When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Cathie Wood’s Ark Invest claimed it foresees Tesla to hit the $3000 level by 2025. Nobody doubts that it really can happen as Tesla’s performance is outstanding, especially in 2020. Ark Invest’s bear scenario implies Tesla will reach $1500 per share, while according to the bull scenario, the stock price will hit $4000.

This optimism is caused by Elon Musk’s intentions to launch an autonomous robotaxi service. No driver, just a smart tech system! According to Ark, it will bring in as much as $327 billion in revenue for Tesla.

It’s worth mentioning, Tesla is the largest holding for Ark Invest. The company has been a long-term Tesla bull and has already predicted the massive Tesla’s growth back in 2018. And, Tesla has even outraced Ark’s predictions and beat Ark’s forecasts two years ahead of schedule!

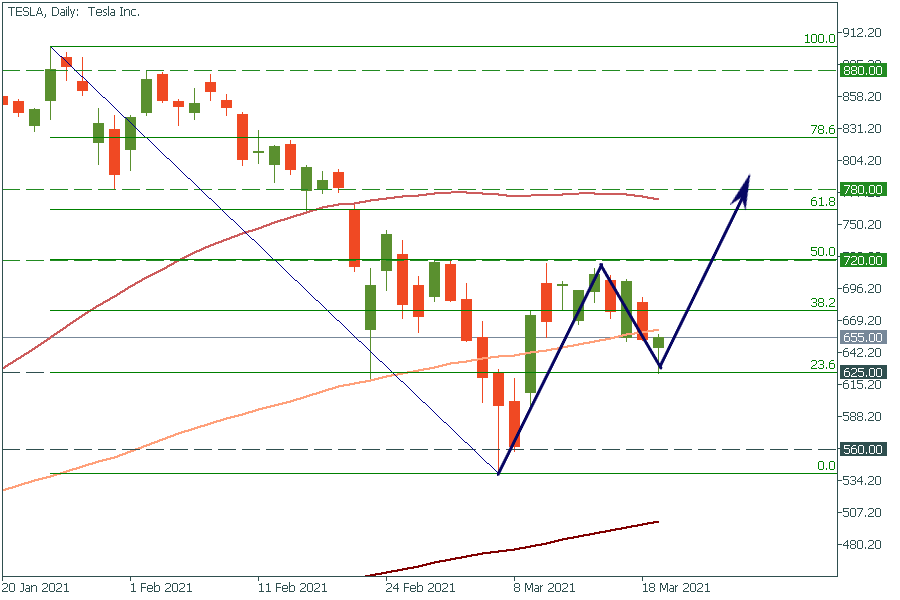

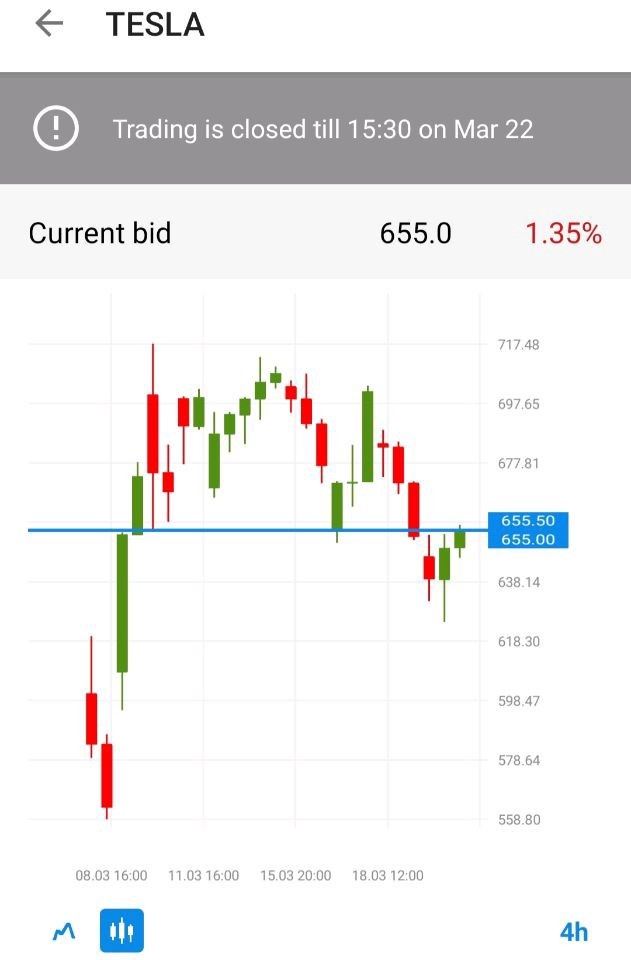

Tesla has risen by 3% in pre-market hours, driven by encouraging Ark’s forecast. Once the stock trading is available (wait for 15:30 MT), Tesla should jump to the 50.00% Fibonacci retracement level of $720.00. If it manages to break this resistance, the way up to the 50-day moving average of $780.00 will be open. Just in case, be aware of support levels at the 23.6% Fibo level of $625.00 and the low of March 8 at $560.00.

The stock trading is also available in our app FBS Trader.

Don't know how to trade stocks? Here are some simple steps.

When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

The bullish movement in the stock market is gaining speed, and Bitcoin ETFs are closer than they might seem. What do we need to know for the next trading week?

On Wednesday, September 22, Microsoft will be holding a product launch. The event starts at 18:00 GTM + 3.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later