The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The Federal Open Market Committee is releasing its monetary policy statement today at 21:00 MT time. As usual, policymakers will provide the decision on the interest rate and possibly announce forecasts for the future of the regulator’s monetary policy. The meeting will be followed by the press conference with the Fed Chair Jerome Powell at 21:30 MT time.

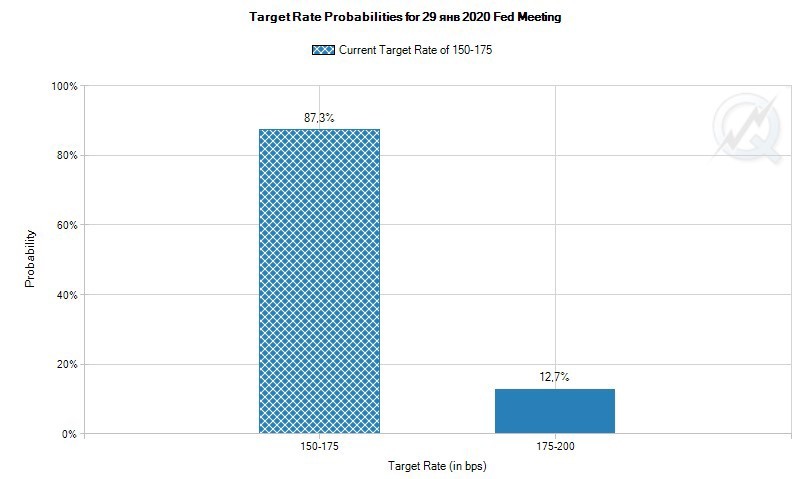

The market expects no changes to the current interest rate, which is held within a range of 1.5-1.75%.

Sourced by: CMEGroup

Despite yet another attempt by the US President Donald Trump to call for the lower interest rates yesterday, the Federal Reserve is not likely to listen to him for now. The interest rate is seen as appropriate amid the current economic conditions of the United States.

Many economists recommend keeping an eye on the comments by Mr. Powell concerning inflation. According to them, the Fed Chair may suggest taking more serious steps to meet the 2% inflation objective. That’s not a surprise, though, as the Fed members have recently forecasted the inflation to exceed its target in three years. That means that the Federal Reserve may announce additional measures to boost the current low inflation level. Thus, the tone of the Fed may change.

The meeting will be important not only for inflation comments but also for the fresh updates on the balance sheet’s expansion. The Fed has been conducting the expansion of its balance sheet since October, buying $60 billion worth Treasury bills per-month and lending the billions of dollars into the short-term money market. It boosted the stocks and weakened the USD. Though the Fed Chair pointed out that the current re-adjustment of the balance sheet has nothing to do with the quantitative easing, analysts think that the policy has similar effects to it. Economists widely expect the end of the expansion in spring, but the comments regarding it may affect the markets.

The markets will be closely watching the opinion of Jerome Powell on the coronavirus spreading and the uncertainties surrounding the next steps of the US-China trade deal. If the effects of these risks on the economy are acknowledged, they will have a negative impact on the USD.

Of course, the FOMC meeting tends to affect the USD pairs. Among the most volatile, we can highlight EUR/USD.

If we look at the H1 chart of EUR/USD during the previous meeting, the pair rose by 46 pips right after the release of the statement.

This time, the case may be different. Right now EUR/USD is sliding towards the 1.0980 level on H4. If the Fed is optimistic, there is a high chance of breaking this level and falling towards the next support at 1.0968. In case of a breakout, look at the 1.0945 level. On the other hand, if the Fed disappoints, we expect the retest of the 1.1022 level. After that, bulls may focus on reaching the 1.1040 and 1.1056 levels.

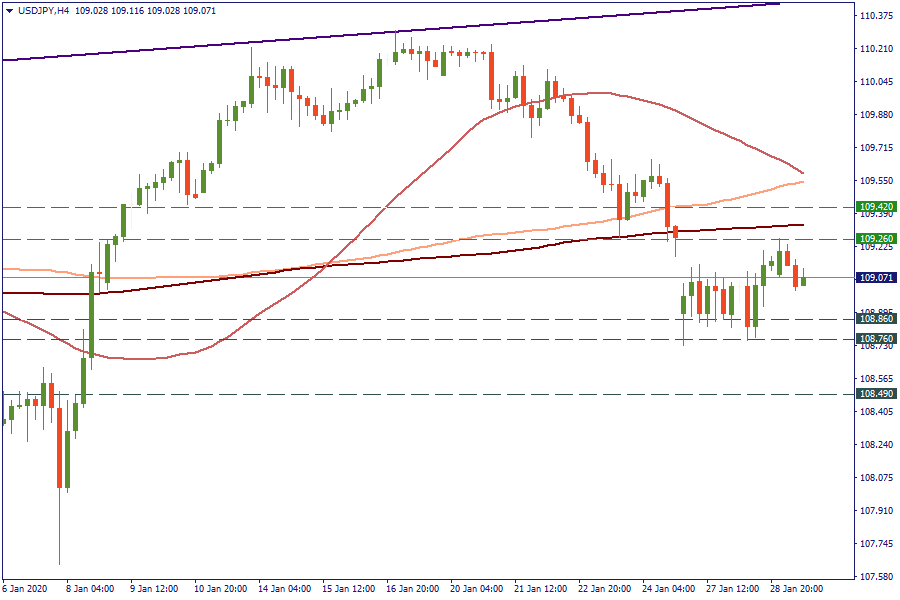

If you’re tired of EUR/USD, take a look at USD/JPY, which may move even lower on the dovish Fed, while the pair is well pressured by the 50-day SMA on the daily chart.

On H4, the dovish Fed may pull the pair to the 108.86-108.76 levels. The next support will lie at 108.49. The USD strength will help bulls to retest the 109.26 level. The next one will be placed at 109.42.

Now, while you’re waiting for the outcome of the meeting don’t forget to press

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later