The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Until very recently, the race for the presidency and winning the voters was a known drama with a preset scenario: a number of ugly public clashes between Trump and Biden over in the course of debates, then the final voting in November, and then it’s done. Obviously, there is a number of deviation possibilities expected to this scenario, but still, the general scheme is pretty clear. If you can call that “clear”. But several days ago, it became even more twisted than before. Donald Trump got COVID-19. It happened on Thursday, actually, when the first test got out, but the public announcement was held back until later on to make sure that a more formidable medical confirmation gives the same positive result. The market got down, such a disappointment, and all of a sudden, so many more negative possibilities out there, and all right just a month ahead of the presidential campaign… What now?

Now, Donald Trump – as a true politician and public “architect” – took this virus and made it a part of his presidential campaign. The logic here is “I have the virus. Biden hasn’t. So I’ll make it my weapon against him now”. When you look at what’s been happening during the last two days from this angle, everything becomes clear. And you can expect more of that. That we cannot possibly know the true status of Donald Trump’s health – is a fact. But he, as a politician, is not interested to disclose this fact. He needs tension. He doesn’t want to show an easy victory over the illness just in two days – he wants to use the “marketing resource” of being sick with COVID-19 to the maximum. So he drives out the Walter Reed Hospital and waves a hand to his supporters who shout “we love Trump” and “God bless our president”. Never mind that it is not advised to get out of the isolation in any way – even if you are a US president – as long as you have COVID-19, and Trump not only endangers the people around him but makes people gather around the hospital when they are supposed to socially distance. In the end – whenever it is – Trump will credit the victory over the virus to his public image. So he hopes, at least.

We don’t really know what’s happening to him and how severe is his particular case of COVID-19. We know that he has been given several drugs that are given to different types of patients at different stages of the illness. His health advisors are giving contradictory information and, in some cases, openly admit that they don’t immediately disclose the true reality of the president’s sickness. It was said that Donald Trump is for discharge this Monday but again – how far that is from the truth, we cannot possibly know. Observers are complaining at the same absence of credible information or lack of it. So all we can do now is wait until the sun rises in the US…

In general, Forex seems to be pretty alive. No strong trends favoring particular currencies are visible in response to the “miraculous recovery” of the US President – rather, some corrections.

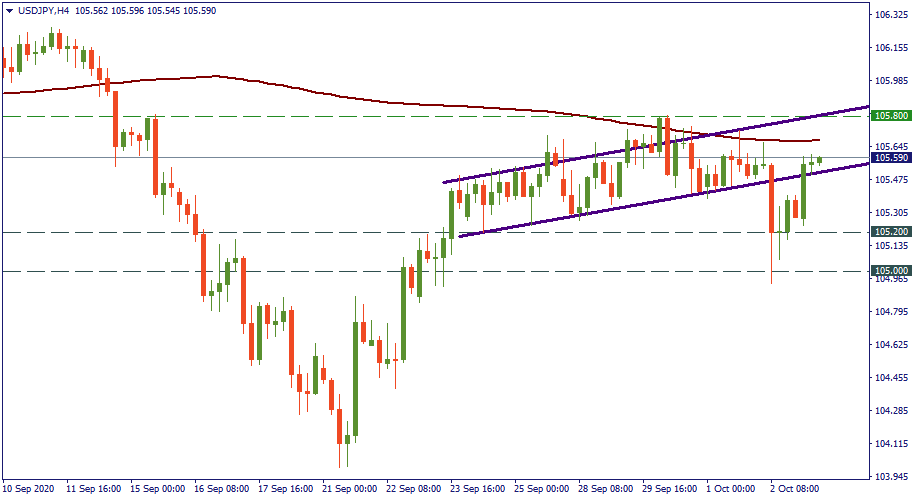

USD/JPY got back up into the channel from the range of 105.00 – 105.20. the 200-MA is still the first resistance to be crossed.

EUR/GBP keeps descending as it has been, from the September high of 0.9260 to the lows of 0.9040. the latter is a fresh bottom, although the price touched it on September 28 already. Currently, it’s marching upwards in a bullish bounce.

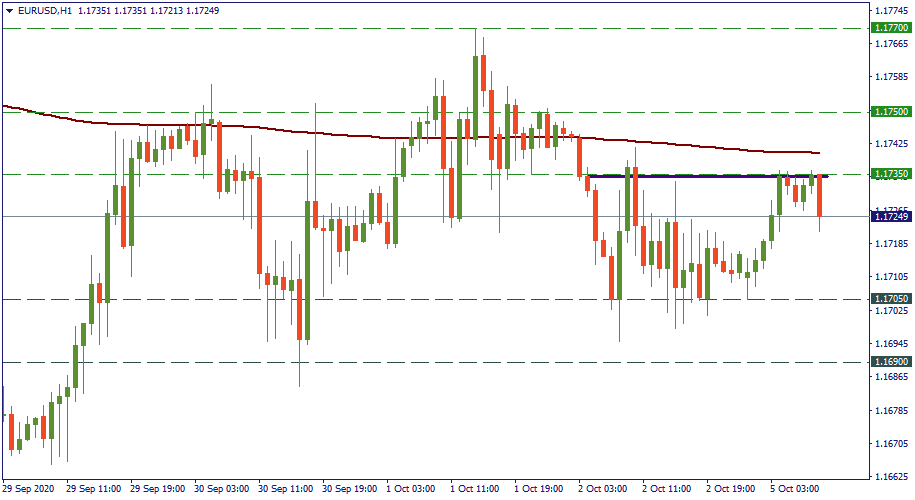

EUR/USD, as the pair which is “most concerned” with the US President’s health just goes through volatility – what else can you expect… It dropped from 1.1735 to 1.1705, then got back to 1.1735, and now it is again looking downwards - probably, against at 1.1705.

Gold rose to $1 915 on the fears of what more can go wrong because of Donald Trump’s illness. But after that, it dropped back to $1 890 saying “ok so he is getting better, no boost for me then”. The general trajectory is still uptrend though, just the sudden spike has been corrected.

As you can see, the reaction is pretty diverse, somewhere muted, and contradictory. As expected with Donald Trump, right? Anyway, let's wish him the soonest recovery - aside from all poslitics - and stay updated.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later