The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

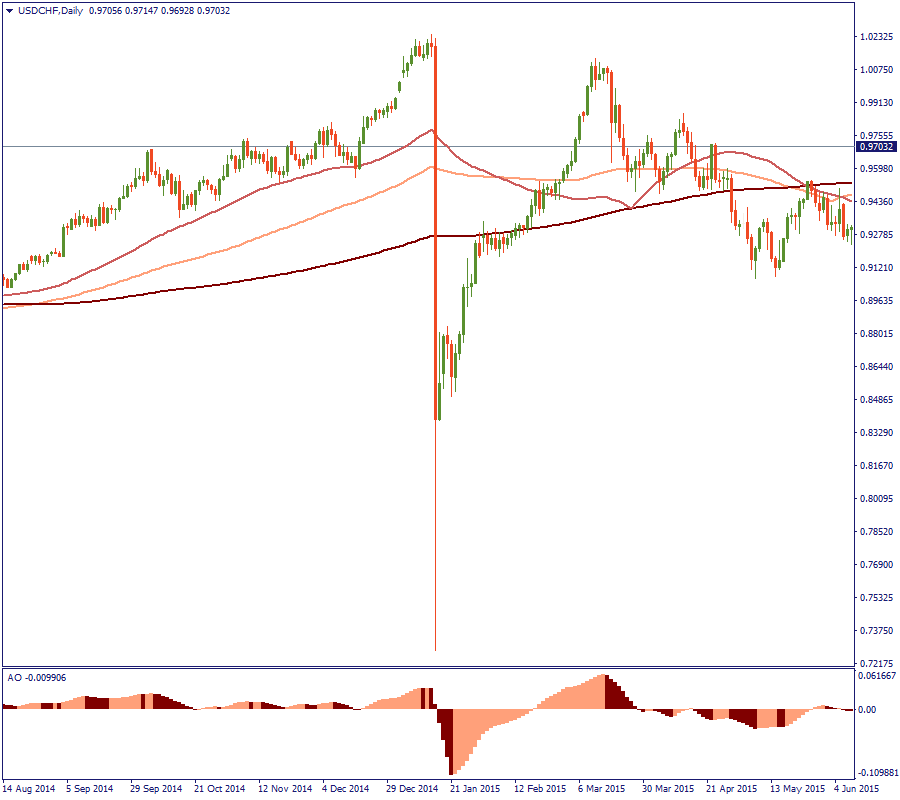

January 15 is a well remembered date in the Forex world as it marked the decision of the Swiss banking authorities in 2015 to unpeg the Swiss franc from the euro. To many traders, the daily chart of USD/CHF is the best reminder of that day, although the story itself takes place between EUR and CHF.

That announcement was as unexpected as visible were its immediate results. Let us pay homage to that event by reviewing the history of the relationship between the two currencies and try to foresee what the future holds for them.

Since October 2007, the euro was losing its positions to the Swiss franc. This process was fueled by the crisis unrolling in Eurozone, which forced investors to drop the euro and seek refuge with the Swiss franc as a safe-haven currency.

Consequently, the higher demand for CHF pushed its price up and kept solidifying it for the next four years against the EUR. That led to harder conditions for the Swiss exports as they make up to 70% of the country’s GDP and mostly have the Eurozone as their final destination. In other words, while the European money was losing its value all the way down to 2011, Switzerland with all it has to offer was becoming way too expensive for the Europeans to afford.

Seeing that, the Swiss National Bank decided to fix the exchange rate at 1.20 francs per euro. The currency peg took place in July 2011, which is visible at the monthly chart of EUR/CHF. Immediately, all the previous price fluctuation was gone, and the currency pair was now traded almost exactly at the level of 1.20. Of course, that came at a price: Switzerland had to issue millions of new banknotes to buy the euro in order to keep the intended exchange rate. That was one of the factors that led to eventually discontinuing the peg later on, as we will see a moment later.

The decision of 2011 was taken in the middle of the world economic turmoil. That is, when Switzerland had to “fight off” global investors who didn’t know where to put their money to keep it safe. However, times changed since then. 2015 was telling a different global economic story, although it was not a sunny side of the street yet.

In 2015, the world was slowly picking up the pace, although the crisis echo was still present in the Eurozone. To make things better, the ECB started planning the quantitative easing measures. That supposed that the SNB had to print even more francs to keep the 1.20 rate against the euro, which instigated the inflation fears among the Swiss economists. Coupled with the non-obviousness to maintain the peg with the possibly sinking ship of the European currency led to a logical but a very unexpected decision.

On January 15, 2015, the Swiss National Bank announced the end of the EUR/CHF peg. The corresponding area of the chart shows a plunge to the level of 1.02. That day was the start of an uptrend, which EUR/CHF has not seen since 2007. With the freely traded Swiss franc, the EUR/CHF was now on a rising curve. However, as soon as it reached the historical level of 1.20, things turned dark again.

Trump’s trade war against China probably ruined the possibility for SNB to see further depreciation of CHF against EUR at that time, as the investors were looking for a safe-haven currency once again. Therefore, the demand for it started rising and driving the relative value of the franc up. Consequently, EUR/CHF has been mostly in a downtrend since then, practically nullifying the efforts of SNB to support EUR/CHF as it is now even lower than where it was before the peg.

Nevertheless, the latest developments in the US-China relationship show that CHF may lose the focus of global investors’ attention. At the same time, although ECB is continuing its quantitative easing measures, things seem to become gradually better for the Eurozone. Hence, Swiss exports may have a sip of fresh air for a while.

As we have mentioned before, global economic processes strongly affect the EUR/CHF relationship.

The trade war between the US and China kept the CHF appreciating against the EUR since the first part of 2018. On the daily chart, the marked downtrend is a local continuation of an overall larger decline since March 2018.

However, 2019 close on a much lighter note, as the two countries made notable steps to end the trade conflict. January 15 is expected to conclude that with both sides signing the Phase One trade deal. Based on that, the revived risk appetite of investors fortified the EUR against CHF. That’s why, despite the recent downswing, we see mostly sideways movement in the last months of 2019. The downtrend has been finally broken.

Hence, it is safe to assume that this picture will keep the positive mode for EUR/CHF as long as the global economic environment does not get tilted to the gloomy side of fears and uncertainty again. The resistance of 1.1063 may be a good level to check the market’s positivity, while 1.0630 will serve as regional support if 1.08 is finally crossed.

The safest position to take in relation to EUR/CHF is to hold and observe. Yes, we know that the nuclear apocalypse is no longer upon us, but the solid proofs are still too fresh and few. The 1st quarter of 2020 will show where the Eurozone goes, where the US-China relationship go and hence, where the investor’s money goes. For now, the Swiss franc can celebrate freedom in a no-man territory.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later