Recently, for the first time in two decades, the euro reached parity with the US dollar…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

European Union is one of the most economically stable regions in the world. Inflation is usually low, so are the bank rates. Some of the banks even charge fees for depositing the euro. But coronavirus changed the game. Now, the European central bank needs to act to support the rapidly changing economy. This article will analyze the possible scenarios for the EU, and what's more important, look at the charts. There is a lot to see, let's go!

President Christine Lagarde's press conference fell quite clearly on the hawkish side on February 3. While there were no changes in the ECB's action, the comments during the press conference were interesting. As expected, all monetary policy instruments were left unchanged.

The ECB still expects a strong economic recovery and points to strong labor market developments over the coming months. At the same time, the risks to the economic outlook were still labeled as "broadly balanced," but the ECB stressed more downside factors than it has previously. Regarding the inflation assessment, the ECB spoke less about the expected inflation trajectory. Even more interestingly, the ECB reintroduced the phrase that "risks to the inflation outlook are tilted to the upside for the first time in years." This risk assessment had disappeared from the ECB's introductory statements when quantitative easing (QE) was started.

No one could have seriously expected the ECB to act today as there is simply nothing the ECB can do to bring down inflation immediately. But now, the market has a clearer view of the bank's plans. This year, Lagarde opened the door to a speeding up of asset purchase reductions and a rate hike. Considering all this and assuming that energy prices do not drive over the next four weeks, we expect the ECB to speed up the reduction of net asset purchases and bring them to an end in September. It will allow the ECB to hike the deposit rate at least once before the end of the year.

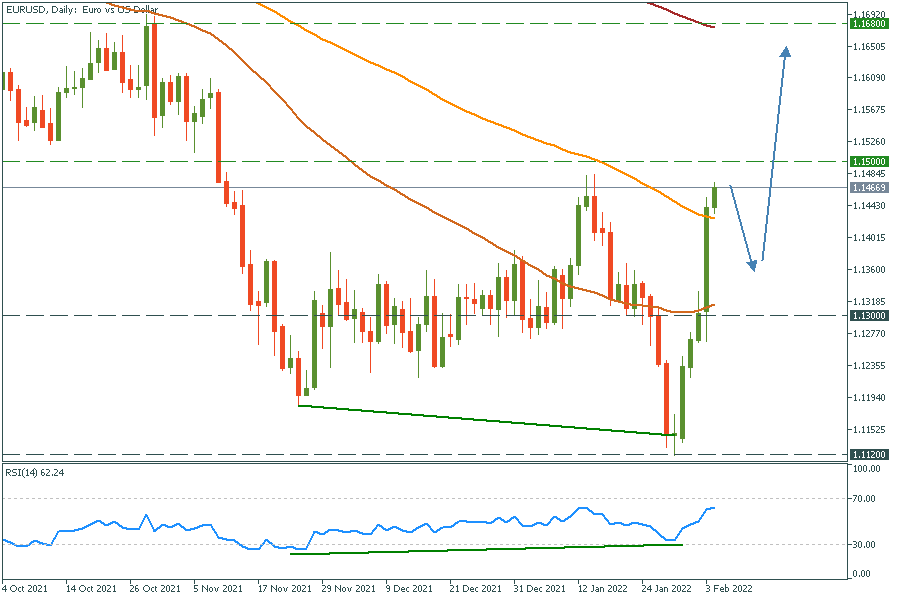

The support at 1.1180 got cleared, and bullish divergence on the RSI has formed. From now on, the euro looks strong against the dollar. We expect the pair to consolidate between 1.1300 and 1.1500 before the further surge.

EUR/USD daily chart

Resistance: 1.1500; 1.1680; 1.1900

Support: 1.1300; 1.1120

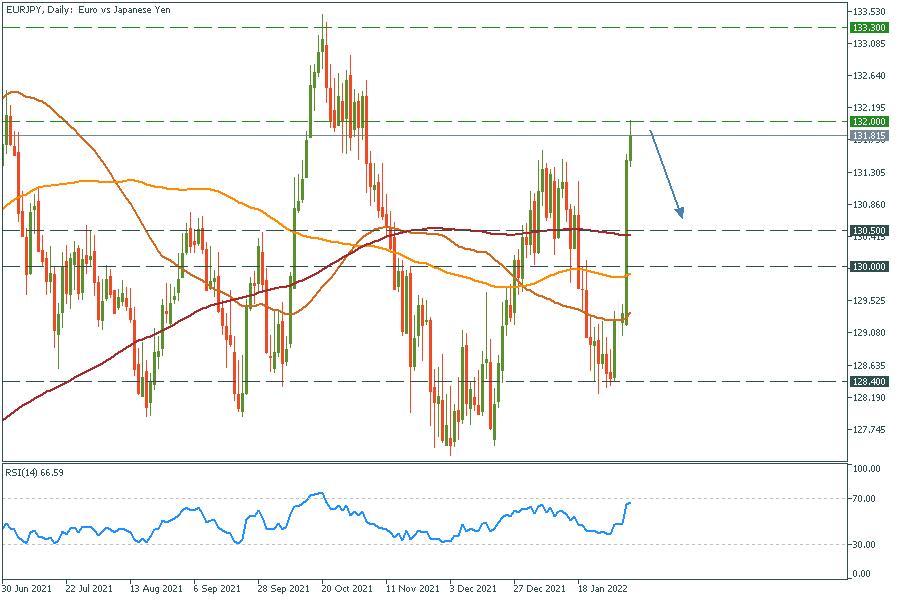

We see the reaction to round 132.00 round number in EUR/JPY. A pullback to 200-daily MA should happen before any growth.

EUR/JPY daily chart

Resistance: 132.00; 133.30

Support: 130.50; 130.00; 128.40

The same goes for EUR/GBP. Robust bullish momentum will slow down as the market decides the next movement. So a 0.8422 is a sweet zone for buy orders.

EUR/GBP JPY daily chart

Resistance: 0.8500; 0.8600

Support: 0.8422; 0.8380

To sum up, the euro skyrocketed a little bit too much and needs a minor correction. But overall, we expect EUR to rise in a matter of weeks.

Recently, for the first time in two decades, the euro reached parity with the US dollar…

The second earnings season of 2022 has almost begun. From banks and tech stocks to cars and the retail sector: in this outlook, we covered the most promising releases of this summer and made several projections on the companies’ prospects.

The stock market has reversed, and now it’s going lower and lower…

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later