The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Today is the day X for the European markets as the European central bank is releasing its monetary policy decision at 14:45 MT time. This is also the time when a relatively new ECB president Christine Lagarde is going to prove her strengths as a leader of the European regulator amid the economic slowdown. With surging number of cases in Southern and Central Europe and a confirmation of a pandemic by the WHO, immediate actions are required to prevent the European economy from the worst. In addition, according to Ms. Lagarde herself, the worst scenario is a possibility of the 2008-style crisis. Thus, it will be particularly interesting to follow her press conference after the bank’s decision at 15:30 MT time.

Key things to focus on in the ECB statement

Analysts expect a wide range of measures to be applied by the regulator. Let’s have a look at all of them.

Rate cut. The European Central bank is expected to cut the deposit rate by at least 10 basis points to minus 0.6%. Compared to the cuts by other major banks, including the Federal Reserve, the Bank of England and the Bank of Canada, the move by the ECB seems to be not so impressive. Nevertheless, for the European regulator, the step is big. Keep in mind that its monetary policy is already extremely loose. Moreover, some ECB members had earlier been against any cuts at all. Still, a cut of this amount probably won’t affect the EUR much.

Liquidity for banks. It’s important to keep the banking system full of money so that banks continue providing loans to businesses. The ECB can make longer-term loans for banks known as TLTROs even cheaper or loosen conditions for the collateral that banks post in return for liquidity.

Boosting QE. The ECB may increase the pace of monthly asset purchases from the current 20 billion euros ($23 billion). However, it won’t be easy for Lagarde to push it through as German policymakers have long been in opposition of such a step. At the same time, given the coronavirus, even Germany may see the need for emergency actions. If the amount of the QE is significantly increased (in two times or more), this will have a chance to pull the EUR down.

Economic projections. The ECB will update forecasts for the region’s economic growth and inflation, so we’ll find out whether the central banks sees a recession ahead.

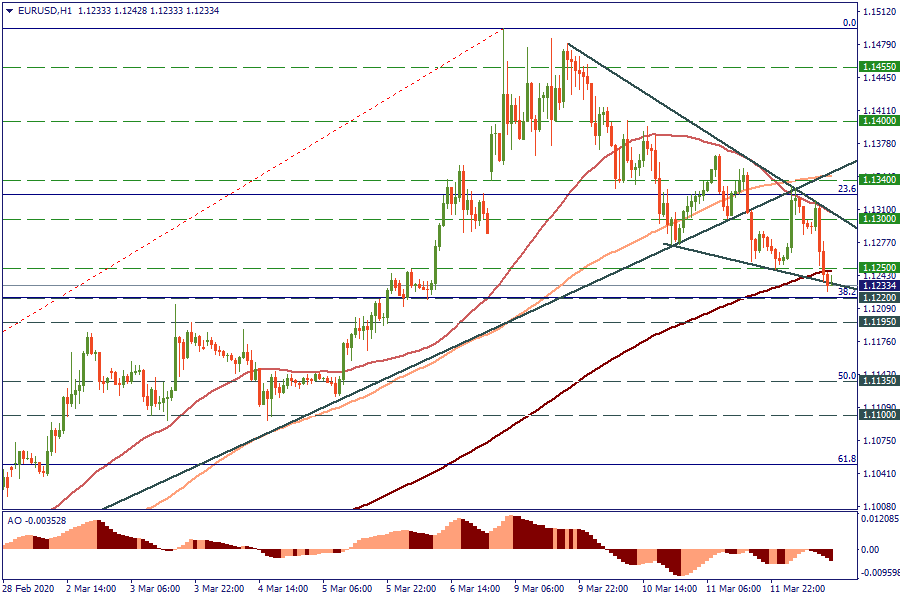

EUR/USD has been declining during the recent sessions. Support is at 1.1195 and 1.11. An advance above 1.1250 is needed to trigger growth to 1.1300.

Although analysts and traders have their expectations and forecasts, the ECB is able to surprise the market. Remember about the risk management and follow the market to grasp a good trading opportunity.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later