I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

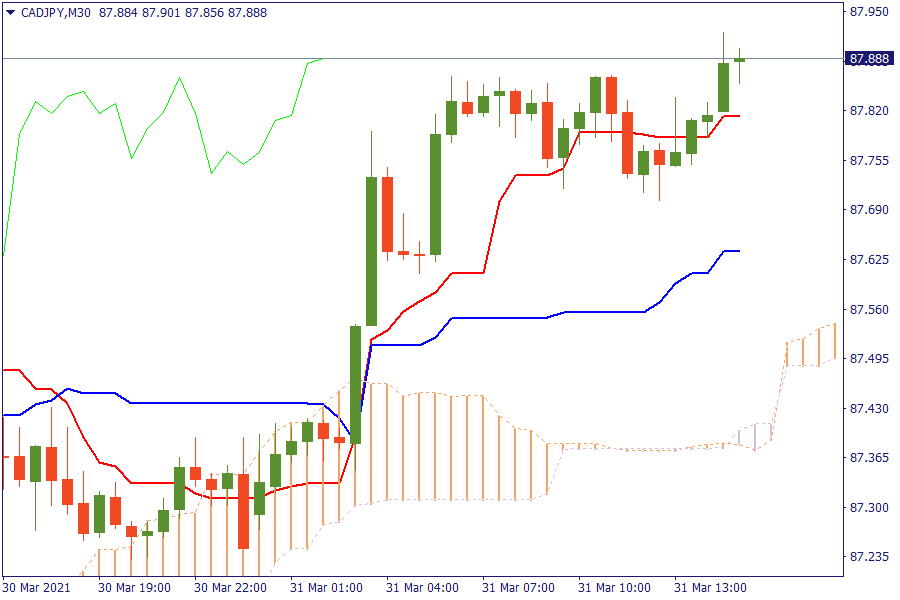

Ichimoku Kinko Hyo

CAD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

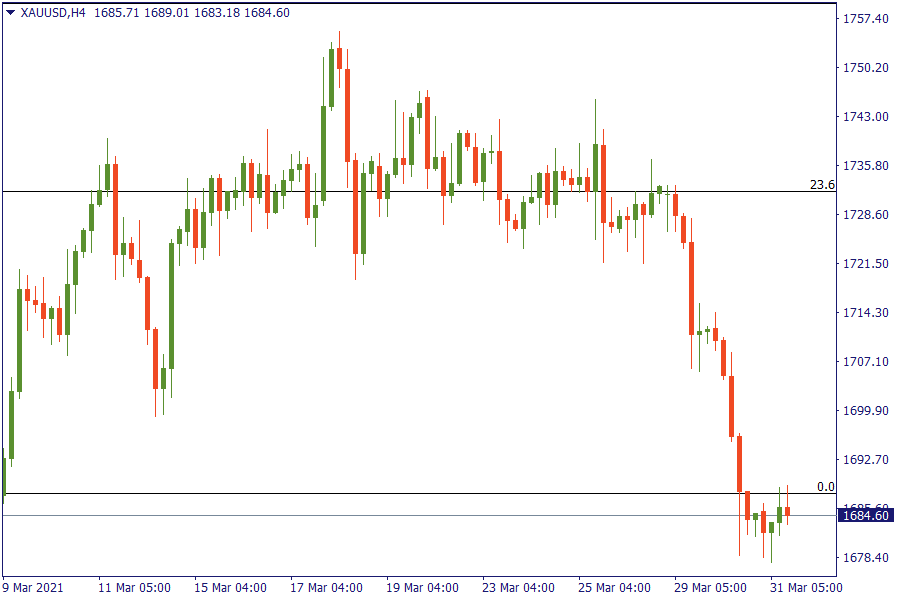

Fibonacci Levels

XAU/USD: Gold facing a further weakness the last hours and trading below a full retracement area. Gold continues to flirt with session lows.

US Market View

U.S. stocks are seen opening mixed Wednesday in cautious trading, with President Joe Biden set to unveil his infrastructure plan and ahead of the release of closely-watched employment data. Investors are awaiting details on President Joe Biden’s plan to revitalize U.S. infrastructure later Wednesday, including the size of the total package and what measures will be taken to fund it.

Britain will on Wednesday push G7 allies to get tough on China over "pernicious practices" that undermine the international trading system, calling for an overhaul of outdated and ineffective World Trade Organization rules. Trade minister Liz Truss will host her G7 counterparts and the new head of the WTO, using Britain's platform as current president of the group of rich countries to promote post-Brexit Britain as a leading free trade advocate. Wider relations between London and Beijing have soured in recent months, with tit-for-tat sanctions over China's human rights record and a bitter row over reforms to the governance of former British colony Hong Kong.

Ahead of this the ADP Research Institute releases its report on private payrolls for March at 8:15 AM ET (1215 GMT). The number will likely show a significant pickup in hiring as lockdowns ease and weather improves, with expectations for a gain of 550,000, a significant jump from February’s 171,000 increase. This will act as a curtain raiser for Friday's official employment for March.

USA Key Point

I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Futures for Canada's main stock index rose on Monday, following positive global markets and gains in crude oil prices. First Citizens BancShares Inc's announcement of purchasing the loans and deposits of failed Silicon Valley Bank also boosted investor confidence in the global financial system...

Investor confidence in the global financial system has been shaken by the collapse of Silicon Valley Bank and Credit Suisse. As a result, many are turning to bearer assets, such as gold and bitcoin, to store value outside of the system without...

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later