China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

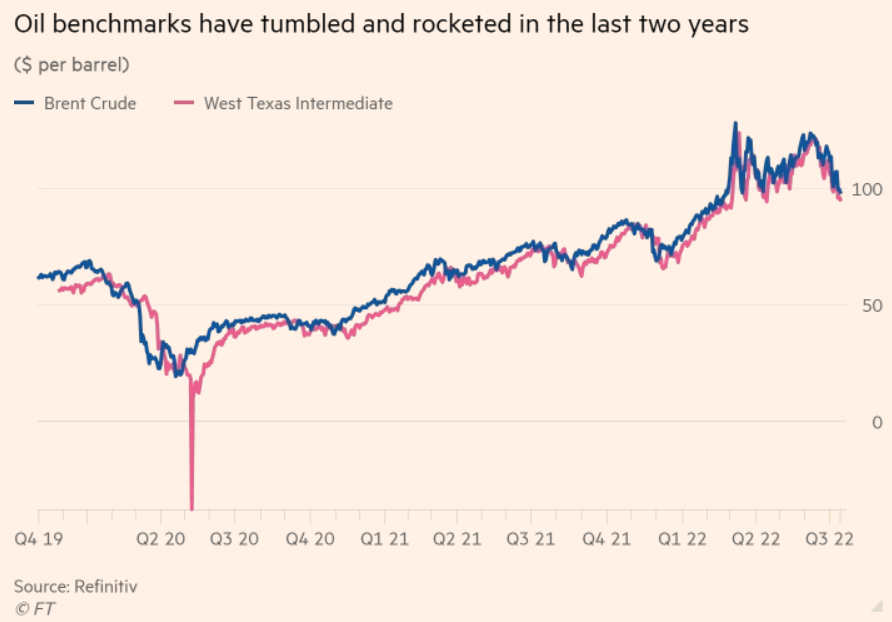

The past two years have seen the biggest swings in oil prices in 14 years. This rollercoaster has baffled markets, investors, and traders. The main reasons for such dynamics were geopolitical tensions and the shift towards clean energy. In the last two years, oil traded as cheaply as $19 a barrel - or at minus levels if you're looking at WTI futures - and it went up to $139.

We haven't seen such huge swings in oil prices since the 2008 financial crisis when oil collapsed from $150 to less than $40. The collapse was due to the fears of a global recession, which led to a drop in oil demand as in our current situation.

The result was a sharp rise in inflation amid sluggish demand, slowing economic growth, and growing recession fears.

Oil prices may drop to $90 a barrel if the world's largest oil consumers continue to struggle with high inflation and low growth.

Oil may drop below $90 and stay around this range for a while. Economic woes in the world's two largest economies will affect oil demand. The effects will, of course, be seen on Brent and US WTI prices.

At the same time, oil demand may find some support from record high natural gas prices, especially in Europe. That will prompt consumers and factories to switch to oil-fueled generation to survive the brutal winter ahead. In addition, the oil supply is not expanding and may even face problems in the coming period as oil demand increases in the winter.

Supply concerns are expected to escalate as winter approaches, as EU sanctions banning sea imports of Russian crude and oil products are set to take effect on December 5. The modest increase approved by the OPEC+ of 100,000 barrels per day in September will not be enough to meet the increased demand.

Technically, Brent (XBRUSD) may drop to 80.00 if it breaks below $90 and settles below that level.

China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

The US dollar index has lost around 12% since October 2022 till its local low at the end of January 2023.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later