The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Finally, it happened: on January 31, 2020, the UK officially left the European Union. It was a long way since June 2016 when the Brexit referendum took place. Many things have changed: the UK survived internal and external uncertainties, the economy suffered, the British pound depreciated, and Theresa May lost her position of the Prime Minister. Boris Johnson managed to take the country out of the EU. Nevertheless, it’s not the end yet.

The transition period will last until December 31, 2020. And it will raise many crucial questions such as sovereign risk, corporate earnings, market valuations and more. Britain will need to find its identity within global markets that may be not easy as it was a part of the European Economic Community since 1973. The European officials claim the transition period may go beyond December 31. What will the UK look like after Brexit? Let’s find out.

Recently Mr. Johnson declared: “If we can get this right, I believe that with every month that goes by, we will grow in confidence not just at home but abroad… I know that we can turn this opportunity into a stunning success.”

Despite inspiring comments by Boris Johnson, analysts predict a continuation of the negative effect of the Brexit both on the economy and the domestic currency.

It is not a surprise, Britain suffered significant investment outflows during the Brexit period. According to data, in ten quarters before March 2017, the foreign direct investment inflows in the UK economy was 300 billion pounds. In ten quarters after March 2019, the country suffered 40 billion pound outflows.

British equities are one of the examples. Since June 2016, FTSE 100 was much weaker than the S&P 500, Eurostoxx and Nikke.

Even if the country manages to negotiate on the Free Trade Agreement during the transaction period, the changes in the trade and economic environment within the country will not support investment inflows.

Research and Development Corporation forecasts the fall of the economic growth by 0.17 percent this year. The percentage may hit 0.39 percent by 2025 if the negotiations are extended. Sounds not that bad until will count it in real money. The country will lose 1.6 billion-pound this year. By 2025, this amount may rise to 3.75 billion.

The country lost its investment attractiveness during the Brexit era. According to Deutsche Bank AG, the UK will suffer more investment outflows. Moreover, they claim the British pound is still too expensive. Thus, a larger budget deficit and looser monetary policy will affect the British pound.

