China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Natural gas is the cornerstone of the European economy. If most of the world is struggling with rising energy prices, Europe is under the fiercest attack among us. Natural gas and electricity prices have risen to "ridiculous" levels, increasing pressure on consumers and businesses across the EU. As the energy crisis worsened, inflation jumped in August to 9.1% in the Eurozone, forcing European leaders to improvise rescue plans and emergency measures to spare consumers the devastating economic pain in the upcoming winter.

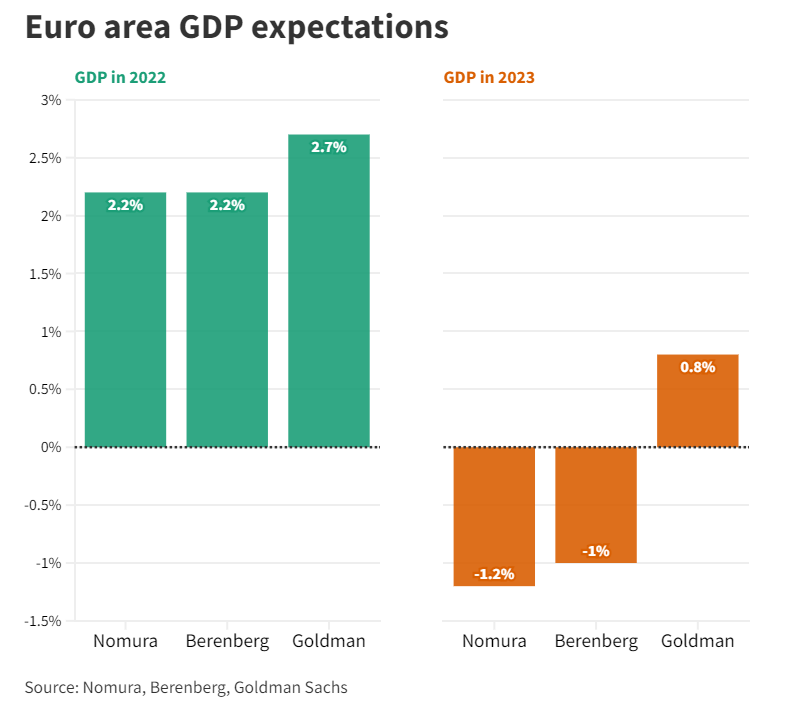

The EU plans to intervene in markets directly in the short term to curb rising energy costs for households and businesses, threatening to push the Euro area's economy into a deep recession.

