The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

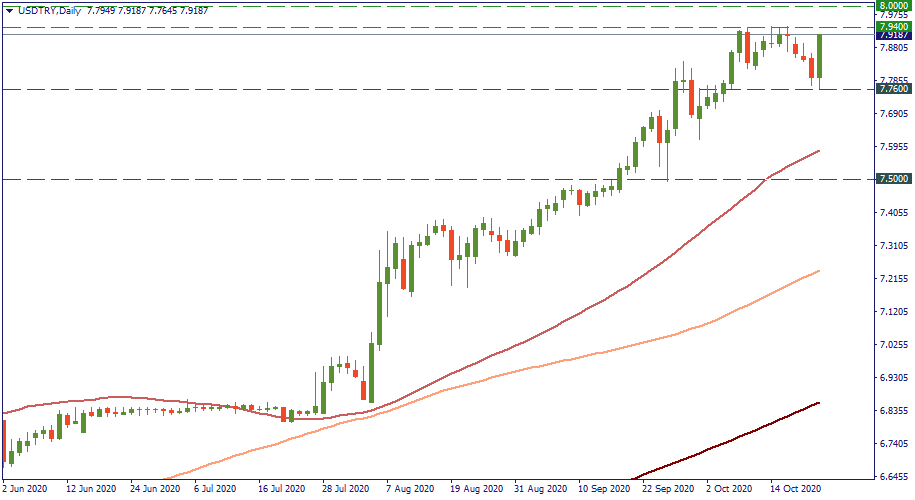

USD/TRY reached 7.94 a week ago. Since then, it was moving down. Lately, it has been floating above 7.76 between the 100-MA and 200-MA. Today, a stunning spike back to the recent highs happened - that's because the Turkish Central Bank refused to increase the interest rate... once again. As you will see, that's the bank's systemic approach, and such a loss of value may not be the last time for the TRY.

On a larger timeframe, 8.00 is not yet reached but may now soon be challenged. Falling to 7.76 may be a precursor to larger bearish moves to the depths of 7.50 in the midterm but it would need a very substantial pressure downwards to drag it further - meaning, something extraordinarily favorable to the Turkish lira would need to suddenly emerge. In reality, TRY is becoming highly unstable. The fundamentals are bad. The overall technical review suggests that dropdown was merely a tactical stop in the course of a long-term depreciation of the TRY.

Here are some facts from the Turkish reality so far: unemployment 14%, inflation 11%, the US was worth four Turkish liras in 2018 – now it’s almost eight. It’s obvious that the Turkish President prefers to “go out” and go military as he has lately been doing in almost every region surrounding Turkey. Rather than taking a look at the domestic issues and try to – what almost any economist would suggest – raise the interest rates. Geopolitically, there is much more: as much as the US has been lately quite unhappy with how Turkey turns its back on NATO buying Russian arms, if Joe Biden comes to power screws will be tightened even more. In general, Joe Biden appears much less an “entrepreneur” president like Donald Trump and much more an ideologically-driven “old-school-style” president. And such a president will definitely have little approval of the current Turkish approach to external affairs and internal issues. In simple words, the Turkish lira will be in trouble. Well, so far, let’s just watch the bounce from the current lows and see when 8.00 gets crossed by USD/TRY.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later