eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The Federal Reserve’s aggressive tightening policy has led the US dollar to reach multi-decade highs, pressing currencies worldwide.

A United Nations agency is warning that the central bank’s actions create a high risk of pushing the global economy into recession. Thus, the UN calls on international central banks to stop increasing their rates. As a result, the markets reverse after this statement, with US500 gaining 5.40% since the beginning of the week.

In a new report, the United Nations stated that tightening monetary policy meant to fight inflation could inflict worse damage globally than the financial crisis in 2008 and the Covid-19 shock in 2020.

The agency estimated that each Federal Reserve 100-basis-point increase would lower the economic output of other wealthy countries by 0.5% and the economic output in less developed countries by 0.8% over three years. That’s because a strong dollar makes importing essential items like food and fuel more expensive for other countries. A Strong greenback especially crushes poorer countries that must meet their debt obligations in dollars.

The UN agency called the Fed’s actions an “imprudent gamble” with the lives of less fortunate people. If central banks don’t “correct the course,” emerging countries could tumble into debt crises and health and climate emergencies.

Jerome Powell many times highlighted the Fed pays attention only to the macroeconomic data, such as labor market and CPI numbers.

On October 7, the Bureau of Labor Statistics will announce NFP, followed by the CPI release on October 13. These events will define the greenback's trend for the next month.

According to the latest labor market data, initial filings for unemployment claims fell last week to their lowest level in five months, a sign that the labor market is strengthening even as the Federal Reserve is trying to slow things down.

Jobless claims for the week ended September 24 reached 193 000, decreasing by 16 000 from the previous week. The drop in claims hit the lowest level since April 23, and the first-time claims fell below 200 000 since early May. The data highlight a possibility of stronger than expected NFP numbers on October 7, as analysts' predictions are rather low with only 265K.

Usually, bigger-than-expected NFP numbers push the US dollar higher, highlighting the economy's strengths.

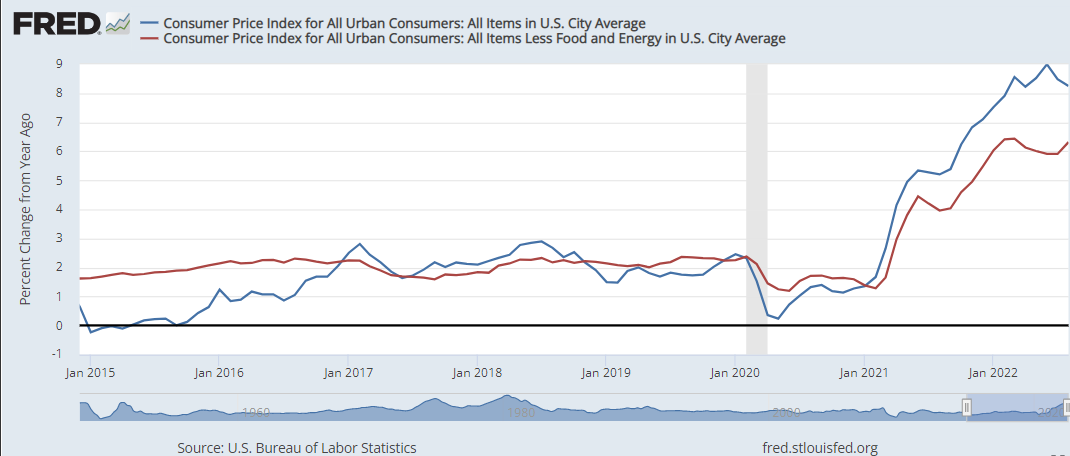

Markets will also closely watch the Core CPI as the index gained 0.6% m/m in August. Core CPI tends to be the most important inflation data right now, as it shows people's mood to buy non-essential goods (the index excludes food and energy).

Usually, bigger-than-expected Core CPI numbers push the US dollar higher, highlighting non-essential goods prices increase and, in addition, high demand for these goods.

US dollar index, daily chart

We can notice that the US dollar index always retests previous highs on the daily timeframe. This time is not an exclusion. US dollar index declined to retest 06 September highs. If the price breaks below, it will plunge to the support trendline at 108.20.

If buyers lose this trendline, the US dollar index will keep falling towards 104.80, and the overall bullish trend will be over.

On the other hand, if buyers hold this support, the index will still have a chance to reach 114.50 and even 118.20, pushing global currencies and risk assets to new lows.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later