Bank of Indonesia Governor Perry Warjiyo announced that Jakarta is following the lead of the BRICS bloc to reduce dependence on the USD and diversify the use of currency in international trade. Indonesia is "more concrete" than the BRICS...

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

If you follow the crypto market, you know that the big updates in major blockchains may cause big buzz and add volatility to the prices of crypto. And this time we will focus on one of them. In the middle of September, somewhere around September 15, the Ethereum Main network will come through the massive update called "The Merge." Ethereum will transit from the proof-of-work (PoW) to the proof-of-stake (PoS) protocol in this event. Sounds complicated? Let’s find out what is hidden behind this change and how it impacts the ETH price.

First, let's start with the explanation of what the Ethereum Mainnet (main network) is. In simple words, this is the central public Ethereum blockchain. This is where the main action occurs; the real-value transactions are operated through smart contracts. As Ethereum is a decentralized blockchain, a transaction requires reaching a consensus among all nodes (computers connected to the network). For now, the Ethereum Mainnet uses a Proof-of-Work consensus protocol. This mechanism relies on crypto miners. Miners compete in solving a mathematical equation. When the task is solved, a new block is validated in the system, and a miner receives a reward in the form of gas fees. Apart from the Proof-of-Work consensus, there are Proof-of-Authority (PoA) and Proof-of-Stake (PoS) consensus mechanisms. While the former requires the identity of validators and is suitable for permissioned blockchains (closed and non-anonymous), we will focus on the Proof-of-Stake protocol, which is the main change that will happen through the Merge.

Apart from Proof-of-Work, the PoS mechanism is not based on competition between miners. For participation in minting (getting) a new block, users need to stake or lock a specific amount of the network's cryptocurrency in a unique contract. The more crypto assets a user has staked, the more chances they have to be chosen as the next block producer. In addition to the amount of crypto for staking, other factors may be included in the PoS: the length of time for staking and randomness. Some PoS networks have strict rules: if a node validates untrustworthy transactions, the validators face slashing of their crypto. In other words, all their crypto capital gets burned.

Now you know the main differences between the consensuses. Of course, there are more nuances and insights. However, the basic understanding of these approaches is enough to get what Ethereum is going through.

The PoW protocol in the Ethereum blockchain carries multiple global problems.

Interestingly enough, Vitalik Buterin was planning to apply this mechanism from the start, according to the Ethereum Whitepaper. However, it seemed impossible in 2014. And now, in 2022, the time for Ethereum on the Proof-of-Stake has finally come! The Merge update will be the major part of the long-lasting Ethereum 2.0 development that started in 2020.

“Phase 0” (“Beacon Chain”) – December 1, 2020 - During this phase, the Beacon Chain blockchain was created as a separate layer from the Ethereum Mainnet. It operates on the PoS consensus mechanism. It does not process transactions and only coordinates the network of stakers through the ledger (list) of accounts.

“Phase 1” (“The Merge”) – approx. September 15, 2022 – As its name implies, this phase will merge the Beacon Chain and the Mainnet, moving its consensus mechanism from PoW to PoS.

"Phase 2" (or "Shard chains") – approx. 2023 – At the final stage, the Ethereum blockchain will experience sharding. A shard chain is like a group of mini blockchains that operate independently. The current Ethereum 1.0 is expected to become one of the shards of Ethereum 2.0.

The upcoming update carries both benefits and drawbacks.

There are also talks that the transition to the PoS mechanism may push the SEC into considering the ETH security if they see validators in the blockchain as pooling funds engaged in a common enterprise. It seems like a questionable topic for discussion since there is only one cryptocurrency that the SEC names security for now, and it's a bitcoin.

As you can see, while a transition to the PoS consensus mechanism certainly has its advantages, risks are also involved. However, they seem natural for that kind of massive update. Let's now see what the transition means for the ETH price and other assets.

