The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The British pound has been enjoying itself versus the other major currencies during the past weeks. The GBP welcomed the news that Prime Minister Boris Johnson has finally managed to consolidate some power in his hands. Johnson has managed to set the general election for Dec. 12 hoping to get a Parliament that would be more favorable to his Brexit deal. So far this seems to be working: Johnson's Conservative Party has a good lead in the opinion polls.

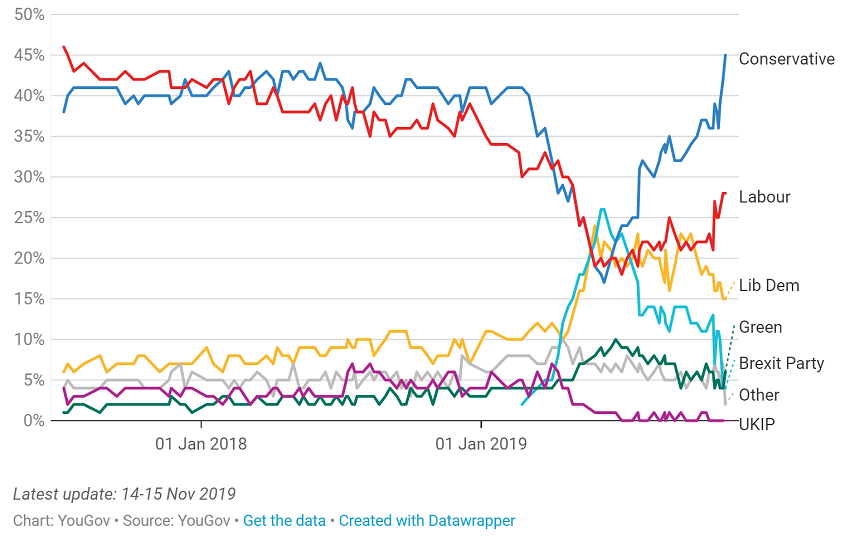

The most trusted source for public opinion is a resource called ‘YouGov’. The latest YouGov poll released on Nov. 16 shows that the Conservatives have the support of 45% of voters, while the Labour Party is supported by only 29% of the UK population. Other polls confirm the strength of the Conservatives. The most important thing is that, as time goes by, the Conservative Party gets further and further ahead of its main competitor. In addition, the Brexit party announced last week that it wouldn’t stand in 317 seats won by the Conservatives in 2017.

This situation is positive for the GBP because market players believe that if the Conservatives have a majority in the Parliament (for that they would need a lead of 10 percentage points or more over Labour), they will pass the Brexit deal in time and then start trade negotiations with the European Union. This would mean that the major source of uncertainty will finally be out of the way.

Of course, opinion polls by no means guarantee the results of the election, so one needs to be careful about the pound’s advance ahead of the event. The major risk for the GBP is that the polls start to narrow: in this case, we’ll see a bearish correction. Still, the market’s perception of things has definitely changed to a more optimistic view. This is reflected in the dynamics of GBP/USD, EUR/GBP, GBP/JPY, and other pairs. Notice that economic releases from the UK don’t affect the GBP much as all attention is focused on the election.

Looking ahead

Boris Johnson and Jeremy Corbyn (Labour) will face each other at the debate on Tuesday evening (Nov. 19, 22:00 MT time). The event may influence opinion polls, so take it into account while trading.

Technical levels

GBP/USD seems aimed at the psychological level at 1.30 after it rose above the October-November resistance line. The next obstacles will be at 1.3065 and 1.3115 (100- and 200-week MAs).

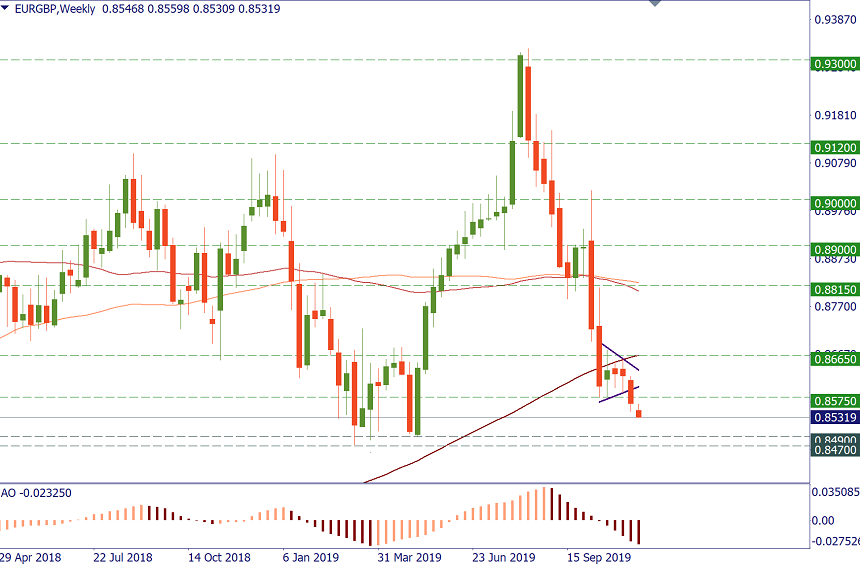

EUR/GBP closed last week at the lowest levels since the start of May an is vulnerable for a slide to 0.8490/70 (May/March lows). The speech of the new ECB President Lagarde and the euro area’s PMIs on Friday will also influence the pair.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later