The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

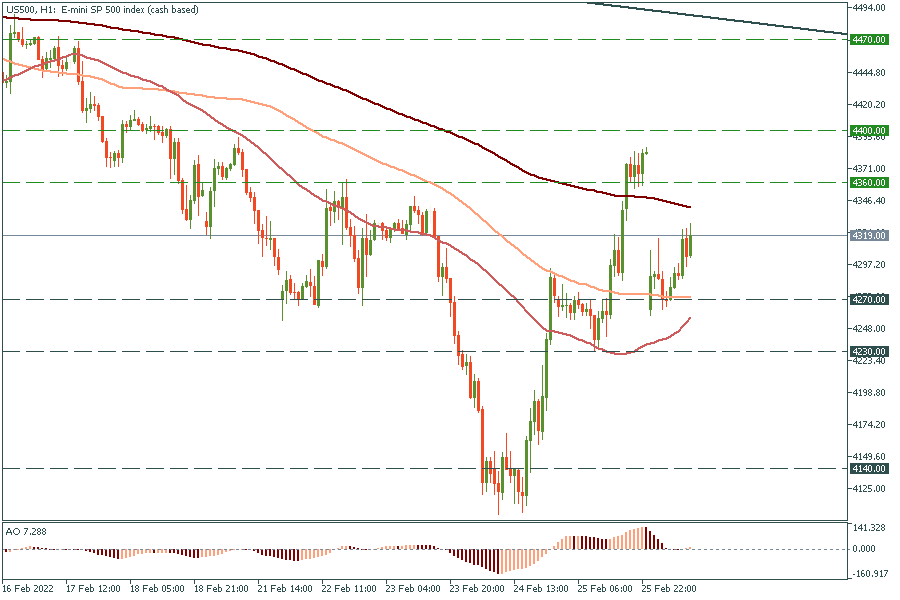

There’s nothing new in markets witnessing sharp crashes and volatility when geopolitical events happen. The initial and immediate reaction to these events is usually the most dramatic. The good news is that the impact is short-lived, lasting only for three months mainly. Although the escalation of the conflict between Russia and Ukraine may be devastating, the truth is that stocks can handle these geopolitical conflicts. We are now witnessing the first meaningful correction in the market after the strong performance in 2021. These types of geopolitical issues provide a good buying opportunity for long-term investors.

According to many analysts, we are in the midst of a structural bullish trend that is likely to continue over the next few years, and corrections will be part of that journey. History shows that 12 months after events like the current crisis, the market moves upwards. The markets' performance after the major geopolitical or historical events since World War II is much stronger than before. The markets even end the year in the green area most of the time.

However, this does not mean that Wall Street will not suffer from some turbulence and violent volatility in the short term.

From Thursday's trading session and its sharp crash, Wall Street's reversal has been wild. US stocks got rid of heavy losses and closed in the green. The major indices saw a massive comeback from sharp declines during the Friday session. The Dow Jones erased its heavy losses by more than 800 points. The Dow Jones Industrial Average jumped 815 points, or 2.5%, recording its best day since late 2020, after dropping 859 points last Thursday. S&P 500 also rose 1.9%, after falling more than 2.6%. Nasdaq Composite Index rose 1.1%.

Here is why the US stocks are resilient and flexible:

In the end, global markets will remain unstable over the coming weeks. While we may see some short-term volatility, these uncertainties provide strong investment opportunities if a recession doesn’t follow. Therefore, traders may try to take advantage of these corrections and swings.

Don't know how to trade stocks? Here are some simple steps.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later