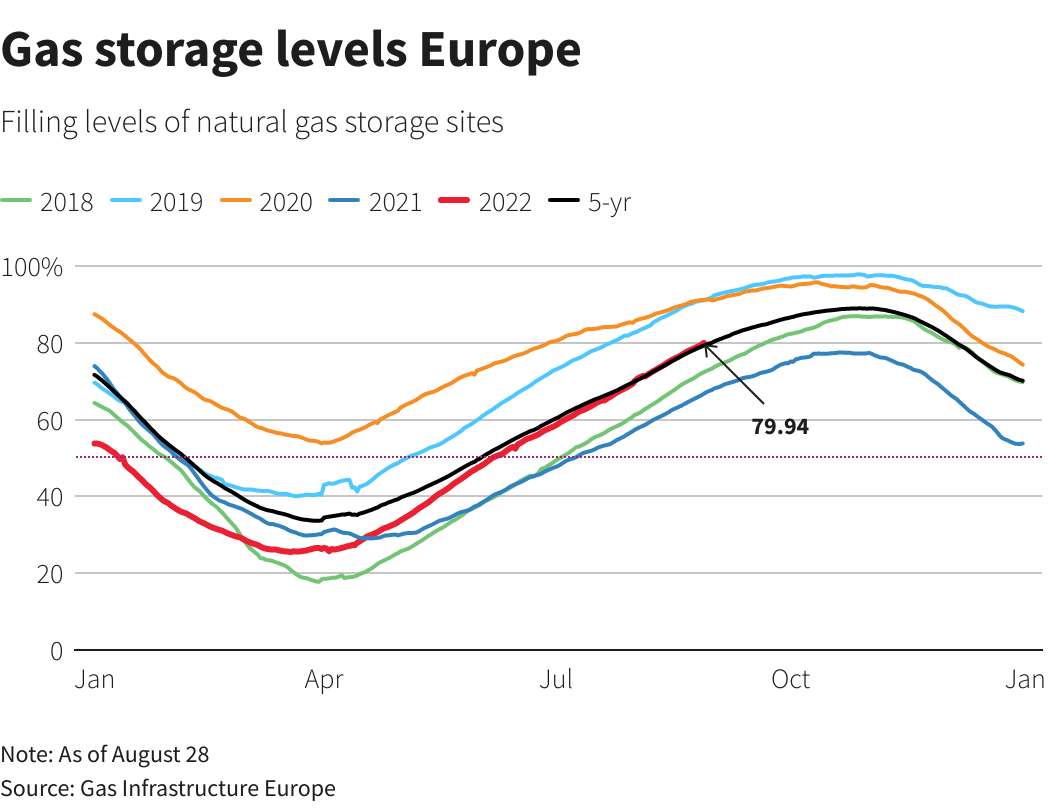

The European Commission is working on unspecified emergency proposals to ease energy costs this winter, ahead of the EU energy ministers meeting on September 9. Meanwhile, efforts to fill storage sites are proceeding faster than planned, providing some relief and increasing Europe's chances of getting through the winter with enough supplies.

The EU is on the right track to filling its gas storage facilities targets. Countries will surpass their target of having 80% of full storage by November, with European storage facilities filling an average of 79.9%.

But analysts warn that the biggest factor in securing energy this winter is cutting consumption to ensure stored fuel lasts through the cooler months. Reducing demand will be more important than storage. If countries fail, Europe's gas facilities will be empty by March and before winter ends.

To avoid a crisis in the winter, countries need to cut gas consumption every month by 15% below the five-year average. That would leave post-winter storage 45% full if Russia kept sending gas and 26% full if Russia cut flows from October.

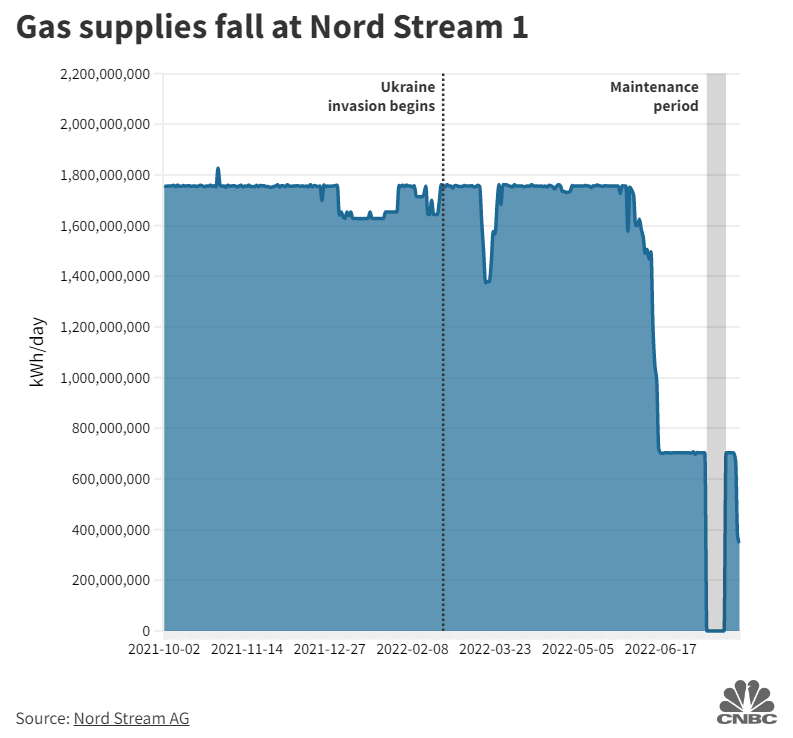

Russia supplies Europe with more than 40% of its natural gas needs, but after the war in Ukraine, Russian flows have already fallen sharply.

Moscow reduced supplies via Nord Stream 1, Europe's main pipeline, to 40% capacity in June and to 20% in July. The justifications were maintenance problems and sanctions, which Russia says prevent the return and installation of equipment.

The amount of gas Russia sends via Nord Stream 1 is now only 20%, so storage alone will not be enough to rebalance the markets. Especially with the repeated closure of the Russian pipeline for various reasons. It was closed for ten days in July. It was closed again last week for three days due to maintenance.

