The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Performance in 2020: +1.6%

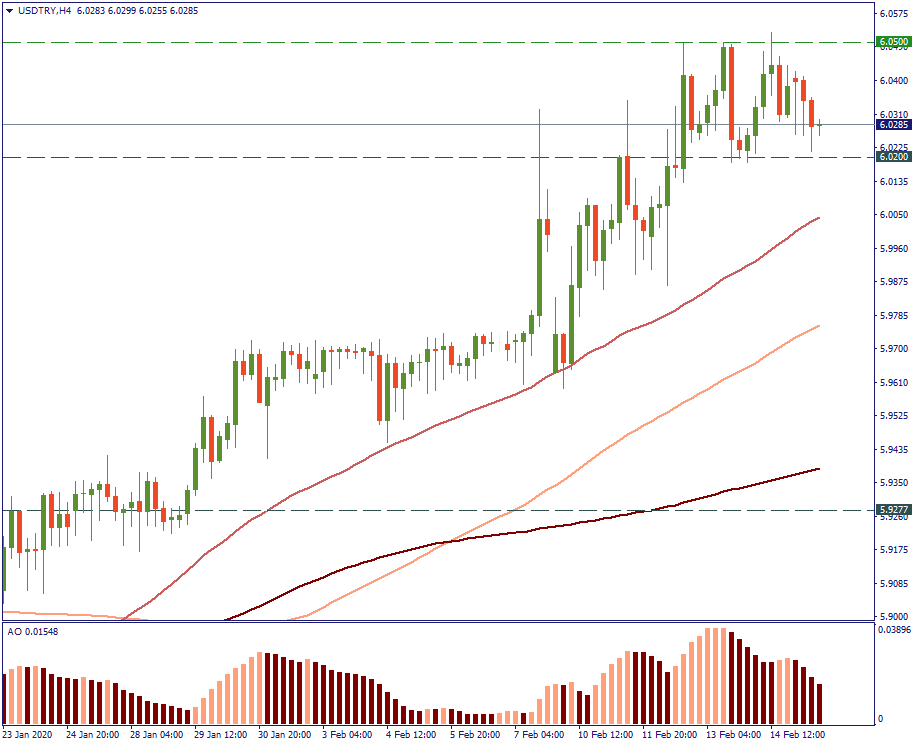

Last day range: 6.0177 – 6.0521

52-week range: 5.2863 – 6.2860

The Turkish lira is depreciating against the US dollar. In fact, that has been the case for more than 10 years, with the exception of the second part of 2018. The main reason for that is that the Turkish authorities are taking risky political and military maneuvers on international stage. That puts a heavy burden on the country’s economy, increases its debt and tarnishes its international image and therefore investing environment. Together, these factors make the Turkish economy slowly sink and fight double-digit inflation.

The Turkish president Recep Tayyip Erdogan is famous for being an enemy of interest rates (among other things). That’s basically why the Turkish Central Bank Governor Murat Uysal keeps slashing the interest rate and is likely to continue doing that. The inflation now is not as high as before, and formally, it gives ground for the monetary authorities to state that they are following a correct course in currency stabilization and disinflation.

However, the true reason in the actions of Mr Uysal seems to be more human than economic. His predecessor in the position of the governor of the Turkish Central Bank, Murat Cetinkaya, was fired by Erdogan for not following the Turkish President’s instructions. Such a thing never happened in the last 40 years since the time of the military coup in Turkey. That tells a lot about the true domestic environment in the country and “how far” things have gone.

In any case, such a policy, even if locally it coincides with certain positive economic factors, will probably inflict more economic damage on Turkish citizens rather than truly control the domestic economic situation. For sure, it will make Turkey lose financial and investment credibility on international scale - Fitch rates it at BB- now.

Not that any analyst was in a position to suggest anything, but it doesn’t take a genius to predict little good for the country where economic authorities prefer bowing to the dictation of political leaders rather than standing truly economic grounds. Probably, to understand the inner working of the Turkish Central Bank, we have to take into account the traditional reluctance of Middle Eastern leaders to follow the path of consultation and deliberation in decision making. Including the economic ones. However, even so, it is unlikely that Mustafa Kemal Ataturk, the founder of the Republic of Turkey (you see him on every banknote of the Turkish lira), would approve pressing on the image of “strong Turkey” on international stage at the cost of long-term economic well-being of his country. In fact, while Ataturk abstained from taking part in any military conflict and got himself busy with building a new republic, Erdogan seems to choose “we’re in” approach in almost every military conflict in the region to boost his image in the eyes of his electorate. You may say "But Trump also does it!". Well, is Turkey as rich as the US to pay for the political games of its country leader? You guess.

Resistance 6.05

Support 6.02

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later