eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

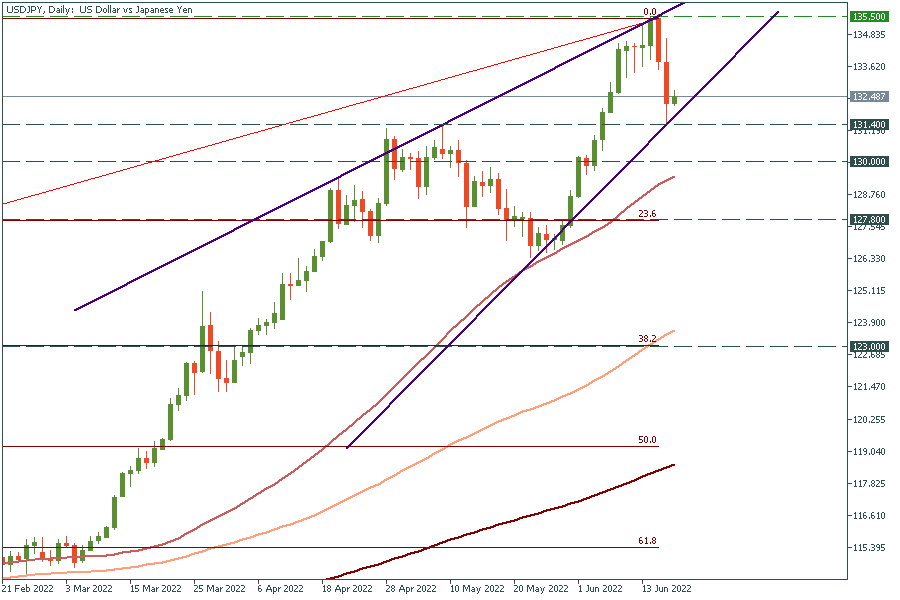

On Wednesday, June 15, USDJPY hit the highest level since January 2002 at 135.57. Despite a correction the same day after it happened, analysts believe the Japanese currency can break even lower against the USD. Thus, USDJPY may reach the 145 level by the year-end. Will the Japanese authorities respond to the weakness of the currency? Let’s find out.

