eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Despite a slight decline from its highest levels since 2002, around 109 range, it is just a correction, and the green king, the US dollar, will resume its rally.

On both sides of the dollar's strength equation, motives exist for it to continue its gains. One is betting on the continued weakness of its major peers, from the faltering European currencies to the weak Japanese Yen, as they suffer from their own problems. On the other hand, the Federal Reserve's insistence on keeping hiking rates and fear of recession will drive the demand for the dollar. The dollar is a winner in both cases.

The dollar rose against the world's major currencies, heading for its biggest rally in nearly 40 years and the third largest since President Richard Nixon broke the dollar's peg to gold more than half a century ago. Many reasons are contributing to the dollar's strength since the beginning of the year:

1. The dollar benefits in all cases, whether during periods of outperformance of the US economy or recession. If risks increase, people seek the strongest safe-haven, the dollar. And if the economic outlook for the US flourishes, we see the dollar benefiting from this positive situation.

2. The Fed's commitment to raising interest rates until inflation returns to its 2% target, even if it will sacrifice some strength in the labor market and slowdown in the US economy.

3. The fear of recession leads to higher demand for the dollar.

4. A widening gap between the hawkish Federal Reserve and other central banks would lead to a stronger dollar.

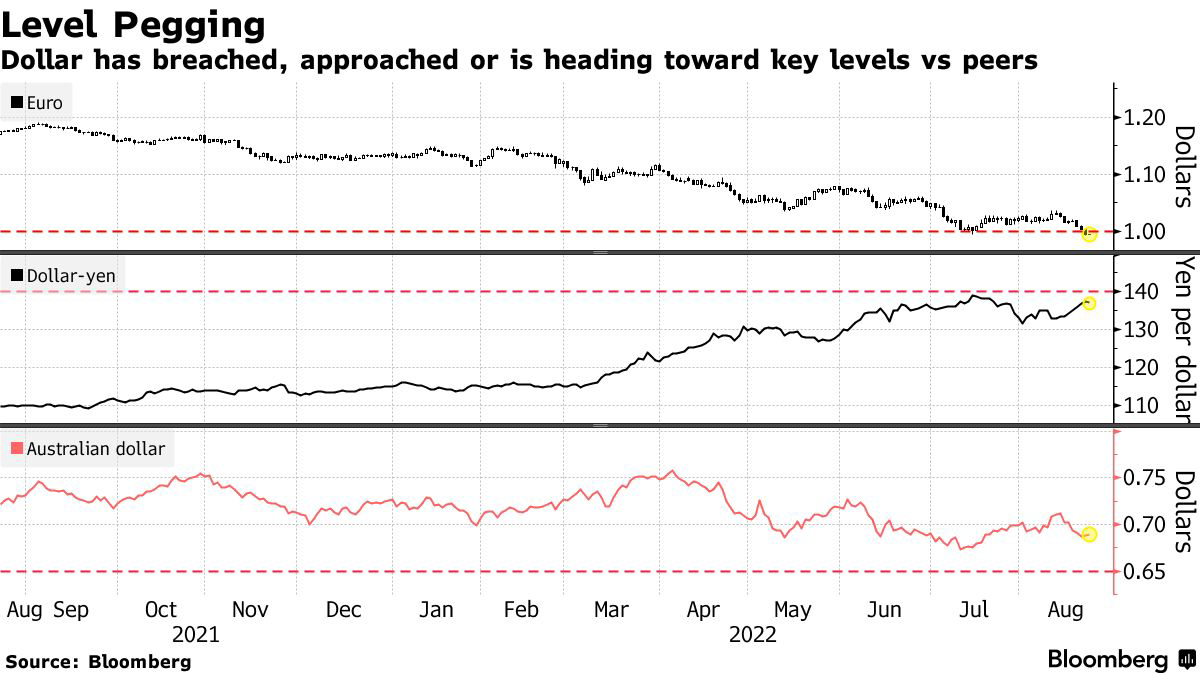

The rise of the dollar was manifested in the dramatic declines witnessed by the rest of the major currencies:

The strength of the US dollar has pushed the euro to parity, the lowest level for the euro since 2002. The euro is unlikely to recover from its lows against the dollar until Europe emerges from the natural gas crisis sweeping the region.

