Recently, for the first time in two decades, the euro reached parity with the US dollar…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

During June 2021, the US dollar index has gained 2.3%, which is the biggest run since March 2020. The main reason for the greenback’s growth is FOMC’S June meeting, where US officials signaled that they expect rates to climb already in 2022. Then, Chairman Jerome Powell mentioned that the central bank started to talk about economic stimulus reduction.

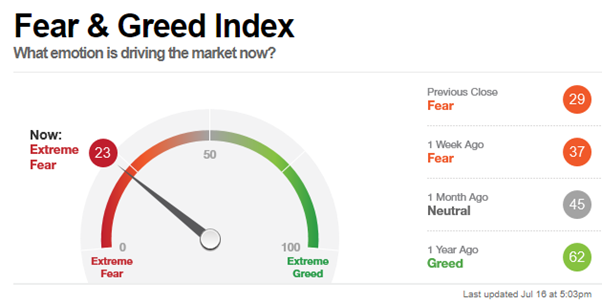

Overbought is the other fact that makes investors to hedge their positions in the stock market. S&P500 gained 101% since March 2020 crush, Nasdaq grew by 125% in the same period. Regular investors are extremely scared and ready to fix their profits since fears about rising inflation could push the central bank to raise the key rate.

Source: https://money.cnn.com/data/fear-and-greed/

At the moment, the US dollar index is showing an opposite correlation with Treasury yields. The same scenario had happened last year but oppositely. Investors betted on the currency falling while yields moved higher in anticipation of economic reopening.

Risk assets can get under pressure while the US dollar is strengthening. As one of the most speculative assets, Bitcoin boomed against the greenback by 2000% after March 2020 might be in danger. It already dropped by 50% from its record high of about $65.000.

Meanwhile, some analytics relate to the position that Bitcoin might keep its growth after overcoming worries related to the recent China crypto mining ban.

US Dollar Index Daily chart

On the daily chart, reversed “head-and-shoulder” has been formed with an estimated target at the level of 97. As soon as the price breaks the resistance at the level of 93.5, it will head towards the main target. This move allows the US dollar to appreciate by 4.5% against a basket of currencies.

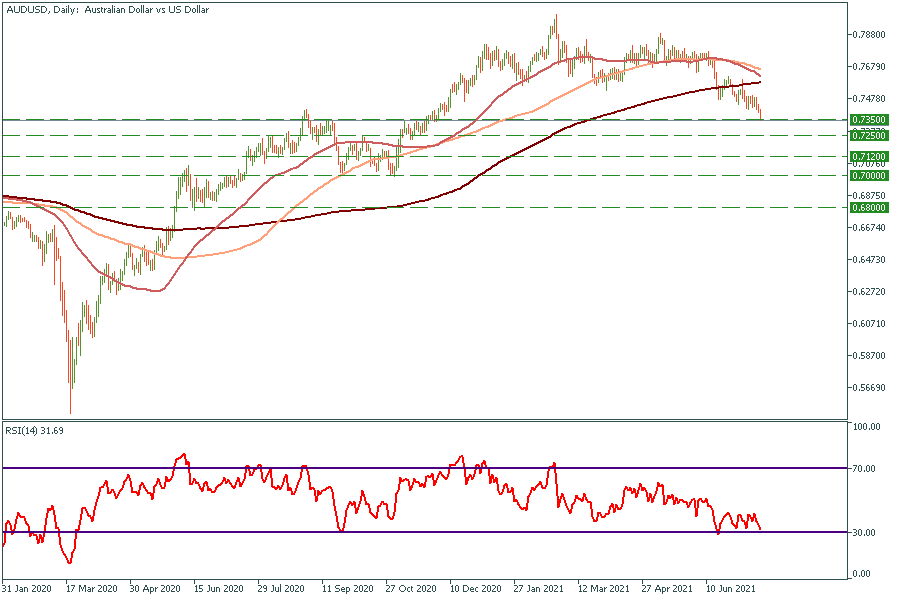

As an example, let’s look at the weekly chart AUDUSD.

US dollar index growth will lead the price to fall with targets at 0.725, 0.712, 0.7, and finally 0.68.

Recently, for the first time in two decades, the euro reached parity with the US dollar…

The second earnings season of 2022 has almost begun. From banks and tech stocks to cars and the retail sector: in this outlook, we covered the most promising releases of this summer and made several projections on the companies’ prospects.

The stock market has reversed, and now it’s going lower and lower…

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later