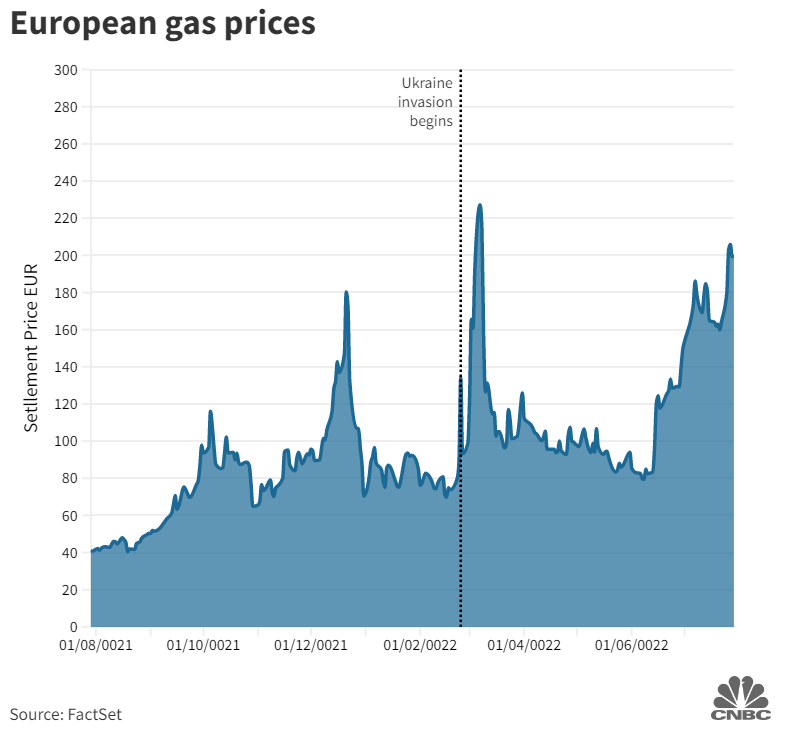

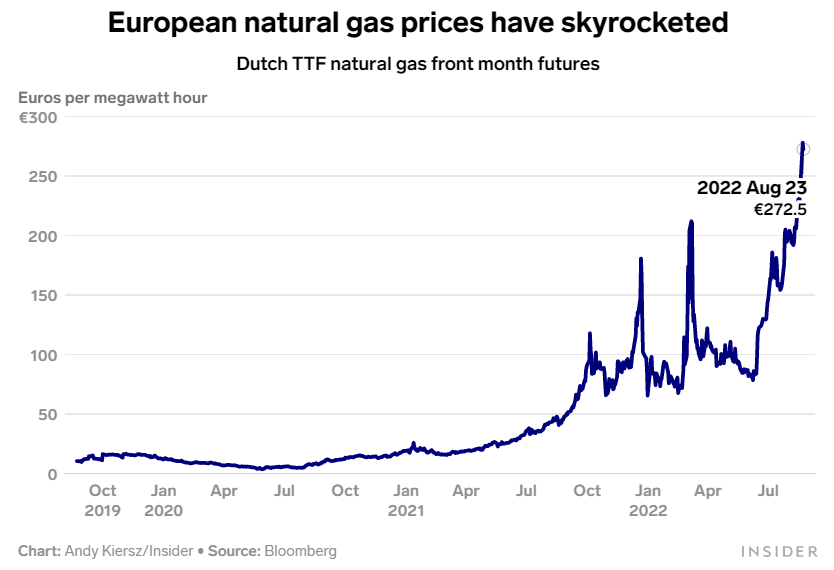

With an energy crisis raging in Europe, the uncertainty over the flow of natural gas has sent prices to unprecedented levels.

1. On the oil scale, the price of natural gas has reached the equivalent of $500 per barrel, ten times the current average oil price ($100).

2. Compared to the US, gas in Europe has risen to more than 10 times its level in the US, with US gas trading close to $10/MMBtu.

3. While European gas prices reached a record level above 340 euros per megawatt-hour, or $100 per million British thermal units.

These numbers raised fears of the coming winter and cold homes without gas for heating, in addition to the explicit threat to energy-intensive industries.

With the possibility of direct intervention in energy markets from the EU to ease the energy crisis, gas prices dropped, witnessing a rare relief from the recent rises.

Natural gas prices in Europe dropped sharply to €220 per megawatt hour, declining by more than 30% from record levels near 340 euros.

The German economy minister expects gas prices to drop more soon. Germany, the largest gas consumer in Europe, said its gas storage facilities are set to be 85% full by next month.

China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

The US dollar index has lost around 12% since October 2022 till its local low at the end of January 2023.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later