Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

On Thursday, February 6, Australian monthly retail sales will be announced at 02:30 MT time.

This indicator reflects the change in the total value of sales in a country during a month at the retail level. In other words, it shows how much more stuff people bought during the reference month than in the previous one. Therefore, this is the first-hand signal of people’s wealth change and their economic comfort in the present moment. If they have money, if they are confident they will not fall short of it tomorrow, they buy more today. If they are not sure that the situation will be favorable next month, they will preserve their funds and save this month, reducing their expenses and bringing the sales down.

More interestingly, the indicator may be brought down to its components and reflect the change of activity in each corresponding industry. Hence, certain microeconomic and industry trends in the country may be foreseen based on the change of sales value in a particular industry, even if the increase in the total value of sales stays the same as in the previous month.

There is a correlation. However, an extent to which the currency will react to the indicator depends on the nature and gravity of the indicator change. In the short-term, a better-than-expected figure boosts the market, and the currency rises. Therefore, if retail sales significantly increase in Australia, the AUD is likely to rise. In the long-term, however, the logic of economy states that a prolonged period of time of increased buying (we are speaking months) and hence increased sales reflect stronger economic activity. As such, it poses an inflation threat and a possibility of ensuing currency depreciation. Hence, in any given month the financial authorities will weigh this indicator against other factors to measure their response well.

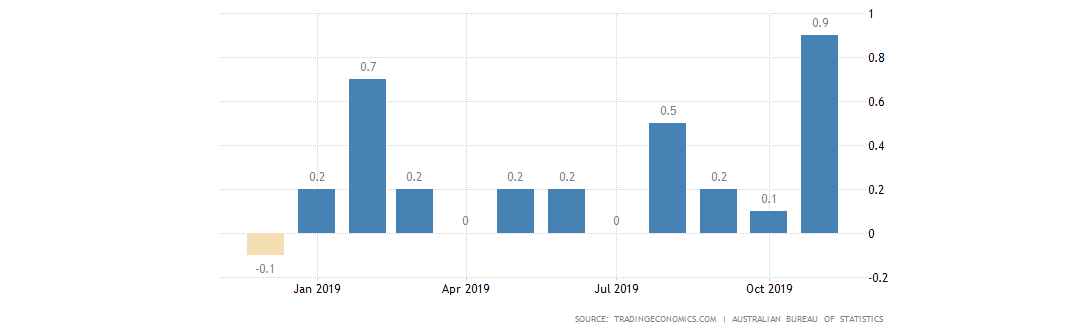

You trade AUD. You will find it in currency pairs such as AUD/USD, AUD/CHF, AUD/JPY, and AUD/NZD. Take note that the previous indicator was 0.9%, which is a rarely seen figure and it beat the expectation of 0.4%. It is unlikely that the coming release will show the same level of increase, that’s why the market priced-in the probable disappointment at the level of -0.2%. Such a low expectation is also a rare case, so unless things are going really bad in retail sales, the actual indicator is likely to come higher than this forecast. At least, slightly. Another factor in favor of such prediction is the fact that the reference month for Thursday indicator is December 2019, which is supposed to have brought higher sales due to holiday season and New Year-Christmas gifts. But be careful: the damage of Australian bushfires is still on and still in estimation – that could have caused lower sales than expected.

No, there is something else. If you are interested in the AUD, you are probably a fan of Australia. At least to some extent. And it makes sense because it is a marvelous country with a lot to discover. What makes it even more attractive is its’ neighbor – New Zealand. These countries do not only compete in beauty and the right to host major film making (Lord of the Rings, for example), but also in the economy. They are counterparts as much as rivals, so each major and minor news coming out on either side immediately affects the AUD/NZD. So that’s just a “bonus level” for those who like a more detailed approach to currency trading.

If you did, then you are on your way to check the economic calendar - you don't want to miss all the events, right?

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later