eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The highest inflation in the UK doesn’t leave a chance for their currency to feel good. Hundreds of households in the country are in a very fragile condition, trying to allocate their funds between high food and even higher electricity costs. How deep can the pound fall? FBS analysts explained everything in this article.

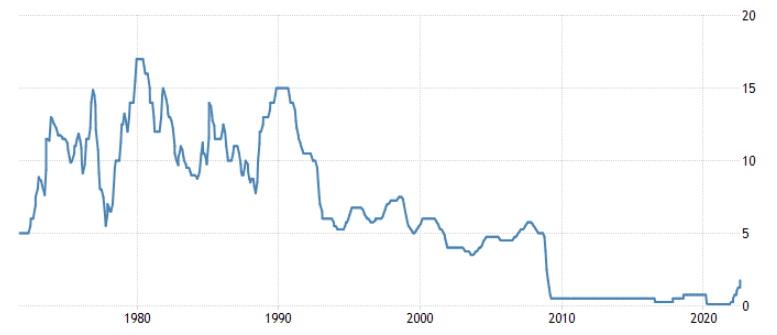

The annual inflation rate in the UK increased to 10.1% in July of 2022 from 9.4% in the previous period and slightly above market forecasts of 9.8%. It was the highest reading since February 1982.

Source: tradingeconomics.com

Gas prices are rising at an unseen speed, putting the UK on a path to 18% inflation next year. It would be the highest rate among larger western economies, Citigroup report says. Bank of America and Goldman Sachs have a slightly more positive view of the next year’s inflation at 14-15%. Still, these numbers press on the country’s currency. The Bank of England (BOE), which has a long-term target set at 2%, will have to react.

Tory, one of the leading parties in the UK, is electing a new Prime Minister after Boris Johnson’s resignation in July. Liz Truss, one of the candidates to become a new Tory leader (and the next Prime Minister), is accusing the BOE of being too slow to increase interest rates to deal with rising inflation. However, we cannot agree with her completely.

We should take into account that BOE was one of the first major central banks to hike the interest rate from 0.10% to 0.25% in December 2021. Back then, the rate hikes were intended to slow down the economy after the rapid money printing because of Covid-19. Nobody could have imagined that geopolitical tensions would go to a completely new level two months later, followed by the rapid growth in commodities. On the other hand, with a 2% inflation target, the bank should have reacted much earlier because price growth exceeded 2% in the middle of 2021, much before the first hike.

The last rate hike took place on August 4 as the Bank of England raised the rate by 50 basis points. Combine it with the current inflation of 10% and the war in Ukraine that is unlikely to end in 2022, and you will get a terrifying outlook for Great Britain. In 1982, the UK interest rate was close to 15%. We suppose the situation may become the same this time, and the bank will become more hawkish as prices skyrocket.

Some relief will reach the UK in case of a relatively mild winter. A Downing Street spokesperson urged people not to panic over energy supplies. He said the UK has one of the world’s most diverse and reliable energy systems. If so, price growth may slow down significantly (because it’s supported mainly by energy costs), and the BOE wouldn’t need to be extremely aggressive in its decisions.

Usually, a rate hike is a bullish factor for the currency, but this time it’s not so simple. The BOE failed to strengthen the GBP amid high inflation, and we may see a rise in the GBP only in two cases:

As for now, none of these scenarios seems likely, and with growing prices in the UK, the GBP will tend to decrease. In the GBPUSD pair, the double bottom pattern is trying to form. However, on the 1.1740 support breakout, the pair will reach 1.1450 in less than a month.

GBPUSD daily chart

Resistance: 1.2324, 1.2700, 1.3000

Support: 1.1740, 1.1450

The weekly timeframe is even more pessimistic, especially in case of the red zone breakout. A horizontal channel continuation pattern has been forming for the last five years. In case of a breakout, the movement will be massive, with possible, although long-term, targets at the parity level (1.0000).

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later