The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

S&P 500 and other stock indexes rose over the past 12 months despite the global recession. Should you buy it now?

Coronavirus cases have almost reached 5 million. By the way, it’s just the official data, nobody really can say what is the true picture. Moreover, unemployment claims surged to unprecedented levels, economic activity fell to unseen lows. This list can be prolonged further and further. However, that didn’t bother investors. Why?

The first reason is that the Fed took all efforts to mitigate the damage from the coronavirus. It cut rates to zero, poured trillion dollars through aid packages, bought corporate bonds both high-rated and junk. After all this, Jerome Powell assured that there is a lot more ammunition the Fed can use if needed. So, there is no doubt that the economy will be safe no matter what. Those comments, of course, pushed the S&P 500 price upward.

We are approaching step by step to the end of the coronavirus pandemic. Many biotech companies are working day and nights to create the desired vaccine. Yesterday we got some promising results from one of them – Moderna, Inc.! After those optimistic news, the stock went up.

According to Ned Davis Research, about 58% companies of the S&P stock weren’t significantly damaged by the coronavirus. Moreover, top 5 companies such as Microsoft, Apple, Amazon, Facebook, and Alphabet outperformed this year. So, S&P 500 gained due to those 5 ones.

Now S&P gains, but most analysts believe that soon the S&P will reverse. As lockdowns eased and small businesses started to reopen, the coronavirus cases may rise again. Moreover, the Q2 earning season will bring terrible data that nobody has ever seen before. The negative sentiment will push stocks down eventually.

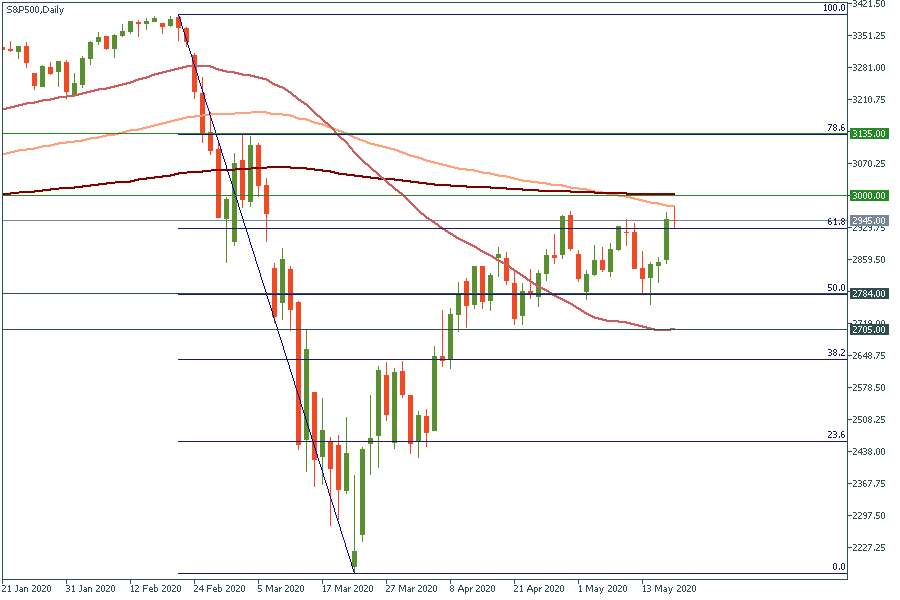

The S&P had been rising since March 23, then the price froze and entered the horizontal corridor. It hit 2950 twice and struggled to go up. That’s why, there is a high possibility that the price will soon fall down to 2784. If it does, it will dip further to 2705. Nevertheless, if some factors push it above 3000, it will surge to 3135 then.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later