Recently, for the first time in two decades, the euro reached parity with the US dollar…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The risk-on sentiment started this week has moved potentially risky investments, such as emergency market currencies, the AUD, the NZD, and the CNH, higher against the American safe-haven – the US dollar. Currently, the Chinese yuan is focusing on the levels of spring 2019. Should we expect further lows or it is just the short-term recovery of the Chinese currency? Let’s hear the analysts’ opinions.

October is forecast to add volatility to the US dollar for two main reasons. Firstly, the United States enters the pre-election stage. The recent debate between the Democratic candidate Joe Biden and the Republican Donald Trump signaled a possible further escalation of tensions between the candidates ahead of November 3. Thus, we need to be prepared for more unexpected announcements and possibly compromising information. More analysis of the connections between the US election and the USD is presented in the article “TRUMP, ELECTION, USD: Cleveland debate”.

Another thing that is driving the USD crazy is the anticipation of an additional coronavirus stimulus package. According to the US Treasury Secretary Steven Mnuchin, he and the House Speaker Nancy Pelosi made progress in stimulus talks last week. Despite that, the House of Representatives voted for a delay of a stimulus bill yesterday in order to give more time to Mr. Mnuchin and Ms. Pelosi for discussions. For now, the Democrats persuade the Republicans to agree on the $2.2 trillion stimulus package. This is $1 trillion more expensive than the proposal by the Republicans. The next vote in the House of Representatives is scheduled for today. As a result, nothing is certain. If the policymakers fail to reach an agreement on support measures, the risk aversion will strengthen the USD.

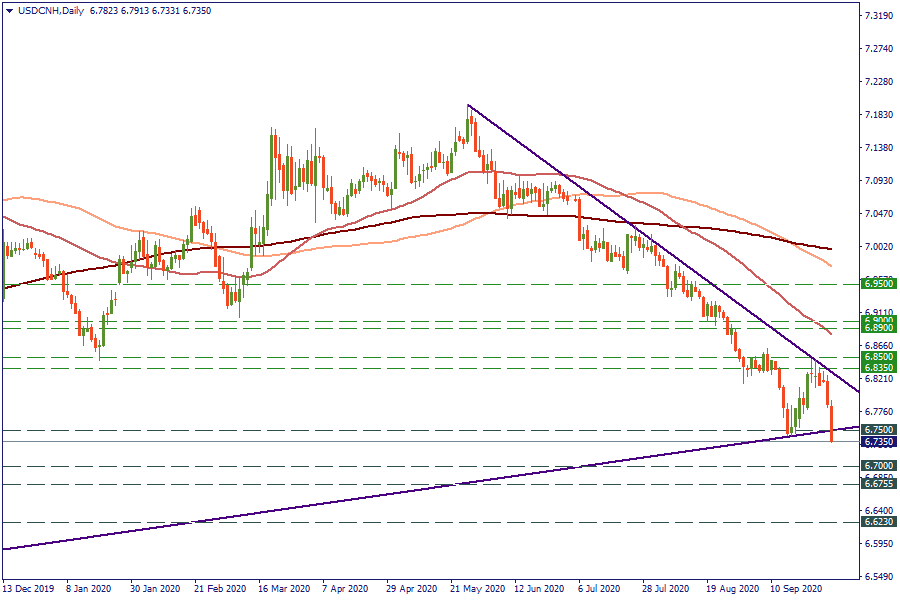

On October 1, USD/CNH has broken below the low of September 16 at 6.75 and started to go down towards the 6.7 level. If the USD gets positive momentum today, the pair will return above 6.75 level to the resistance at 6.8350. This scenario will go in line with the forecast by UOB Group, which expects consolidation between 6.75 and 6.8350 for the next 1-3 weeks. Alternatively, an agreement on stimulus may pull the pair to the low of April 2019 at 6.7. The breakout of that level will trigger further selling pressure towards the next strong obstacle at 6.6755.

Recently, for the first time in two decades, the euro reached parity with the US dollar…

The second earnings season of 2022 has almost begun. From banks and tech stocks to cars and the retail sector: in this outlook, we covered the most promising releases of this summer and made several projections on the companies’ prospects.

The stock market has reversed, and now it’s going lower and lower…

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later