The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

It’s amazing how the sentiment drives the markets. Just two weeks ago we were expecting the price for the yellow metal to outperform the last April’s levels above $1,340. And now it has already fallen below the $1,289 level (last May’s support). What are the reasons and what may drive the yellow metal back to its highs?

Reasons behind the slump

At first, the market continues to expect the positive outcome of the trade truce between the US and China. We don’t know the exact date and the final outlines of the trade deal yet, but analysts are sure that the deal is about to be reached soon. To confirm their hopes, US president Donald Trump started to pressure trade negotiators from the US to reach an agreement with China soon in order to boost the stock market. At the moment, the next key step in reaching a deal will be made on Friday, March 15. On this day, lawmakers will vote on a foreign investment law to find a solution on the intellectual property rights issue. If it’s successfully made, we may suggest the trade deal is almost reached.

Secondly, let’s not forget about the USD strength during the last days. Despite the lower-than-expected figures of the ISM manufacturing PMI and the risk-on sentiment across the markets, bulls pushed the US dollar to its highs in the middle of February. And, as we remember, the high USD pulls the price for the yellow metal to the fresh lows. That’s how the market works.

What else pulled the price for the yellow metal during the last days?

On Monday, one of the biggest gold producers Newmont Mining rejected a merge offer from Canadian Barrick Gold, stating that the offer was not interesting to its shareholders. Instead, the US company suggested establishing a joint-venture in Nevada. The further details of the suggestion have been negotiating since then. But, in fact, the rejection of Barrick’s bid ruined the possibility of one of the biggest M&A in history and affected the price for gold.

What factors may push the price for gold up?

The current situation in the market may seem risk-encouraging, but, as we know, it can change very fast.

The trade deal is not reached yet, which means that any fresh uncertainties will hurt the sentiment in the market. China has already rejected the US demand to keep the Yuan stable against the USD. In addition, the news that the Chinese telecom giant Huawei Technologies sued the US government over the unconstitutional ban of its products increased doubts over the good relationships between two countries. Should we expect more pitfalls ahead of the final deal? If they affect the market sentiment, it will provide an opportunity for gold to go up.

Also, pay attention to the releases for the United States, which may push the price for the yellow metal up, if they are weaker than the forecasts. For example, the release of the American trade balance on Thursday came out lower, than the expectations, as a result, the USD weakened and gold was supported.

On Friday we anticipate the jobs data, including the level of NFP (non-farm payrolls), average hourly earnings and unemployment rate. According to forecasts, the level of NFP will increase by 181 thousand jobs, the level of average hourly earnings will advance by 0.3%, while the unemployment rate is expected to reach 3.9%. Lower figures for payrolls and average hourly earnings and the higher level of unemployment rate will weaken the USD and, therefore, push the gold up.

Next week we need to keep an eye on the releases of retail sales, CPI and PPI. They may also determine the direction of the USD and yellow metal.

Chinese data will also influence market sentiment during the upcoming days. The low level of manufacturing PMI published last week once again warned the market about the global economic slowdown. Next, the release of trade balance (forecast of +257 billion) on Friday and CPI (forecast of 1.5%) on Saturday will grab the attention of economists. The lower-than-expected levels will result in risk aversion.

Let’s look at the key levels for the upcoming days.

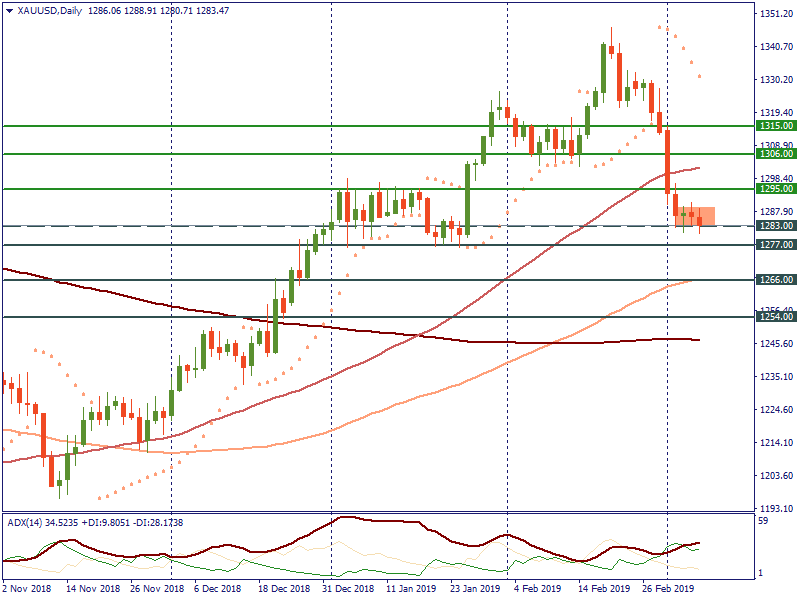

On the daily chart for gold, the yellow metal is trading near the $1,283 level with low volatility. If the risk aversion in the market increases, the price for the yellow metal will rise towards the resistance at $1,295. The next resistance is placed at $1,306. Strong bulls may try to break this level and target the next resistance at $1,315. In case the gold continues to move down, it will fall below the $1,283 level to the support at $1,277. The break of this level will help bears to pull it lower to the support at $1,266. From the indicators' side, ADX shows the strength of bears and parabolic SAR shows the downward movement for gold.

Conclusion

The recent hunger for risky assets pulled the yellow metal from its highs. However, the concerns over the global slowdown and trade uncertainties keep circulating, which may help the yellow metal to take back its positions.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later