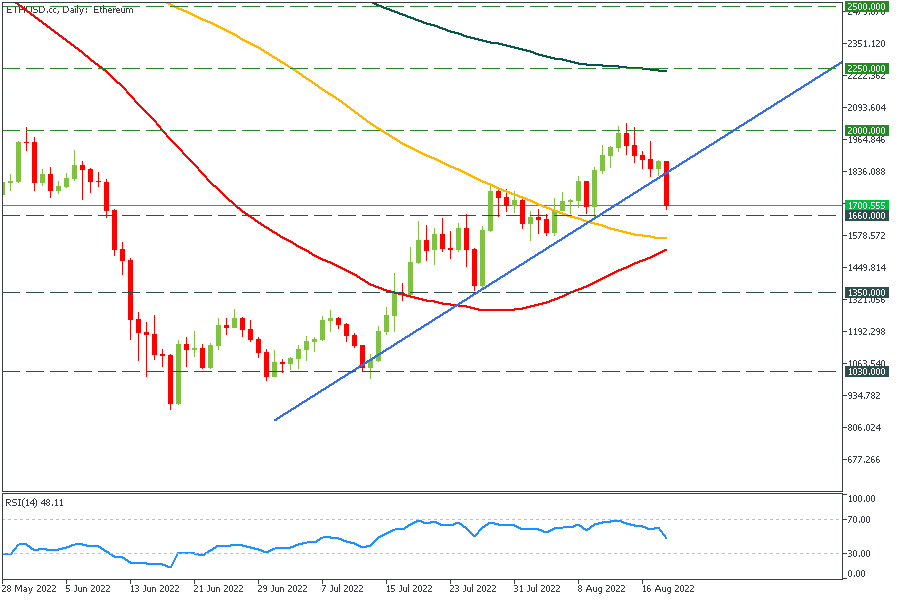

Some analysts believe that if the Merge is successful, the ETH will repeat the success of Bitcoin after halving, as more and more traders will buy the ETH expecting a further rise. Let's look at the chart to see if that could happen.

If we look at the chart after a Goerli testnet, the final test before the Merge was successfully implemented, the ETH made a decent spike by more than 8%. The price marked the high above $2000 and corrected lower.

Also, don’t underestimate the importance of the BTC performance for the whole crypto market. While BTCUSD goes down, other cryptocurrencies follow it. As a result, on August 19 we saw a big bearish pressure on the ETHUSD chart after the Bitcoin fell.

If it strikes above 2000 on a successful update, the next significant resistance levels will lie at 2250 and 2500. Note that we will likely see a correction after an update since traders will be fixing their profits. If the price breaks through $1660, the next support will lie at $1350.

