The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

On Monday, the Federal Reserve implemented unexpected stimulus measures in order to support the US economy amid the pandemic of a new coronavirus. The Fed cut the interest rate by 1% pulling it within the range of 0-0.25%. Among other tools introduced by the regulator, there were buying $700 billion worth of Treasury bonds and mortgage-backed securities. The last but not least, it cut a so-called discount rate – short-term loans available to the banks through the discount window. Despite these significant steps towards economic stability, the initial reaction of the stock market was negative. S&P plunged to the support zone at $2,360.

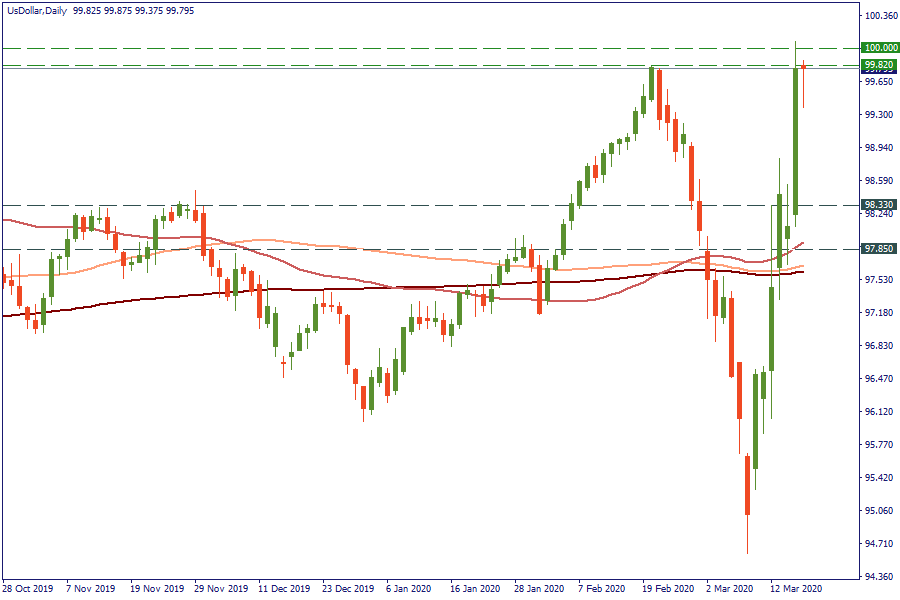

The USD, on contrary, continued its bullish performance despite the stimulus, ruining the traditional market behavior. Yesterday, the US dollar index retested the resistance at 99.82 (a high of February 20).

Analysts name several reasons for this market behavior. The first one, of course, is the shock wave. As the Federal Open Market Committee was planning its meeting on Wednesday, a surprising announcement right before the opening of the Asian trading session stressed the volatile markets even more. While the bank was trying to present the information as softer as possible, the market interpreted this as the late actions by the Fed.

The second is the fear that no more monetary tools left, as the Federal Reserve already showed all tricks up its sleeve. “What about the negative interest rates?” – you will say. In theory, they are possible. But the Fed Chair Jerome Powell has denied multiple times that they are necessary at the moment. The same goes to the purchases of corporate stocks and bonds.

The third reason analysts believe is the unnecessary buying of Treasuries and mortgages. Compared to 2008, there is no instability in the mortgage market. Instead, we should pay attention to corporations, which are unable to generate enough capital to service their balance sheets. Thus, providing loans to the businesses directly (helicopter money) would be more appropriate in that situation.

Finally, it was historically proven that monetary policy stimulus is not suitable to deal with a supply shock. As consumers stay at their homes, lower mortgage rates won’t stimulate to buy homes.

Despite the easing, the demand for the safe-haven USD continues rising. According to many analysts, investors will still prefer the US dollar and won’t choose to put their money overseas, while the global sentiment is unstable. The Fed changes to the monetary policy may have an effect on the USD, but only in the longer-term. As the pandemic spreads and the recession is knocking, we may likely see the USD keeps strengthening against other currencies.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later