The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

These days everyone is racking brains trying to foresee the future path of the US dollar. This isn’t an easy task. Unlike last year, when the Federal Reserve raised interest rates 4 times and the greenback outperformed, this year the Fed is expected to cut the federal funds rate. However, analysts are far from consensus about how big these cuts may be. As a result, forecasting gets harder than ever. In this article, we have gathered the main things you need to know about the US central bank and the USD.

The United States vs. China

The fear regarding the US-Sino trade war has diminished after the Presidents Trump and Xi Jinping met at G20 summit last weekend and made a truce. While the immediate threat of more tariffs from both sides has gone away, the fundamental issues remain unresolved.

On the one hand, the existing risks support demand for the USD as a safe haven. On the other hand, they increase the odds of rate cuts in the United States and limit the strength of the American currency. Ultimately, the influence trade risks and fears have on the USD will depend on the US economic data: good figures will make the greenback strengthen even during the periods of risk aversion, while soft releases will make it underperform.

Donald Trump wants a weaker USD

The US President argues that interest rates in America should be lower. During the past week, he accused Europe and China of currency manipulations saying that their central banks depreciate national currencies and that the United States should do the same.

If the USD goes up fast and by much, we’ll expect other verbal and even actual interventions from the White House. The purpose of the weaker dollar for Trump is to get more money from American exports.

The impact of the jobs report

According to the Nonfarm Payrolls figures released on Friday, the US economy added 224K jobs in June. That’s much more than the expected number of 162K and the gain of 72K seen in May. The release made the USD strengthen versus other major currencies as investors’ fear of the upcoming recession eased.

At the same time, we can’t ignore the fact that wage growth missed estimates (0.2% vs. 0.3%) and the unemployment rate rose from 3.6% to 3.7%. As a result, to support the future job creation and prolong the positive economic cycle, the Fed will likely still need to reduce rate.

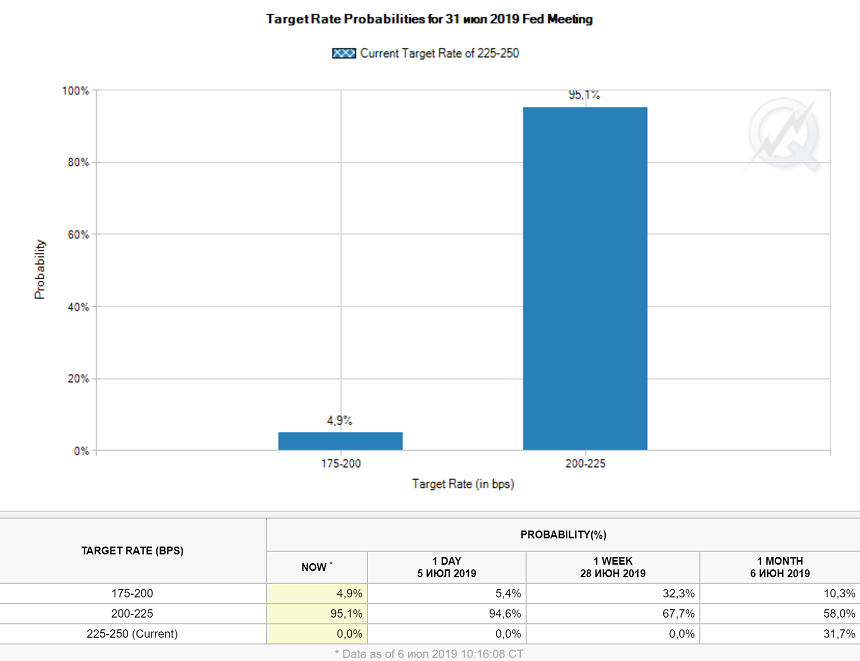

Still, while earlier the market was talking about the possibility of the 50-bps cut on July 31, now the common opinion is that the Fed will reduce its rate only by 25 basis points. The picture below shows that futures on the federal funds rate now price in a 95.1% chance that the rate will be reduced from the current range of 2.25-2.5% to 2.00-2.25% at the end of this month.

Events to watch

July 9, 11 - Speeches of Fed Chair Powell

July 10 - FOMC Meeting Minutes

July 11 - US CPI

July 12 - US PPI

July 16 - US Retail Sales

July 25 - US Durable Goods Orders

July 26 - Advance GDP

July 31 - Fed’s Meeting

Conclusion

As you can see, every week will bring some key news for the USD. All in all, the fact that the market is ready for a rate cut limits the further downside for the USD. The currency has all chances to remain strong versus the EUR and the GBP. At the same time, the position of Donald Trump will likely prevent the greenback from significant appreciation either. Bear this in mind when you make your trade decisions!

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later