The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Some traders love trading gold, others – hate. What’s the reason? Gold tends to fluctuate with a greater volatility than major currency pairs. For instance, the gold price rose almost by 7% in April, while the price of EUR/USD changed by only 0.7% in the same month. So, gold most of the time strongly sticks to the trend. If it goes up, it will continue increasing for a long time, and vice versa. You’ll be able to double or triple your account, if you catch the right impulse, but be cautious and always remember about the risk management and put stop losses. Also, there are some strategies that can help you to avoid the gold pitfall.

When one of these factors happens, the gold price tends to increase. Gold is a safe-haven asset, that’s why investors buy gold to preserve their capitals from loss in times of the market uncertainty and risk-off sentiment. For example, these days you can notice that the gold price reached unseen levels amid the coronavirus pandemic. We even got two factors that pushed gold upward: economic crisis and low interest rates.

Trade breakouts in the direction of the long-term trend. Here is the rule: when the monthly closing price of gold is the highest it has been in six months, that is a bullish signal, so you may consider going long on XAU/USD. In opposite, when the monthly closing price is the lowest it has been in 6 months, that is a bearish signal.

There is some statistical data that the gold price tends to increase in some months of the year and decrease in others. You shouldn’t base your analysis only on that, but it can give you an extra hint. Gold mostly rises from September to May and falls from June to August. Of course, these are generalities. Not every year the gold price repeats the same seasonal movements. It’s really important to follow news and monitor price movements on the chart.

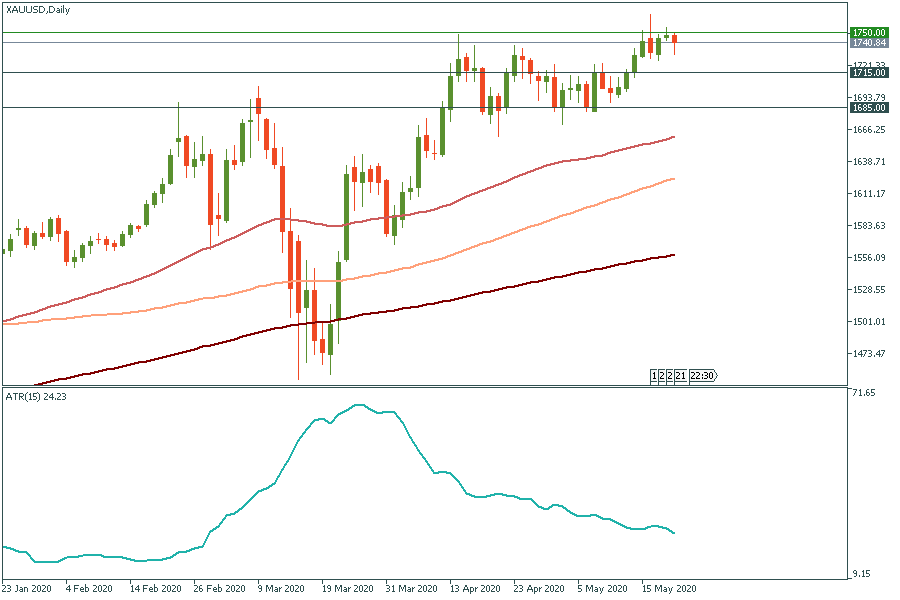

It has been already mentioned above that volatility really matters for trading gold. That’s why the Average True Range (ATR) indicator can really help to find entry points. What you need to do is simply open the daily XAU/USD chart and insert the ATR indicator with the 15 period. If the ATR indicator goes up, the gold price will break out to new highs. Let’s look at the chart below: the ATR value isn’t increasing now, so we can assume that it won’t be any significant change in trend soon. Based on all above rules, the price may move down a bit in the short term, but the long term remains bullish. It could have a pullback to 1715 or even 1685 and then surge again to 1800.

Now you have all tools to trade gold and get profit! Also it will help you to diversify your portfolio and reduce risks.

Here you can always find fresh news and analysis about gold .

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later