The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Walmart is one of the biggest retail corporations in the US, with $244 billion in total assets. Does it worth buying amid rising prices and supply concerns that shatter the world economy? We decided to analyze Walmart ahead of the upcoming earnings report.

Walmart has performed well since the stock market crash in March 2020, gaining 55% over the last years. It may seem not much, but Walmart is a retail company that resists volatility. Average spending grew across 2020 and 2021, rising by 22% and then by an additional 2%. Store sales felt great, too, increasing by 6% through late 2021. Sounds great, but there is a serious concern about future earnings.

The E-commerce segment is likely to be a stumbling block this year as the recession comes to the world’s economy. Shops are moving away from digital spending as Covid-19 becomes a regular flu-like disease and people are no longer locked in their homes.

To fight back the market share, Walmart needs to increase its popularity among US citizens and decrease its dependence on digital shopping (or increase its quality). That will be a major challenge because Walmart’s closest rival – Target – is gaining speed due to better supply chains and pricing policies. That’s why Target is able to post lower revenues but higher profit margins. But Target has only 2000 stores against Walmart’s 11 000, so we have a more worthy opponent – Amazon.

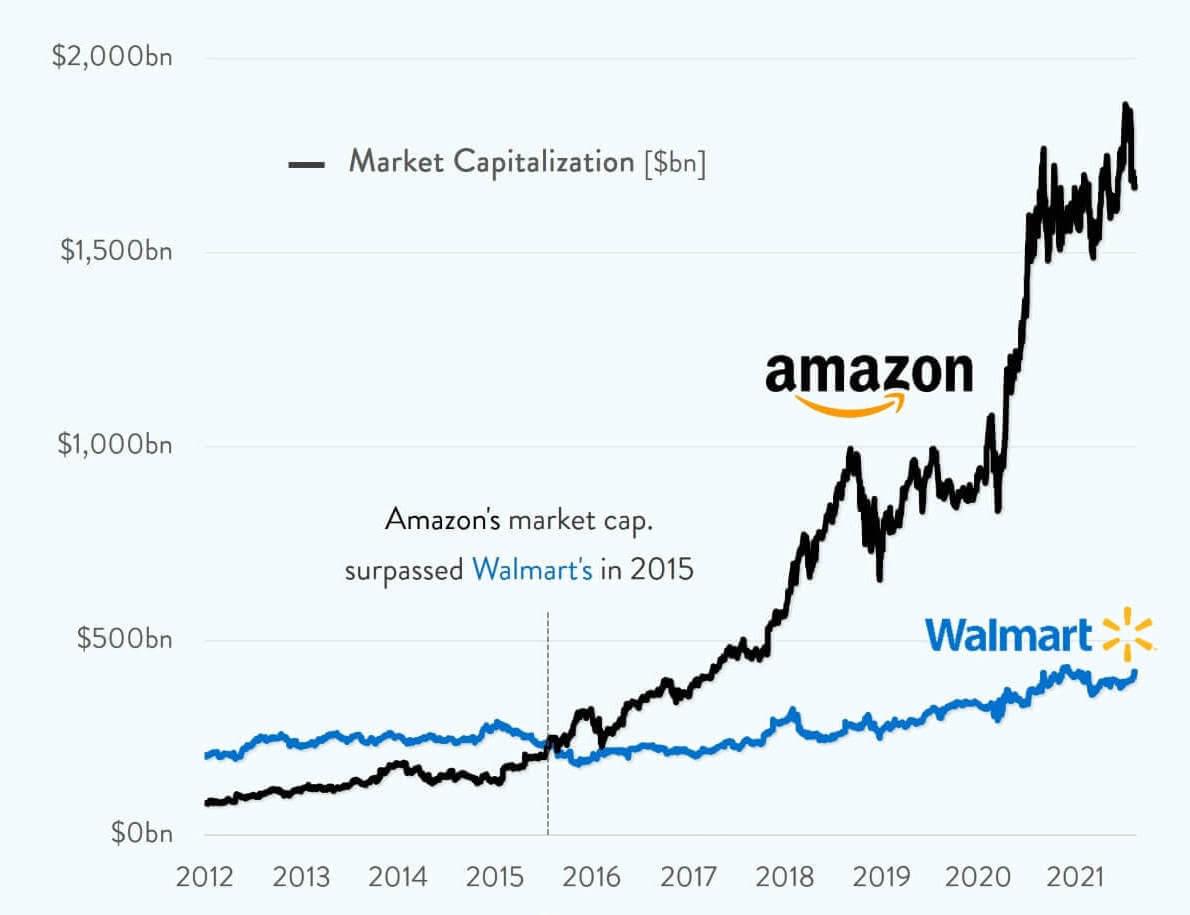

Amazon surpassed Walmart’s market capitalization in 2015 and has been on the top since then. Walmart has a far worse digital segment and scalability. Can the company change the game and be a first?

