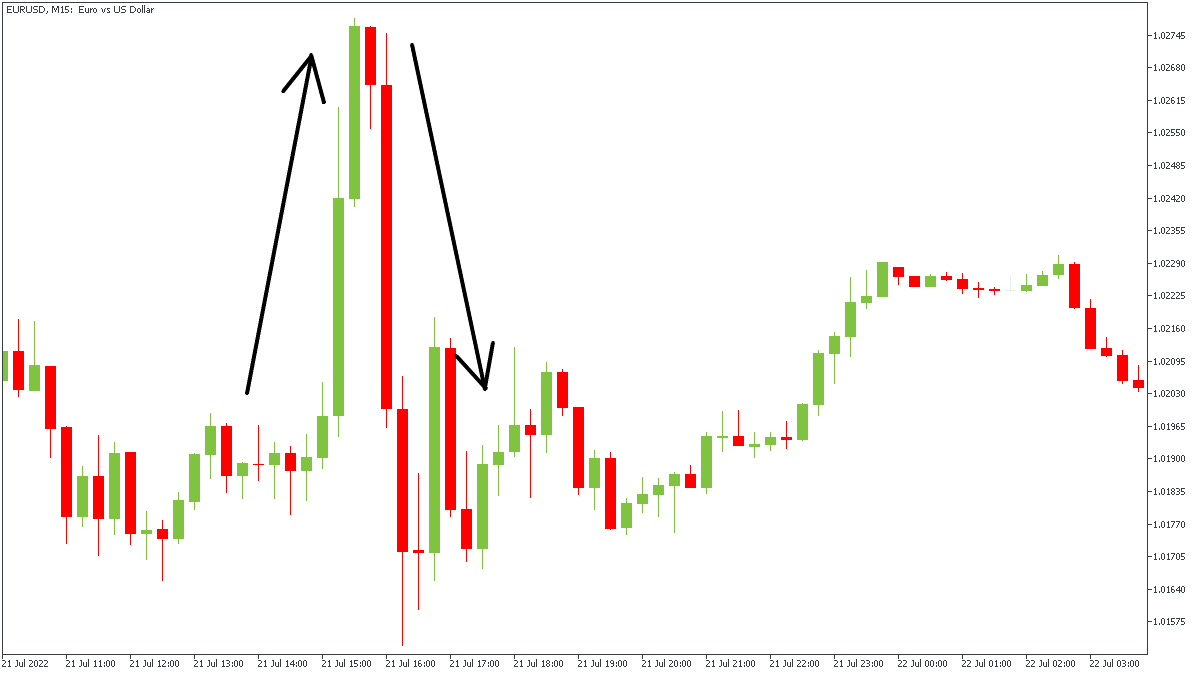

The last rate hike was bigger-than-expected and created a series of spikes in the EURUSD pair, boosting it by 800 points. However, later the pair plunged by 1100 points.

Instruments to trade: EURUSD, EURJPY, EURCAD.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later