The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

In general, the US response to the virus hasn’t shifted beyond the purely medical field to secure border control and treat those who are discovered as infected by the coronavirus. At the same time, the position of the Fed lately has been pretty inert and followed the scheme “we will not move a step unless there is a strong indication to do that”. And that’s a sound scheme because the US economy has been showing steady growth and resilience, giving good labor market indications and inflation under control. In fact, the long-term context of the position which the US economy is in may be even more than positively moderate (especially, if you listen to Donald Trump). Accordingly, the Fed’s stance towards the coronavirus has been to observe and be ready just in case.

But clouds are gathering above the US economy, even though it is least impacted among other countries. Corporations are reporting losses, market indices passing through regional lows, global GDP is damaged significantly. How much does it take to force the Fed to step back from its “monetary non-involvement” course? Last Friday, the US Fed’s Chair Jerome Powell informed: “The fundamentals of the US economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy”.

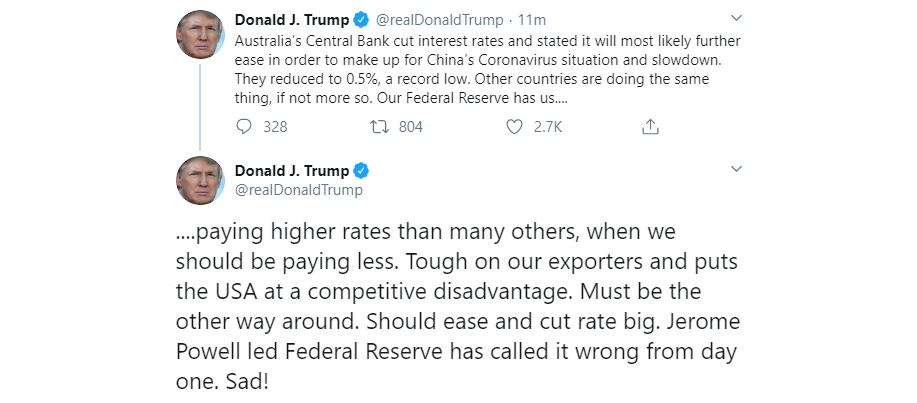

And this is what Donald Trump thinks about this.

There is not much to add as he says it all himself in a pretty direct and explicative manner. Maybe just “don’t be said, Mr. President”. We have to note, though, that this message from Trump’s side is nothing new and the coronavirus context just made it surge once again to the surface. Rate-cutting and easing on the US dollar is where Donald Trump has been pushing the Fed from the very beginning of his presidency and even years before residing in the White House he has been giving negative comments towards the Fed’s monetary line. Whether the situation now pushes there objectively, that’s another case, but personally, the US President has always been the supporter of the ease. And now, it is a perfect moment to bring it back to the table.

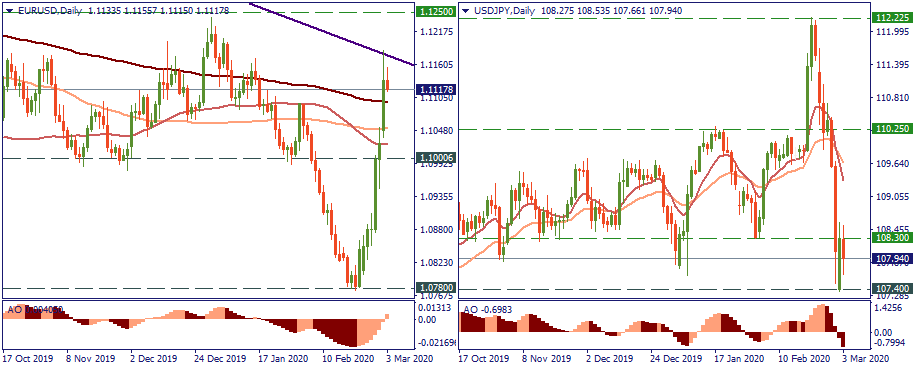

News headlines don't get tired to remind that the US dollar is no longer as safe as usual, with investors switching their interests to other currencies and assets. EUR rose to test the 2-year long-term downtrend, while the JPY re-established itself as a safe-haven currency against the USD. Against other currencies, the USD goes mostly sideways, while its normal behavior is gaining value.

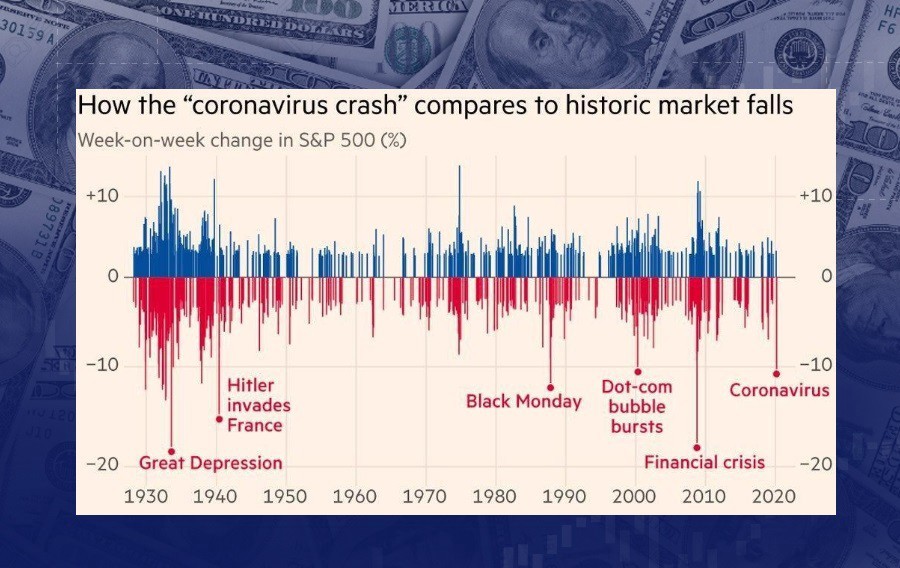

The Fed’s session is scheduled for March 18, which means there are two weeks to go. The dollar is already under much pressure. The market has already transitioned from a phase-one attitude like “We are ok, it’s just in China” to phase two that sounds like “Enemy at the gates!”. Hence, everything will depend on how the virus scenario develops within two weeks. If it keeps the pace, and within two weeks it may be well inside of the US territory, the long-term damage, regional and global, will be pushing the markets to historical lows. In fact, it has already – the image below shows how currently the coronavirus-conditioned global economy looks in the historical context.

Source: Refinitiv

Goldman Sachs expects the Fed to cut the rate by 50 basis points on its March-18 meeting, and make a total cut by 100 points during this year. That reflects the market’s forecasts and explains the decline of the USD. But the intrigue is whether a rate cut will actually help the situation. Strategically, the addressed issue is the economic slowdown which originates in the shortages of supplies from China. Does the rate cut in the US change that anyhow? No, it only may partially offset the damage produced by the wave coming from across the Pacific. In medical terms, a rate-cut taken alone, even if it was sawed down to zero (to the eternal joy of Donald Trump), is only symptomatic treatment. In this case, what would be a proper treatment addressing the cause? It looks very likely that the economy has few more options compared to an individual in response to unknown virus infection: nothing to do, just stay alive, wait, and hopefully, soon everything will be ok.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later