The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Another US Presidential debate took place on Thursday. Donald Trump and Joe Biden faced each other over central questions of American social issues, economics, and foreign policies. What are they and where each candidate is planning to steer the country?

Both candidates were happily accusing each other of falling under “Russian influence”. Both were reassuring the public that their opponent was having “extra” benefits from China. Joe Biden went as far as to say that Donald Trump befriended with the North Korean leader instead of duly putting the latter into a “duly” position as he ought to do. From this exchange, we are getting that Joe Biden – should he become a president and follow his words – comes as a more ideologically strict politician who divides the world into clear camps. Two, precisely: “liberty, freedom, and democracy” – that foes for “good” countries such as the USA, the UK, France, and their peers (in the developed world, most probably); and “autocracy, domination, and force” – that goes for “bad” countries such as Russia, North Korea, Iran, and others (China goes here as well but it is too rich to be recognized as just “bad” – probably, there is a separate category in Joe Biden’s vision for countries like this). In the meantime, Donald Trump, as verbally blaming as he sometimes is, appears to be more of a trading approach, a business approach in a multipolar world. Well, maybe the world is not prepared yet to become multipolar, or maybe it is not supposed to be multipolar – we’ll see. The bipolarity of Biden is so far winning over the multipolarity of Trump by an average of 8% across the US. This would very much affect the USD over other currencies. Specifically, against what many say, there may be a higher probability that the USD loses value in the case of Joe Biden’s victory. Primarily, that’s because that will be a change of direction in the US policies that brings uncertainty: it may force investors to look for other currencies to keep their funds. Second, Joe Biden suggests many programs that require quite a lot of money – much of which will be injected into the US economy if Joe Biden follows his words. More money – less value. There are other implications but probably that will be too much for one article. In a nutshell, it is unlikely that the USD will just stay steady where it is of Joe Biden comes to reside in the White House.

Will the EUR/USD rise above the trend on the USD uncertainty?

Joe Biden said that by 2025 (or 2030, doesn’t really matter) he wants to see the US with zero net gas emissions, etc. He sees renewable energy taking over the oil industry as the energy basis of the economy. Transitioning from oil is his proposition. Trump was very doubtful about that entire approach. He didn’t hesitate to say that this “transition” would be killing for Texas, Oklahoma, and other states that basically live off oil profits in the US. But leaving the debate aside, how realistic is it, in general, to transition to renewable energy 100%? Especially, windmills that Joe Biden is so fond of? And on top of that, how realistic would be all that to complete in a 5-year or 10-year term? Trump, as “un-green” as he may be, was factually correct to state that the US became energetically independent from other countries on his watch. The “transition” from the oil industry may not only destabilize that status but also destabilize the oil market in the world. OPEC may be happy about it though: if the US cut their oil production, there will be more space for the OPEC to market their oil. Prices may go higher.

Can Joe Biden's plan push oil into higher zones?

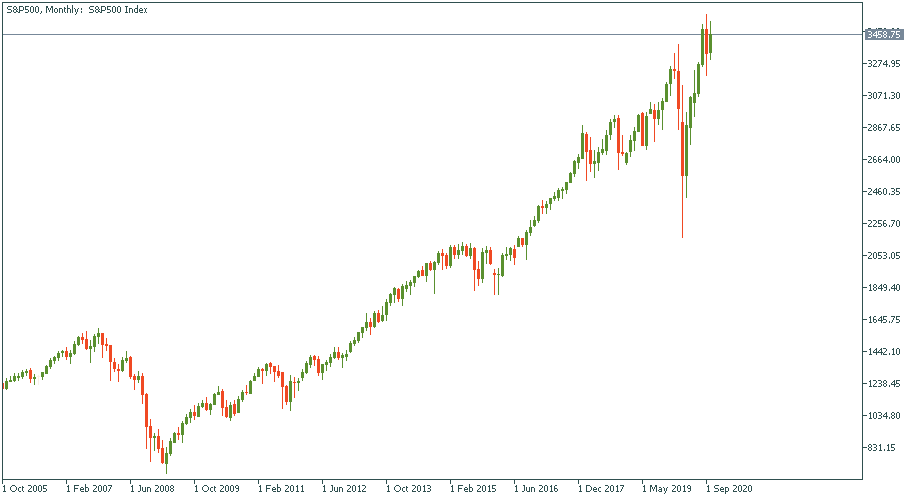

Obviously, Trump stands by the stock market, and the stock market stands by Trump. Biden is like from another room. By saying “the idea that the stock market is booming is his only measure of what’s happening” about Trump, Biden recognized that the stock market and the corporate world, in general, will not be his first priority should he become the US President. Meaning, that’s just another facet in Joe Biden’s stance against how the corporate world enjoys low taxes, high profits, and booming stock prices. Donald Trump explicitly said that the stock market will fall if his opponent wins the election. Indeed, many observers predict such an outcome if Joe Biden wins. Well, you know how to buy the lowest lows right?

How deep may the S&P fall is Donald Trump loses?

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later