The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The US dollar has been enjoying increased demand among other currencies throughout recent months. That is understandable: once a problem hits the world, there is nothing to run for… except for the USD. However, the crisis, as heavy as it is, especially in the US with its persisting infections rate, will slowly go away. With it, the demand for the US dollar will also go away. But when it does, will the USD calmly sit back again on its throne of supremacy in the world of currencies?

EUR/USD started declining in the crisis of 2008, then got back up, but the overall trend is clearly looking downwards. It has to be noted, though, that the last three years are showing the appreciation of EUR and its reluctance to dive below the middle of the channel. It is consolidated horizontally, and if things go well for the EUR, it will renew the 2017 highs. If that happens, the decade-long backbone of the trend will be broken.

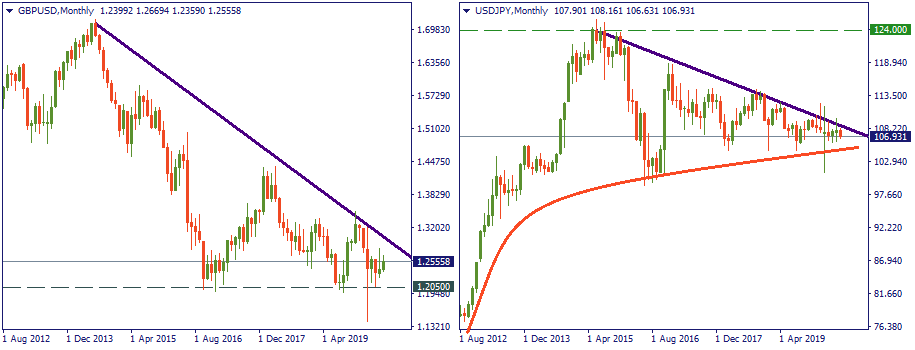

Against the GBP and JPY, the USD also has been having an upper hand since the beginning of the previous decade. GBD/USD has been going down since 2012 – but note the stable support at 1.2050. USD/JPY moved up from 80 to above 120 during 2012-2015. But in 2016, it lost momentum and has been in strategic consolidation at a lower level of 107 ever since.

Finally, AUD and CAD also present roughly the same picture. On the monthly charts, AUD/USD has been going down for as far as the eye can see, and the CAD has been a hostage of the USD in a similar manner. But both contender currencies are challenging their trends currently, with their respective support and resistance being almost intact. Do we have a conclusion then?

The primary observation is that the recent decade has been a decade of the USD’s supremacy. The secondary observation is that since recently, this supremacy seems to be eroded. The EUR, GBP, JPY, AUD, and CAD – irrespective of their own particularities and history of relationship with the USD – are showing that “something strange” is happening with the undisputed strength of the USD. Simply put, it’s getting softer.

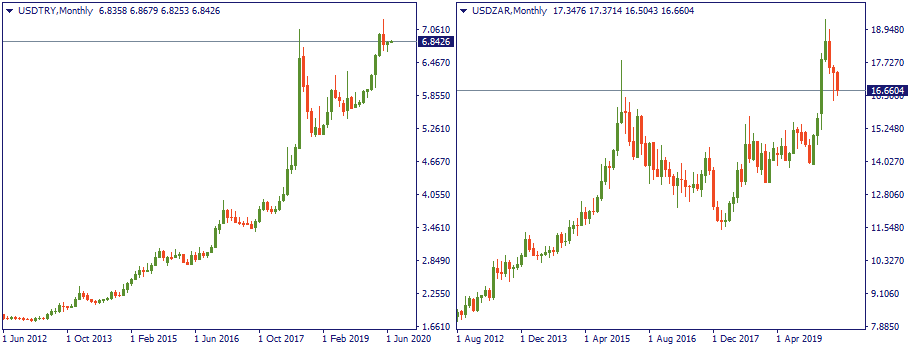

Do the above conclusions concern the RUB, MXN, ZAR, or TRY? Well, to a certain extent – yes, but in reality, the USD is unlikely to weaken to such an extent as to give chance to the exotics to rise above it. Maximum what these can count on is a slower pace of depreciation of the USD. Fundamentally, that may be well explained: if there enough problems in the outside world and inside of the US to make the USD softer, the same problems will press on the exotic currencies even harder. At least, because each of them is tightly linked to the USD and the world economy and, hence, are much more sensitive to any global issue that the US dollar.

Here are some processes that are already taking place. The crisis is coming to the end, and the recovery is underway – that pushes risk-on moods and puts away safe-haven preferences. China is constantly advancing in its global economic presence – this fundamentally increases global interest to the Chinese yuan and other currencies, and further decreases attention to the USD. The US authorities under Donald Trump are leading a protectionist foreign economic policy, which also presses on the USD and strategically erodes it’s international stronghold – such as Hong-Kong, for example, even if it’s indirectly linked to the USD through the GBP. Europe is trying to assert it’s economic power – in increasing clashes against the US economic interests.

In fact, the more you investigate, the more you will find reasons to doubt the strength of the USD in the future. “But China, Europe and all other countries with their respective currencies have the same layout and do also have problems” – yes, true, but there are some observable realities to recognize. Maybe, there will be another decade of the USD’s supremacy. Maybe not. But clearly, we are currently in the phase which that later on may be described as a turning point. Will the post-crisis period change the global economic layout and tilt the table away from the USD? Time will show. But what’s true is that definitely, strategic positions of the US economy in the world stage are very different compared to 2010-s, and hardly anyone will say that they are stronger.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later