Probably, the miracle won’t happen, and Walmart will perform poorly in the earnings report. Not only the company fails to compete with its closest rivals, but other factors are pressing on it.

Walmart likely faced soaring costs in areas like transportation and wages. It has been hard to keep employee turnover low in this tight labor market. And the chain might be seeing a demand shift away from some high-margin products, like home furnishings and apparel, as consumers prioritize spending on essentials.

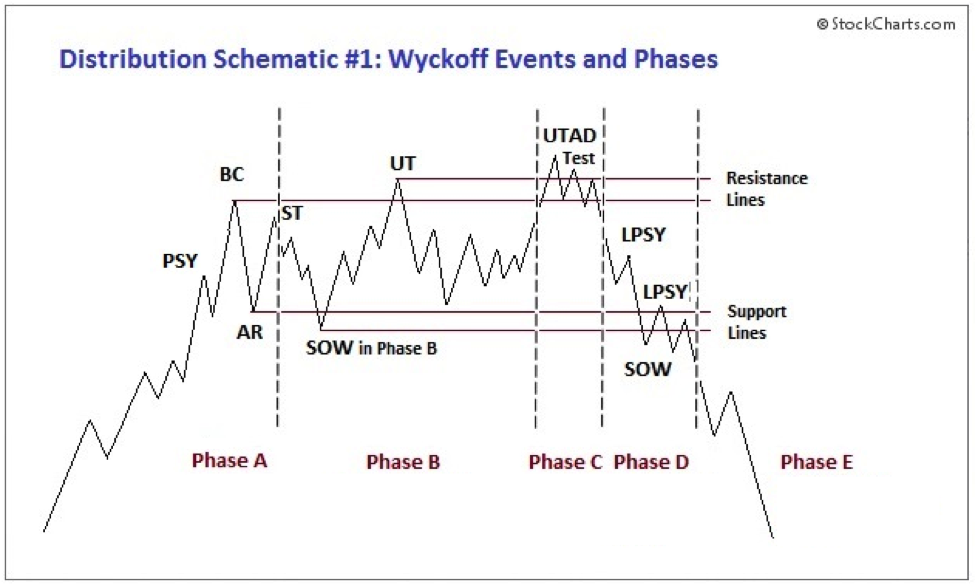

The chart signals the same. Did you know about the Wyckoff distribution model? It tells us about an upcoming recession in the asset. Please take a look at it.

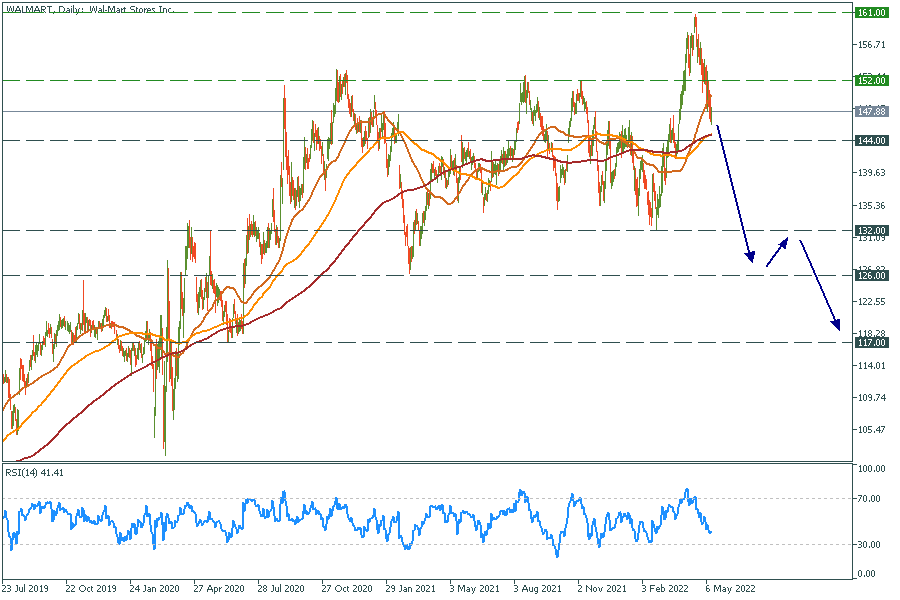

And now look at Walmart’s chart. The chart and the model look almost the same. Thus, we expect Walmart to show worse than expected earnings results and go lower to the support area at $132-126.

Walmart daily chart

Resistance: 152.00, 161.00

Support: 144.00, 132.00, 126.00, 117.00

Walmart will release its earnings report on May 17, before the market opens. Analysts expect EPS of $1.46 and revenue of $138.12 billion.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later