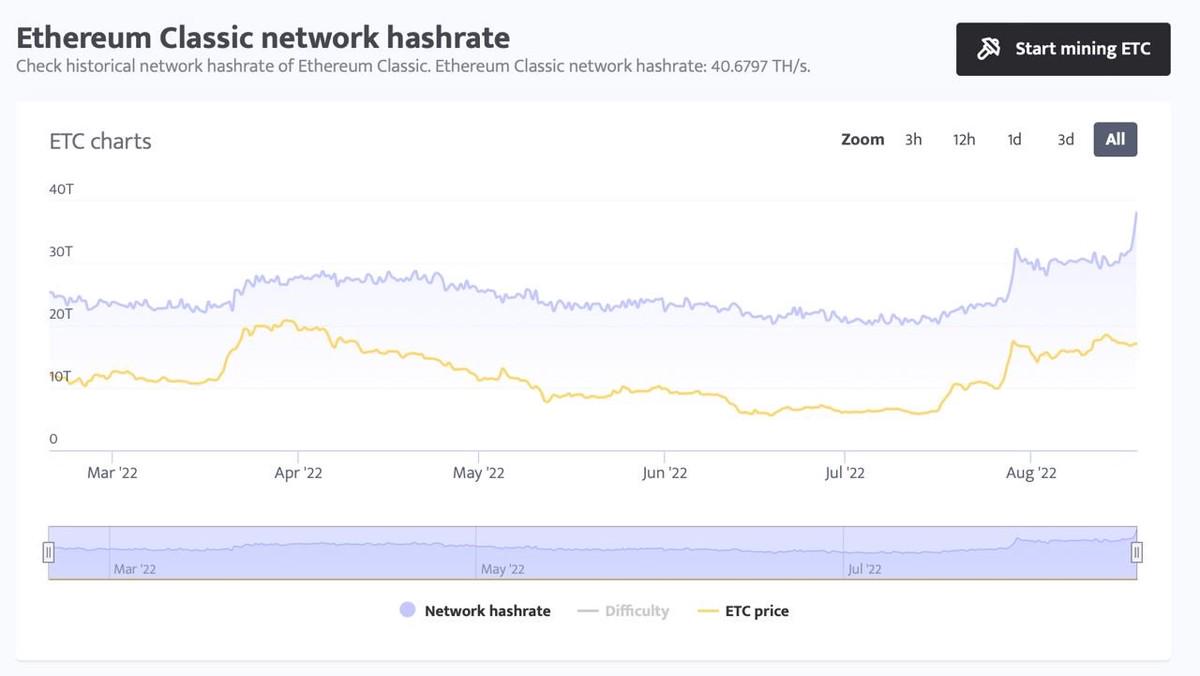

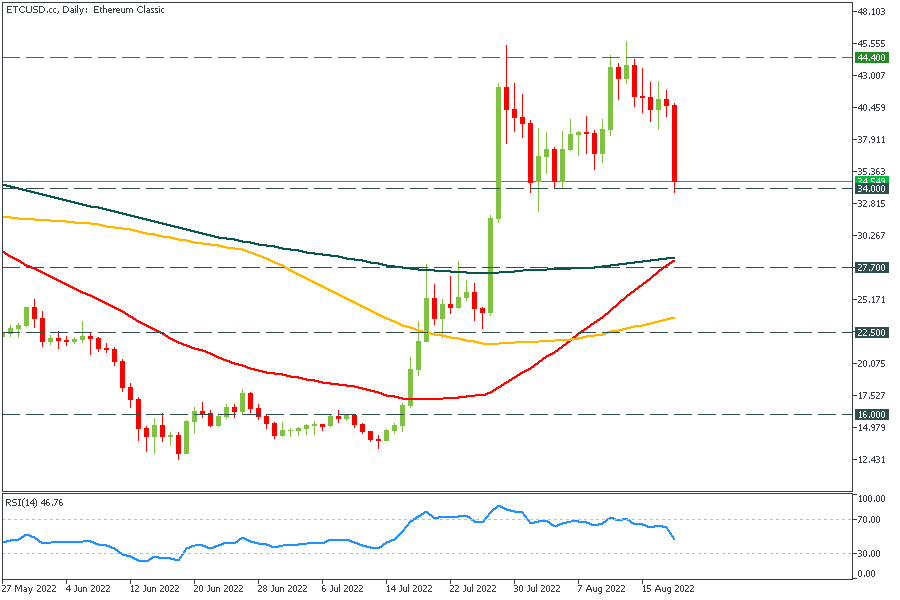

As the end of the PoW on the Ethereum blockchain comes closer, miners are widely expected to move from ETH to Ethereum Classic (ETC). As you can see on the chart below, the ETC network’s hash rate has already crossed an all-time high. A rising hash rate means more miners will hold the coin rather than sell it. And since the ETC is only preparing for the move, it seems like an excellent opportunity to buy it.

On the daily chart, the strike back and breakout of the $44.40 level will indicate a further rise to $50.70 and $57. On the downside, the support levels lie at $34 and $27.70.

According to analysts from JPMorgan, Coinbase will be one of the beneficiaries of the Megre update. The main reason is the market share of the crypto exchange in the ETH assets, which accounts for around 15%. Analysts expect that institutional and retail clients will get value from staking the ETH, pushing Coinbase’s revenue higher. As a result, the stock of Coinbase can follow the upside momentum.

On the daily chart of the Coinbase stock, we can see that it could not overcome strong resistance at $100 and inched lower to $70. If bulls try to overcome the resistance again, the next target will be $116. Otherwise, after a fall below $70, expect a test of the strong support near $50-52.

1. Open a crypto account in FBS Personal Area or in FBS Trader;

2. Deposit money and choose the crypto you want to trade;

Bank of Indonesia Governor Perry Warjiyo announced that Jakarta is following the lead of the BRICS bloc to reduce dependence on the USD and diversify the use of currency in international trade. Indonesia is "more concrete" than the BRICS...

Hold on to your seats, folks! Bitcoin (BTC) is back with a vengeance, soaring past the $30 000 mark on April 11th, reaching its highest point since June 2022. And it's not just BTC - Ethereum (ETH) is also making gains, trading at $1917 and bagging 3.1% gains...

Hey, have you heard about the latest news on de-dollarization? It's the process of shifting away from the US Dollar (USD) as the world's reserve currency for trading...

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later