The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Time flies fast and the market understands it. It seems like the G20 summit, where the trade truce between the US and China happened, was not so long ago. As the second month of the year has arrived and the deadline on March 1 comes closer, the absence of any clear breakthrough in these trade talks adds worries to the market.

Let’s find out where the trade negotiations have stuck for now, what we should expect next and, most importantly, how it may affect the sentiment in the market.

A brief preview of the trade conflict

As you may know, tensions between China and the US started last year after US president Donald Trump announced tariffs on $250 billion of Chinese goods. One of the main reasons behind this decision lies in the intellectual property issue, as American companies claimed the Chinese side in stealing their technologies. Another reason was connected with a huge trade imbalance in certain sectors. In response to this move, the Chinese officials announced the counter-tariffs on the US goods. These actions started a long-lasting trade war between the countries.

Both presidents expressed an interest to end their tariff battle at the G20 meeting in Argentina. During their negotiations, the sides reached a temporary 90-day trade truce. The countries agreed to not increase or introduce new tariffs for that period of time. Also, China announced to buy more of the US agricultural, energy, industrial and other products and to remove an additional 25% tariffs on the US auto sector. The final agreement is expected to be announced on March 1. If the countries do not reach any breakthrough by this date, the US will implement an additional $200 billion tariffs on Chinese goods. As a result, the risk-weighted assets will suffer.

What do we have until now?

Up to this moment, there have been two rounds of trade negotiations. First one was held on January 7-9 in Beijing. The talks did not result in any breakthrough but pointed out a long list of topics for further discussions. Chinese officials confirmed to buy more products and services from the US. However, the intellectual property issue remained unsolved.

The second round of talks also did not provide any certainty, as no final solution was suggested. The market sentiment was mostly driven by the comments and positive updates from the top US officials.

During that meeting, US President Donald Trump, Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin commented about the positive path of the trade negotiations. The sides have had hard discussions on the key structural issues, according to Mr. Mnuchin’s words. But the final point is planned to be made after the third round of trade talks next week in China.

For now, the US president is cautiously optimistic about the outcome of the trade truce. He noted, that if they fail to reach a deal until March 1, the additional tariffs on Chinese imports will be inevitable.

It’s worth to mention, that the anticipation of the possible meeting between Donald Trump and Xi Jinping next week came out to be premature. The US president denied this information. As a result, this news negatively affected the market sentiment on Friday.

What will the outcome of trade talks mean for the market?

If the US and China manage to reach a “great deal”, this news will be highly appreciated by the stock market and the currencies of the close Chinese trade partners – the AUD and the NZD. Both the aussie and the kiwi were affected by the local factors earlier this week, so the breakthrough in trade truce will help them to rise. But it’s too early to be blindly optimistic on that matter.

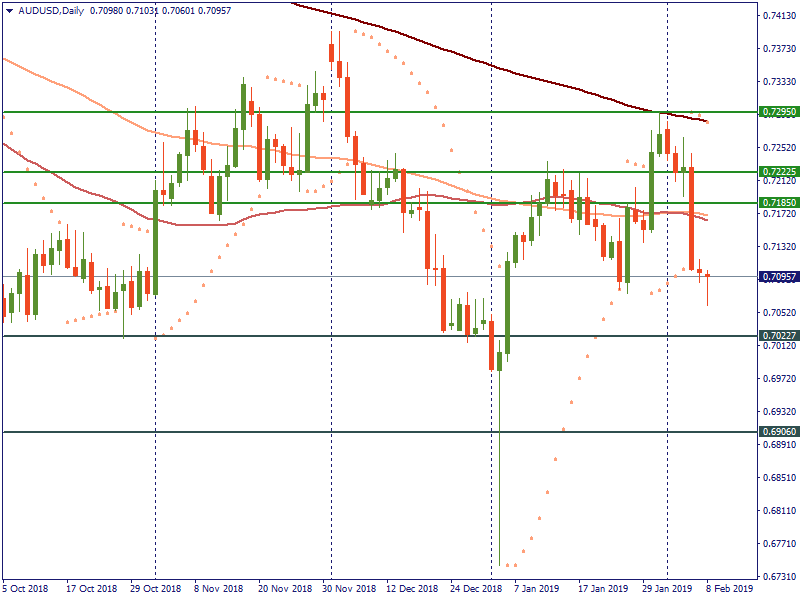

Let's consider the key levels for both currencies.

On the daily chart of AUD/USD, the pair fell sharply on Wednesday after the dovish comments by the RBA governor. Any positive updates on reaching the trade deal next week will push the pair towards the resistance at 0.7185. If the trade deal is reached, this level will be broken and the pair will rise towards the next resistance at 0.7222. After that, the increased risk-on sentiment may move the aussie up even further to the 0.7295 level. Otherwise, if the sides are cautious or uncertain, the pair will break the support at 0.7022 and pull it lower to the support at 0.6906. From the technical side, the uptrend for the pair is still on, as confirmed by the Parabolic SAR. It means that bulls may take over the market.

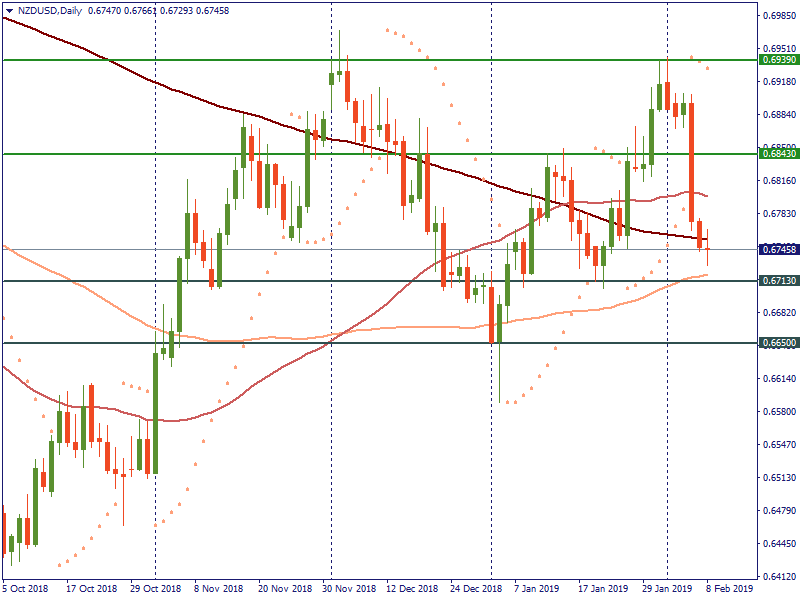

As for NZD/USD, the pair also experienced losses after the weaker-than-expected jobs data. If the outcome on the trade truce is positive, the pair will rise towards the resistance at 0.6843 and will likely break this level. If bulls are strong enough, they will push the pair higher to the resistance at 0.6939. On the other hand, the disappointment in the negotiations will help bears to take control of the market. In this case, we may expect the fall towards the 0.6713 level. The strong risk aversion will pull the kiwi to the support at 0.6650. From the technical side, the uptrend for this pair keeps going, too.

And let’s not forget about the rate statement by the Reserve bank of New Zealand on February 12. The tone of the statement will also affect the New Zealand currency. The dovish tone of the statement will create additional pressure for the kiwi, while the hawkish tone will support the New Zealand currency.

Conclusion

The trade war between the US and China remains the main trigger for the world economy. That is why we are waiting for the outcome of the trade negotiations to bring optimism to the market.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later