Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The deal that was struck by Donald Trump’s administration with the Senate amounts more than $2trln of tax exemptions and financial aid. Out of that, $350bln goes to small businesses, $500bln goes to back loans, and checks of $1,200 to almost every individual in the US. It is supposed to receive a confirmation vote on Wednesday and go to the President’s table for his signature to go into action.

Just to compare, the 2008 crisis prompted Barack Obama’s administration to unfold an $800-million stimulus to lift economic activity. The fact that the current financial aid is 1.5 times bigger than this may mean several things. On the one hand, the virus-hit US economy may be perceived as (but not necessarily be) in a graver condition currently than it was in 2008. On the other hand, having the homework done (hopefully) after the last crisis, the Senate and President Trump’s administration may just be willing to go full-on against the virus in an effort to make the shortest possible crisis and recovery time.

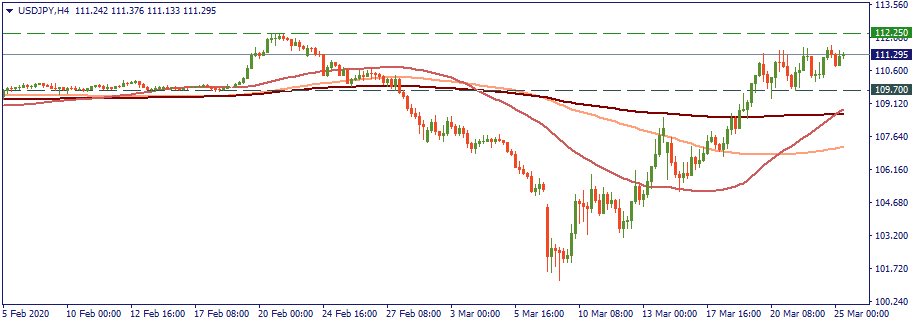

The market, generally, took this measure as a small sign of hope and strength. The risk-on mood got partially back, with the JPY giving room to the USD…

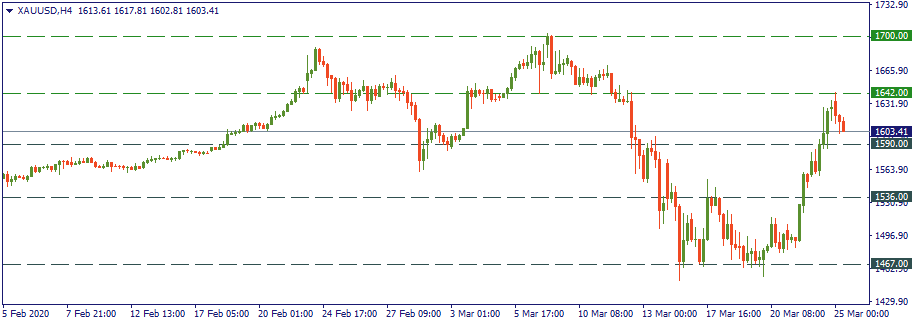

…and gold dropping its steam after its short rally when it started behaving like a normal safe-haven commodity – like gold, in other words.

S&P 500 has been consistently rising since Monday and currently is testing the resistance of the 50-period Moving Average at the level of 2455. Tactically, that’s a meaningful recovery as it is the first time since the beginning of March that the stock market index grows high enough to challenge the descending order of the three MAs. Needless to say, keep going.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later