eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The credibility of the US dollar and its banking system depends on the fact that it's considered safe and low-risk. That's why many countries around the world keep their reserves in US banks and hold US bonds in large quantities. However, if the dollar's credibility erodes because of politics, this international monetary and financial system can start collapsing.

The move of the US and its Western allies to freeze most of Russia's foreign exchange reserves has raised fears that the dollar's hegemony is being used as a weapon.

But, why won't the dollar lose its dominance so soon?

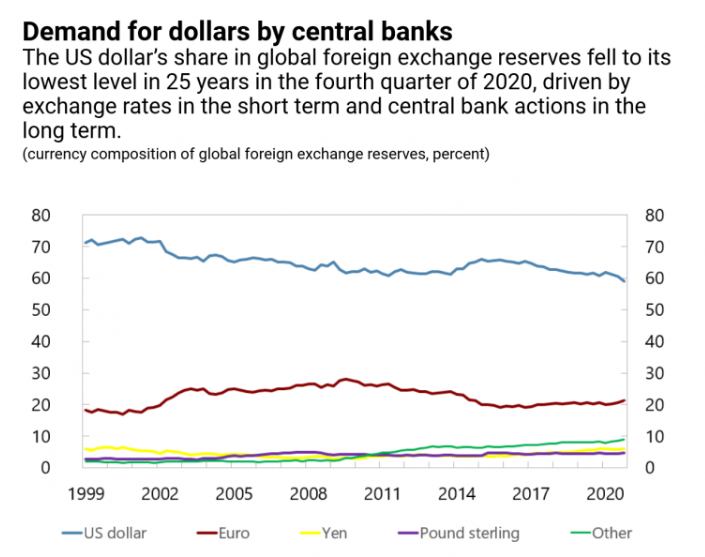

There's no real alternative or competitor. The US dollar is the strongest reserve currency in the world. We can argue that the dollar depreciated after the crazy printing of money over the past three years and hot inflation. We can say that the world's confidence in the US as a strong partner is declining increasingly. However, you must have an alternative to exchange dollars. According to history, reserve currencies give way to each other when a more attractive currency comes along. China - today's rising power - has so far shown no reason for the global economy to trust it.

The euro is the main alternative to the dollar, representing 20% of central banks' reserves. Still, we should be aware of the shift towards smaller currencies such as the Australian dollar, the Korean won, and, above all, the Chinese renminbi.

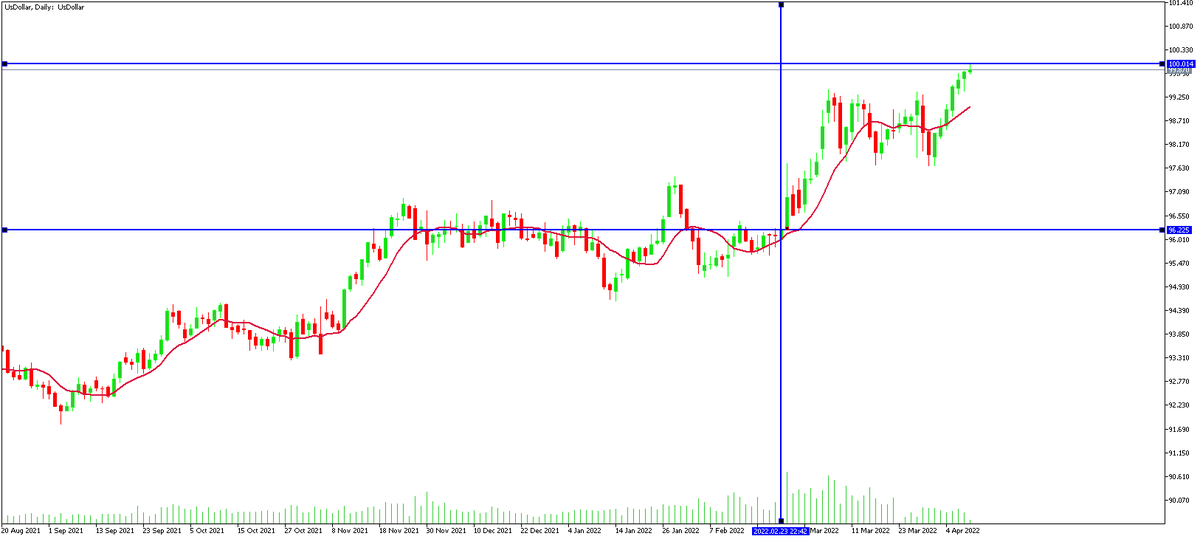

At the moment, the dollar index is still poised to rise after testing levels above 100. On the upside, the next big target is 103.00. The aggressive tightening cycle of the Fed is also expected to support the dollar in the medium to long term.

Chart 1: The Dollar index is on the rise since the beginning of the Russia - Ukraine war on 24/02/2022, reaching levels above 99.80.

Chart 2: The dollar's index next target is 103, last seen in 2020.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later