eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

There has been extreme depreciation in TRY assets recently. There are several important reasons for this depreciation, and we will share them with you now. I will also provide information about whether the depreciation will continue or not.

Reasons for TRY Losses:

After the first quarter of 2021, the increase in demand for USD assets started to come to the fore. With the pandemic, we had periods of restrictions in many countries, and when these restrictions were over, it brought colossal inflation pressure. While inflation suppression increased investors' demand for USD assets, the FED began to give signs of tighter monetary policy. As a result, the US Dollar Index (DXY) rallied to 97.00 after a consolidation slightly below 90.00. This situation put the assets of developing countries under pressure.

TRY assets have been under pressure since the beginning of the year in Turkey, and the economy was struggling with high inflation and high interest rates. As of the third quarter of 2021, Turkish policymakers emphasized that high interest rates are the main reason for inflation. According to the economic rulers, a decrease in interest rates could also diminish inflation. President of the Republic of Turkey, Recep Tayyip Erdogan, stated that inflation is the cause, and the interest rate is the result. The statement was the first event that brought this problem to the center of market's attention. In this period, the Central Bank of Turkey began to make significant reductions in interest rates.

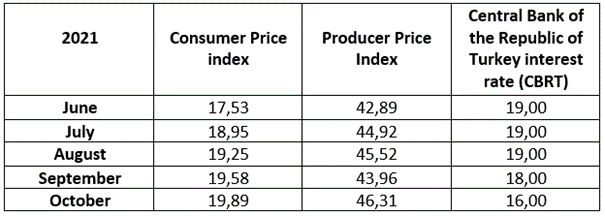

The Central Bank of Turkey (TCMB) determined an economic policy not found in current economic models and started decreasing interest rates despite rising inflation. For example, Bank lowered the policy interest rates from 19% to 15%. In this case, the lack of improvement in inflation and the decrease in interest rates caused investors to switch from TRY deposits to foreign currencies quickly. As a result, the USDTRY pair, traded around 8.5 TL, made a substantial rise to 13.5 TL due to these decisions.

The chart above shows Turkish Central Bank interest rates and the CPI and PPI rates for the Turkey region in 2021. In current economic models, a policy move that has not been encountered before caused significant losses in TRY assets.

Recent statements of the economic management in Turkey pointed to a change in economic policies. Instead of raising interest rates to control exchange rates, they tried to close the current account deficit with exports by liberalizing the exchange rates. Although this move is not included in the current economic models and literature, the Turkish economy management firmly defends its success.

There has been a definite upward trend in the USDTRY pair since 2011, and it failed to break this trend downwards. On the contrary, this channel has been broken upwards in the USDTRY pair, which indicates an extreme volume. In addition, the price reached the "overbought" zone according to oscillators such as RSI, CCI, and MACD. Therefore, if we do not see a significant improvement in inflation rates or tightening the Central Bank's monetary policies in the coming periods, the trend might become even more vertical.

On Wednesday, December 1, Turkey's Central Bank sold foreign currencies for the first time in seven years to stem the lira's decline against the U.S. dollar. TRY/USD reacted with the drop to 12.35 immediately but recovered right after. This event means that Turkey's government will try not to allow TRY to fall further against the USD.

From a technical point of view, we can see that rising wedge combined with divergences on RSI and MACD oscillators occurred on the chart. These patterns are bearish. In the nearest future, we assume that USD/TRY will get rejected out of 13.75, which is the 1.618 Fibonacci level. Moreover, we believe that Turkey's government will be able to push USD/TRY down to 12.6 in the coming months.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later