The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The economy is on the cusp of recession, suffering from high inflation and high interest rates. That eats up salaries, weakens consumer confidence, and may lead companies to layoffs. With all these tensions, stocks collapsed into a bear market.

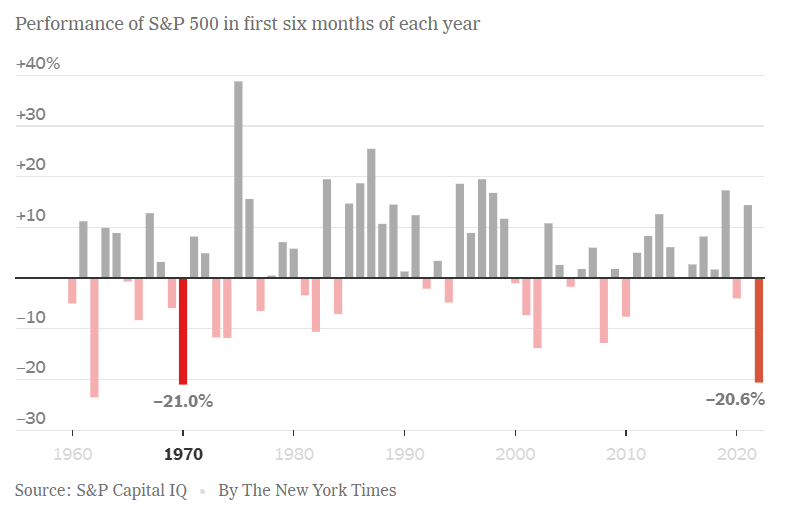

US stocks have delivered their worst first half of a year in more than 50 years triggered by the Federal Reserve's attempt to control inflation and growing concerns about recession and global growth. So what's next for US stocks? Can they recover in the second half of 2022?

S&P 500 ended the first half of 2022 on a bad note, declining by more than 20.6%. Wall Street hasn't seen such a painful start since 1970, when stocks saw a strong sell-off in a recession that ended what had been, by far, the longest period of economic expansion in America's history.

The technology-heavy Nasdaq Composite has lost nearly 30% since 2022. The sharp drop in US stocks has wiped out more than $9 trillion from the market value since the end of 2021, according to Bloomberg data for the S&P 500 Index.

1. Inflation is the theme of the year, and its harsh consequences have already affected everything.

2. The Fed has been late and stubborn in responding to rising inflation despite all early signs that rising prices are not temporary and will persist.

3. The gloomy mood and negative atmosphere are currently dominating the market, with the growing possibility of a recession in the US and Europe.

4. Relying on central banks to facilitate monetary policy to support economic growth, their inability to tighten and hike rates at the right time, and their failure to control inflation.

5. The series of rate hikes were so quick and strong that they greatly confused the markets.

6. The Fed is insisting on continuing to raise rates to fight inflation despite the possible economic risks, even if it leads to a recession.

Stocks have struggled since falling into a bear market in June. History shows that the rapid pace of the market's decline this year may actually be a positive sign, with stocks poised for a rebound if the economy avoids a sharp slowdown or recession.

The good news is that the most recent bull market only took 161 days to go from its peak to a 20% decline, compared to the 245-day average in previous bear markets.

If the Fed avoids a recession as it did in the dot-com crisis (2000-2002) and the global crisis (2008-2009), this bear market could bottom out soon. How this bear market ends will depend on the pace at which inflation decreases, which will determine how long the Fed will keep raising rates and when it will stop.

If the Fed controls inflation over the coming months, markets will stabilize and calm. If the Fed fails, this bear market will be just the beginning.

With a soft landing scenario and stable earnings season, we expect the S&P 500 to end the year around the 3900-4200 levels. If corporate profits declined in the next two quarters and the economy entered a recession, the S&P 500 could drop below 3300.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later