The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

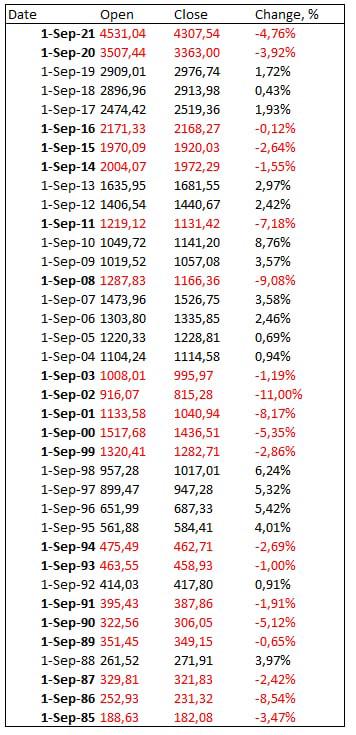

There is a possibility that this scenario may repeat itself. Investors' fears are not unfounded because September is the worst month for the index. According to the historical dynamics, S&P 500 (US500) has been declining in September by 0.65% over the past 38 years.

September S&P500 (US500) index performance since 1985.

Average change of the S&P 500 (US500) index during the past 36 years.

The Crypto market usually also has a rough time in September. Bitcoin lost 12.7% in September 2021, 17.4% in 2020, 17.5% in 2018, 21.4% in 2017 and 45.4% in 2015. The main cryptocurrency increased by 13.3% and 3.95% in 2016 and 2019, respectively.

However, the extrapolation of statistical data to the current situation makes little sense if it is not tied to the economic context.

Several factors confirm a possibility of a deeper correction:

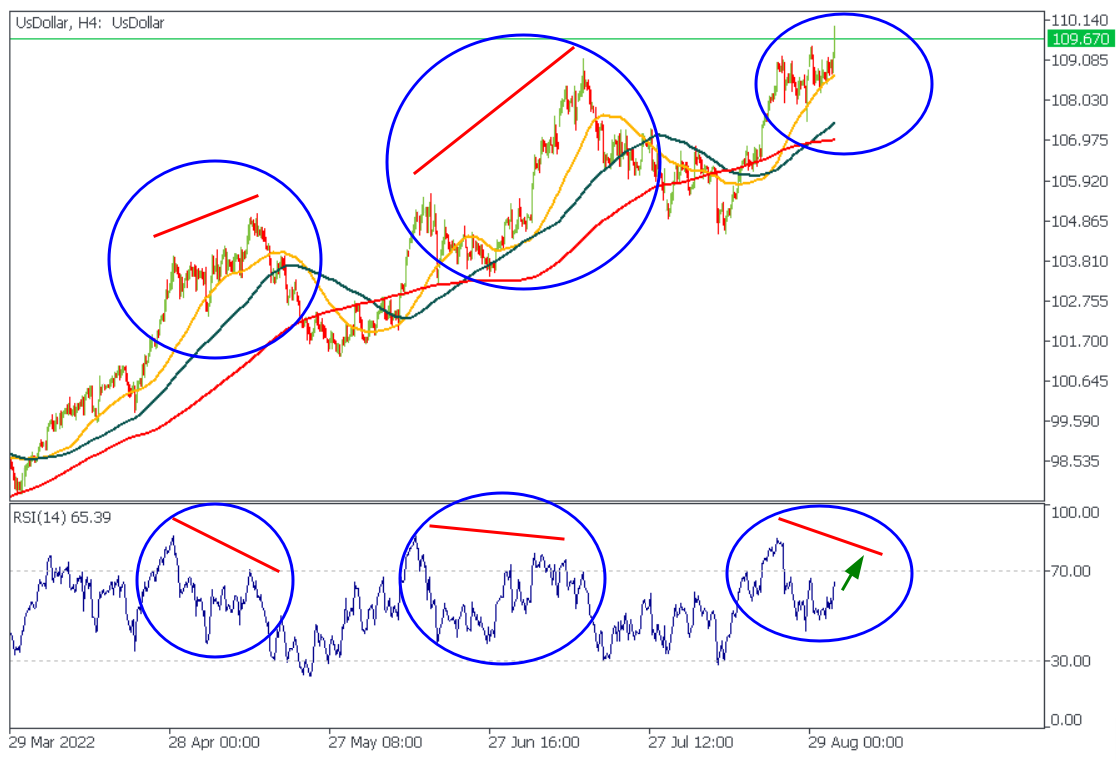

US dollar index, H4

The RSI repeats the same pattern, which has also appeared twice in 5 previous months.

The H4 RSI goes to 84 -> RSI declines, while the price stays at the same level -> Another pump when RSI reaches 70 - 75 -> divergence appears -> deeper correction happens.

The US dollar index is already breaking above a recent high, and currently, the price is aiming at the 111.50 level.

US500, weekly

US500 keeps moving inside an inverted falling wedge. The price has formed a massive range between 3500 and 3650, and it seems like sellers are aiming for it. Moreover, the 200-week moving average, which always acts as the main support for the US500, also stands in this range. If the Fed increases the rate by 75-basis-points, the price will easily decline to this support, where we expect to see the overall market reversal.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later