Hopes for a JPY recovery have faded, despite Japan's recent pickup in inflation. The dollar index is moving steadily towards 137 amid renewed interest in buying the dollar. The Bank of Japan's insistence on holding the ultra-easing policies will increase the yen's weakness against the dollar.

The dollar was the main obstacle to gold this summer. If the dollar index is not at 20-year highs, gold will be about $150 higher than current trading levels, according to Wells Fargo.

4. Even the Chinese currency reached its lowest level against the dollar in two years.

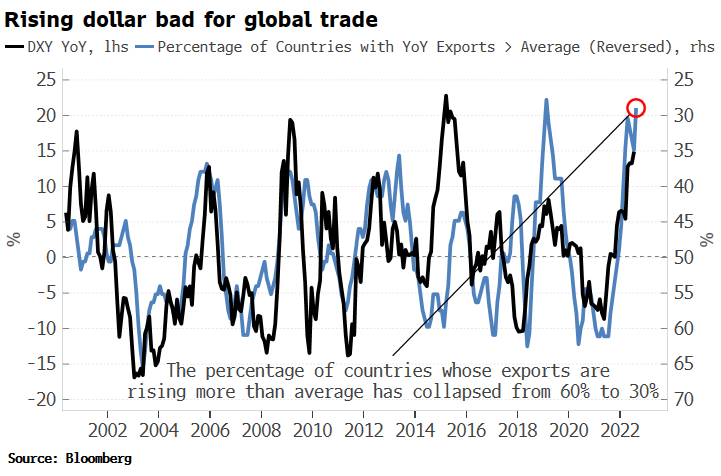

The main driver of global capital flows is trade. Almost all major commodities are traded in US dollars. A higher dollar will eventually result in lower global trade, with the price of everything higher in terms of foreign currencies.

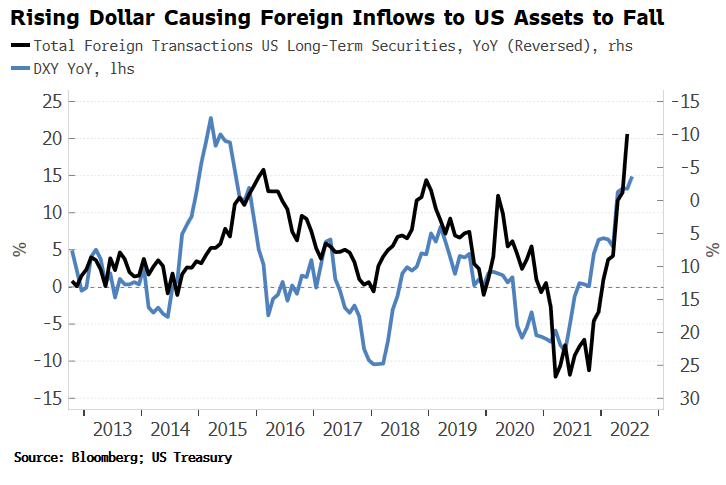

Global trade is faltering, which means capital inflows are declining. The dollar's recent rally could cause global trade to fall - and thus lower demand for dollar-denominated assets - which could lead to weaker dollar demand.

The rapid appreciation of the dollar is even more harmful to emerging markets, whose central banks collectively move the equivalent of more than $2 billion in foreign reserves every day.

On the technical side, all indications suggest that the dollar will continue to rise. All larger timeframes (daily/weekly/monthly) are bullish and optimistic, supporting the dollar's rally.

If the dollar index broke through the pivotal Fibonacci barrier at 109.14 and continued the break, it would be another strong bullish signal.

Despite the corrective movement of the dollar, all signs point to a return to the upside. So moments of weakness can be seen as buying opportunities before a possible retest at 109.00 and a potential new visit to 2022 high at 109.29.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later