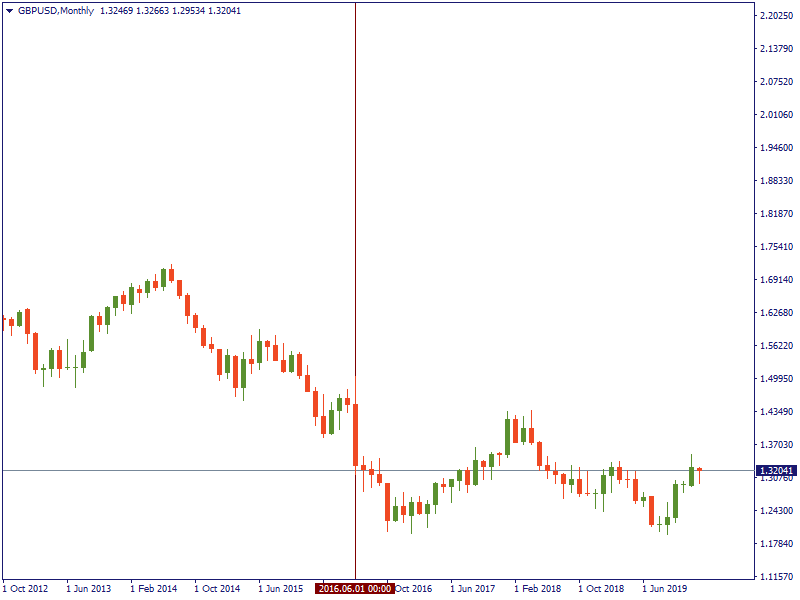

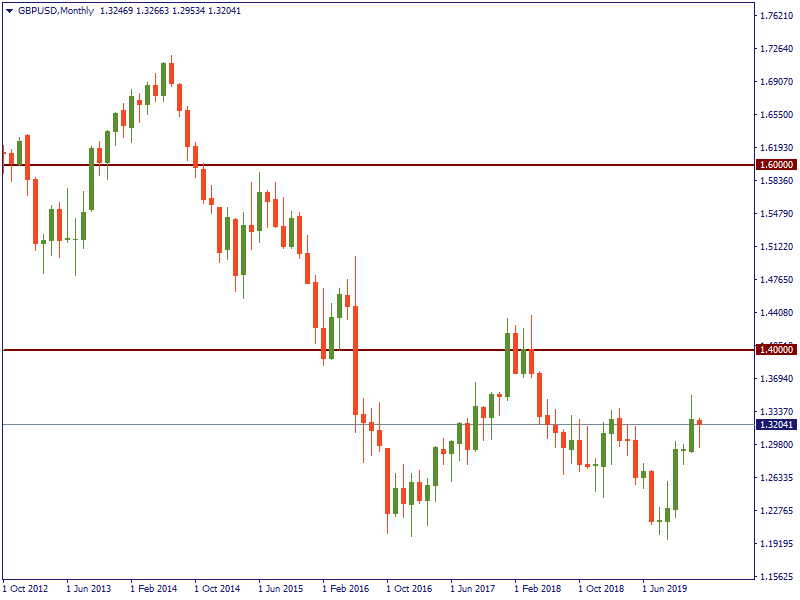

The British pound has been suffering since the Brexit referendum. Although the down trend of the GBP/USD started a long time before, Brexit worsened the situation.

Chief currency strategist at Societe Generale SA Kit Juckes argues the GBP will unlikely meet highs seen before the referendum. Currently, the British pound is 11% below its 25-year average level and 25% below the highs of the times when the British economy was growing fast.

Rabobank claims the political environment will keep weighing on the British currency due to the risks of the hard transition period. Boris Johnson has promised to come to the agreement with the EU until December 31, 2020, without any delays. That means, good and bad news will keep determining the direction of the GBP during the year.

The opportunity for the strong GBP against the USD may arise in the second half of the year when the USD may depreciate due to the Presidential elections and the GBP will be mostly boosted by the FTA. In case of the positive news on the agreement. The GBP will become stronger.

Societe Generale SA sees GBP/USD at the range of 1.40-1.60.

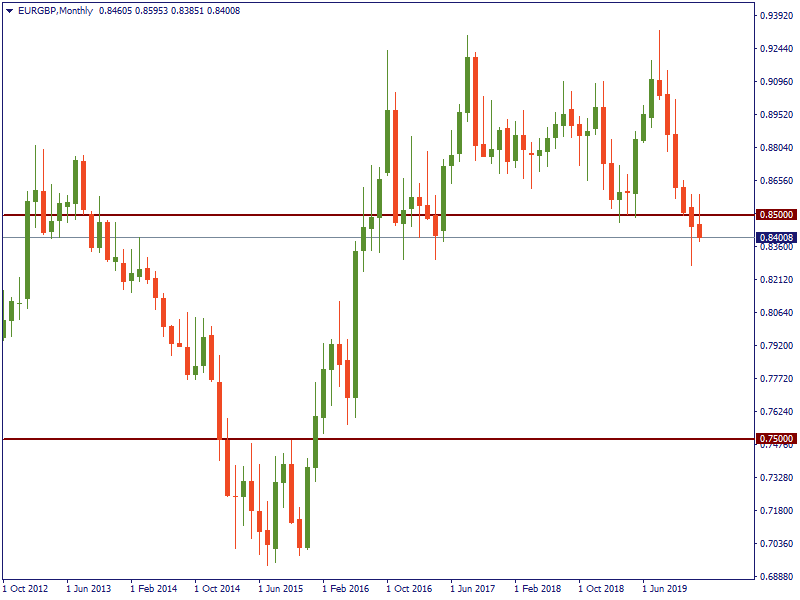

As for the EUR/GBP, the pair is supposed to be traded in a 0.75-0.85 range.

To conclude, we can say that despite the UK left the EU, the British economy and the domestic currency are under risk. If the transition perios is smooth, the negative effect will not be that harmful. In the case of the transition deadlocks, the UK will suffer a lot.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later