The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

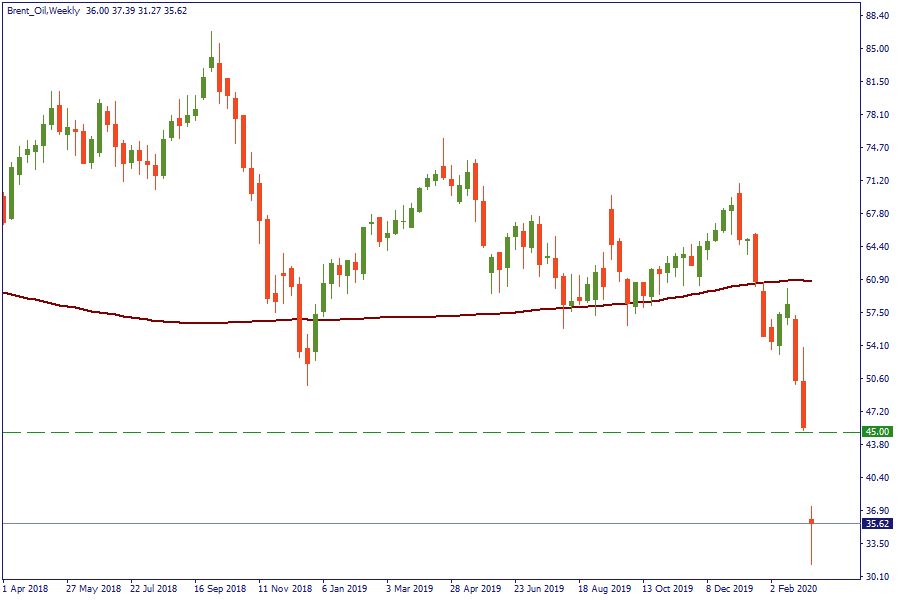

Oil market crashed after OPEC+ didn’t agree on production cuts. Brent slid as low as to $31.27 a barrel. WTI hit $27.34 a barrel. Both benchmarks haven’t really started to close this week’s bearish gap. What’s next? Let’s see what bank analysts have to say about this.

There will be more volatility in oil prices in the next two weeks as that is when the OPEC’s cuts agreement officially ends. The odds are that during this time oil will remain under pressure. What is happening between Saudi Arabia and Russia is a high-stakes poker game.

Traders should be ready for prices staying below $30 a barrel in the second quarter of 2020. The commodity’s price has no support on the downside and may fall below $25 a barrel. Models now forecast quarter-end 2020 levels for Q1, Q2, Q3 and Q4 2020 at $28.6 a barrel, $32.3/b, $35.6/b and $46.1/b, respectively.

Brent oil may temporarily fall to $20 a barrel range over the coming weeks as there’s a big shift in Saudi's approach: the country has started giving discounts and will probably allow inventories to build.

There’s a unique combination of demand and supply shocks that could send prices into the $20s.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later