The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

After volatile months, the Australian dollar seems to step back from its top-performing positions. Now, traders of the aussie await the next driver that may bring the fresh wave of high and lows to the Antipodean currency. Will the meeting of the Reserve bank of Australia (RBA) on Tuesday at 04:30 MT time be that long-awaited trigger for the AUD?

According to the forecasts, the Reserve Bank of Australia will keep its monetary policy as it is now with the lowest interest rate of 0.1% and the massive bond-buying program extended in February. Back then, the RBA introduced additional $100 billion purchases at a rate of around $5 billion a week after the completion of the first package. The RBA Governor Philip Lowe reiterated that the interest rate would remain unchanged until 2024. The main factors that determined the bank's actions were unemployment and inflation levels.

Surprisingly to the markets, the employment level showed an impressive recovery in March. The Australian labor market posted 88.7K jobs, beating the forecast of 30.5K. The unemployment rate fell to 5.8% - the lowest level in almost a year. The RBA may provide its opinion on the boom in the labor market, but we don’t expect a major shift in its views, as the global economy is far from a full recovery and risks still exist.

Another factor the RBA keeps an eye on is a skyrocketing housing market. The property surged amid record-high interest rates and the federal government's HomeBuilder grants program.

NAB recommends following banks' steps on preventing the risks of the housing boom.

With no changes expected at the upcoming meeting, we recommend you focus on the overall tone of the statement. This may help you with short-term trading decisions.

If the RBA's tone is optimistic, the AUD will inch to the upside. These factors include optimism around employment, brighter outlook, and shift in the rate expectations.

Alternatively, gloomy expectations and cautious comments on recovery will be seen as negative factors for the AUD.

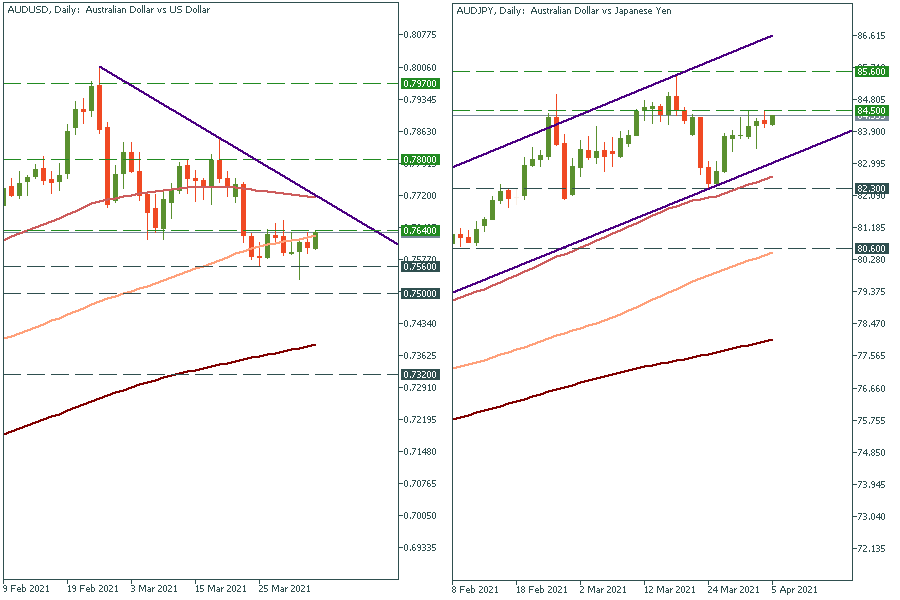

For longer-term trading decisions, you need to follow the technical outlook. Technically, traders need to prepare for the shorts of AUD/USD and AUD/JPY.

AUD/USD formed the pattern that resembles "Head and Shoulders" with the neckline at 0.76. The breakout of this level will lead to a further fall to 0.75. On the upside, the resistance lies at the upper border of the range at 0.7640. If bulls break it, the next key resistance will lie at 0.78.

As for AUD/JPY, for now, it is moving within the ascending channel. The pair reached the levels of 2018 and corrected. Now it is trading below the resistance at 84.50. If the strength of the AUD is limited, the support at 82.3 will be broken. This way, we will see the breakout of the channel's border.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later