eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

On March 16 the Federal Reserve hosted the press conference where it announced several disappointing facts for the US economy. FOMC raised the forecast for the US inflation for 2022 to 4.3% from 2.6% despite the key rate upgrade. Moreover, the FED sharply downgraded the forecast for US GDP for 2022 to 2.8% from 4%.

The US politicians and the White House have been blaming the Russia – Ukraine conflict as well as supply chains issues for the inflation growth. However, it looks more like excuses for a failed monetary policy, extreme prices growth, and huge government debt.

The US dollar has been the reserve currency since 1944. Moreover, even today most of the calculations for oil transactions are calculated in dollars, which supports the US currency. However, nowadays, leaders of the world’s largest and most developed countries such as China, Russia, Saudi Arabia, and India work new settlement system, which will exclude the US dollar.

Saudi Arabia considers using the yuan instead of the US dollar to pay for part of the oil that the kingdom supplies to China. China buys more than 25% of the oil exported by Saudi Arabia, and the kingdom is China's largest oil supplier. The authorities of Saudi Arabia and representatives of big business are increasingly dissatisfied with the foreign policy of the administration of the US President.

India and Russia also consider excluding the US dollar from payments and moving to trade settlements in rubles and rupees. Sides want to use the Chinese yuan as the base currency. The new mechanism will allow Indian exporters to be paid for their goods in local currency instead of dollars or euros.

These innovations in the Asian region can significantly reduce the demand for the US dollar and weaken it.

The FED got trapped between extremely high inflation and the rising government debt of the US. It might play a bad joke with the USD in the nearest future. The world might lose trust in the White House and turn to other currencies such as the Chinese Yuan.

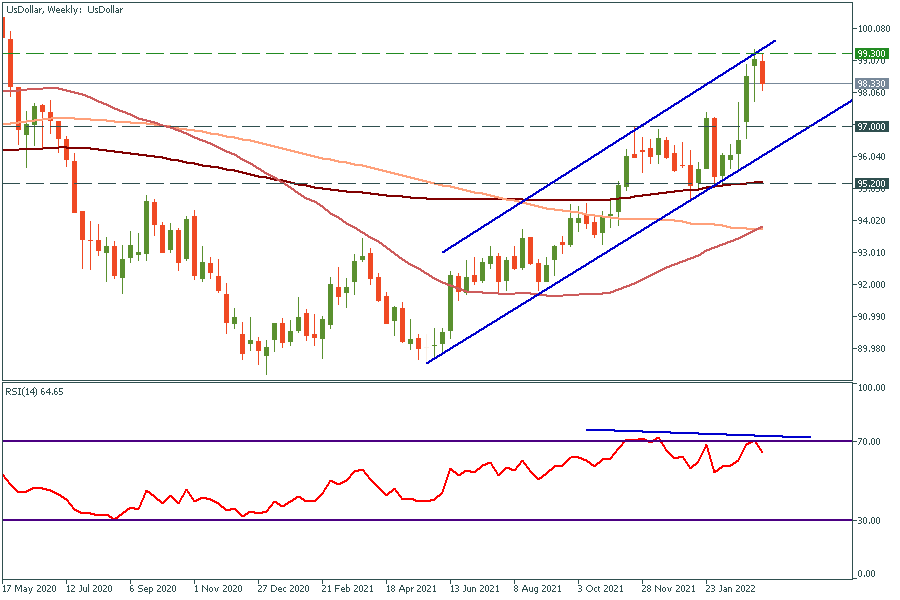

USD, weekly chart

Resistance: 99.3

Support: 97

The US dollar index (DXY) has formed a bearish divergence on the weekly timeframe. The price might decline to 97 within a couple of weeks. Moreover, in the case of lower border breakout, we might see a further decline to 95.2.

GBPUSD, weekly chart

Resistance: 1.3190, 1.3370, 1.3520

Support: 1.2950, 1.2740

The Bank of England was the first to increase the key rate. On March 17 policymakers might increase the rate for the third time up to 0.75. In long term, such steps might make a significant effect on GBP and push it higher against other currencies.

The chart has formed a bullish flag. Traders might consider purchasing GBPUSD at 1.2950 support or after a breakout of the upper border of the flag.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later