The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

This week, the stock of AstraZeneca was one of the most traded instruments in FBS Trader! It was even more popular than the stock of Tesla. There has been news that grabbed the attention of traders this week. It’s also worth mentioning the earnings of a company coming out this Friday. What should you know ahead of it?

EPS = 0.62 (vs. 0.47 in Q3 2020)

Revenue = 9520 (vs. 6578 in Q3 2020)

The release of financial results is expected on November 12, at 13:45 GMT+2.

The destiny of the Anglo-Swedish drug giant has been complicated since the start of the Covid-19 pandemic. You may have heard of the news about the vaccine that causes blood clots. As the cases were linked to AstraZeneca’s vaccine, several countries restricted its use. Luckily for AstraZeneca, the European Medicines Agency (EMA) and the World Health Organization (WHO) both confirmed that the vaccine was safe and effective. The organizations said that the number of blood clots was extremely rare. Another challenging factor for the company this year was linked to the production problems. AstraZeneca cut its vaccine deliveries to the EU by half, reportedly due to problems at its plants and delayed testing of a batch of vaccines.

However, the company managed to stabilize its performance in 2021. Last week, it announced the creation of a new division for vaccines and antibody therapies. Vaccines are seen as not a traditional area for the company, so optimization of its structure certainly helps with business processes. Another positive news is the approval of the drug maker’s antibody cocktail against Covid-19 in Australia. Now, the mixture is awaiting a review by the European Medicines Agency.

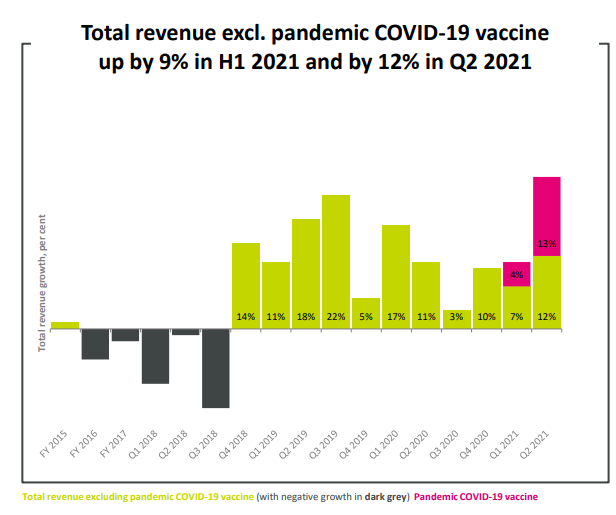

The first half of the year was the golden time for the company. The Covid vaccine resulted in an outstanding improvement of AstraZeneca’s financial results making 9% out of +18% of the total revenue growth in the first half of the year.

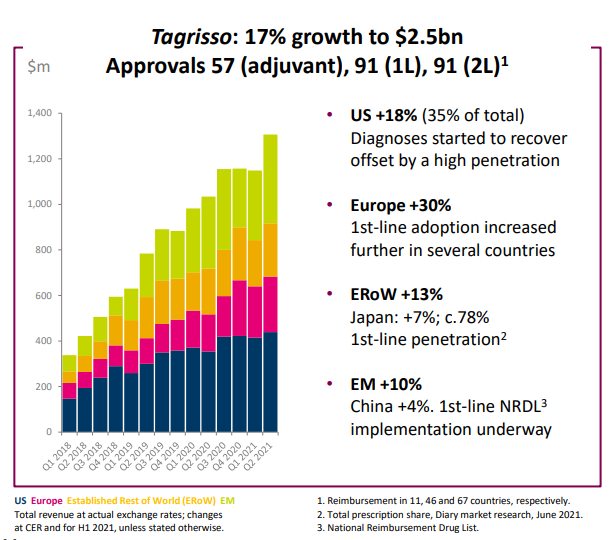

Apart from the vaccine, AstraZeneca has been working on cancer drugs – Lynparza, Tagrisso, Imfinzi, and diabetes medicine. Their sales have been rapidly growing as well. Higher demand for Tagrisso in the United States amid the broad-based adjuvant therapy for treating lung cancer patients may improve the company’s financial results as well. Other medical treatments are also likely to have contributed to sales growth in the third quarter.

The stock of AstraZeneca has been moving within an uptrend. The breakout of the 9500 level will be crucial, as it will lead to the rise to July's all-time high of 10 088. If stock's price breaks below the support of 9240, it will indicate a bearish scenario with the next potential target of 9000.

Summing up, AstraZeneca has a great potential to post good financial results for the third quarter. Its business structure is accelerating and new facilities are developing. Also, it produces necessary drugs for the treatment of Covid-19 and other severe diseases. The demand for this medicine has been growing last quarter and it may attribute to the strong financial report on Friday. Follow the release on Friday at 13:45 GMT+2!

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later