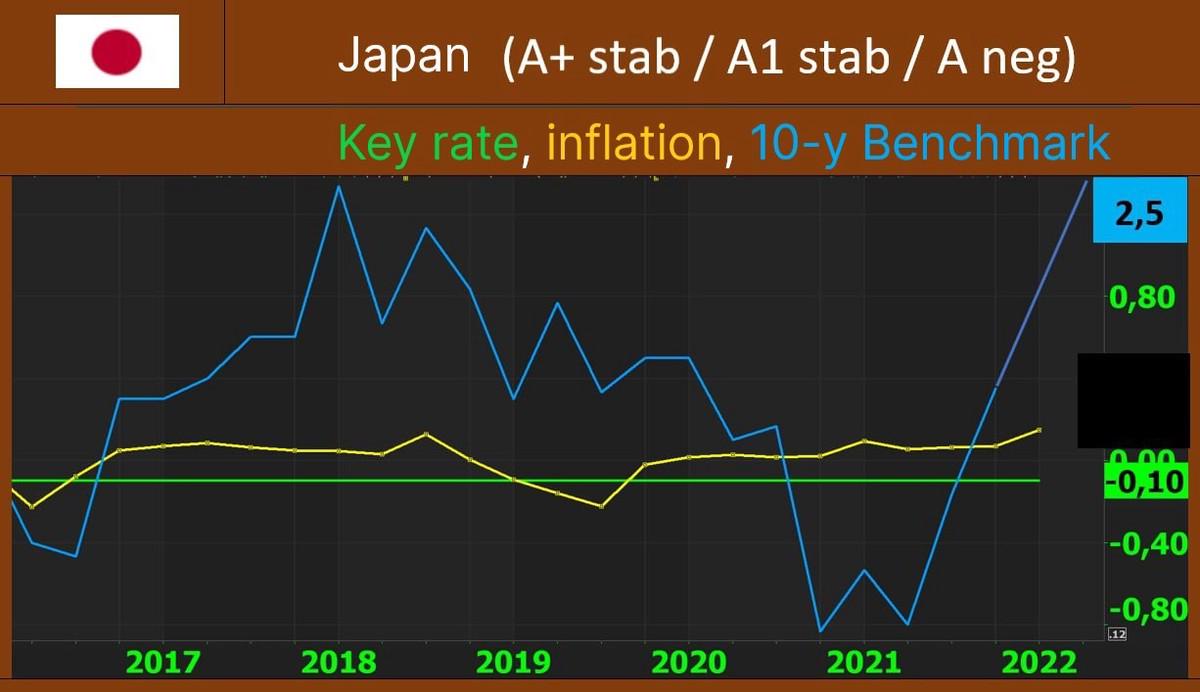

The first reason why the Japanese currency is making fresh lows lies in the monetary policy of the Japanese regulator. The Bank of Japan is the only central bank in the developed world that sticks to the ultra-loose monetary policy. That is, the BOJ has already kept the short-term interest rate unchanged at -0.1% for four years. At the same time, the bank unveiled the unlimited bond-buying program.

The Japanese economy has been going through a slowdown. While the real GDP grew by 1.7% in 2021, the Omicron variant, high imports, and rising energy costs resulted in a contraction of this indicator in the first half of 2022. In the first quarter of 2022, the Japanese economy was down 0.1% after an upwardly revised 1% growth in Q4.

Apart from the challenges brought by coronavirus restrictions, the Japanese economy was heavily pressured by the energy crisis that began after Russian military forces invaded Ukraine. According to Deloitte, the surge in energy prices reduces household purchasing power and limits consumer spending. As mineral fuel imports represent 20% of all imported goods to Japan, a 60% increase in prices will cost more than 10 trillion yen annually. At the same time, supply chain issues make it harder for a country to raise exports.

The following reason why the Japanese yen is weakening against the US dollar is linked to the surge in the US inflation and the Fed’s hawkish steps to pull it down. On June 15, the Fed raised the interest rate by 75 basis points to 1.75%, the highest increase since 1994. It also indicated the interest rate at 3.4% by the end of 2022 and 3.8% in 2023. The decision was bearish for the stock market, weakened the American stocks, and added pressure on Japanese government bonds and the yen. The US Dollar index that tracks the performance of the American currency surged more than 11% on ultra-high inflation and Fed's tightening steps.

The factors highlighted above may not seem surprising to traders, as the BOJ's loose monetary policy was kept in the game for a long time. The BOJ Governor Haruhiko Kuroda mentioned several times that he does not want a strong yen. He also said that the weak yen benefits the Japanese economy, as Japanese companies make profits overseas.

However, at the beginning of June, Mr. Kuroda seemed to change his rhetoric. In his unusual statement, he noted that the BOJ board was concerned about a big slide in the Japanese currency and was ready to "respond appropriately as needed." So, should we prepare for significant changes in the monetary policy of the Bank of Japan?

While the Japanese government pushes the central bank to act amid the weakening yen as fast as possible, analysts make their bets on further monetary policy actions by the BOJ. What does the Bank of Japan potentially has in its pockets that can help the JPY recover?

- The BOJ may intervene in its yield curve control. This is the program developed by the Bank of Japan in 2006. It maintains the interest rate at -0.1% and fixes the 10-year yield at 0%. Its goal was to reach the inflation target of 2%. However, this year the inflation has spiked above 2%, reaching 2.5%. If the central bank decides to change YCC, it may widen the band around the 0% 10-year yield target. Right now, it is hovering around +- 0.25%.

- The Bank of Japan may shorten the target yield from ten years to five. In this case, the regulator may need to speed up its bond purchases.

- The Bank of Japan may end the negative policy rate or the yield curve control. The Japanese yield will be more connected with the market if it happens. However, this decision will contradict the BOJ's loose monetary policy.

- Apart from monetary policy, the Japanese government may provide supportive measures to the sectors negatively affected by the weak JPY.

We believe Japanese policymakers may change their yield curve control and conduct fiscal policy measures if the yen keeps depreciating. However, the regulator is afraid to make such radical decisions for now. The BOJ Governor Haruhiko Kuroda invested a lot of effort into yield curve control, so it won't be an easy thing to refrain from it. That’s why the BOJ meeting on June 17 did not present any changes to the current monetary policy.

USDJPY bounced off the resistance line at 135.50 on June 15. After testing the ascending trend line on June 16, the pair has two scenarios. The first one is to wait for the retest of its recent peak at 135.50. From there, USDJPY will either reverse back to the support at 131.40 or aim to break the resistance and surge to the high of 1998. The resistance will lie at 145. In case of a second scenario, the pair will break below the support at 131.4 and move lower to 130.

Don’t forget that you can trade USDJPY, gold, EURUSD, and S&P500 with FBS! To do that, please be sure you’ve downloaded the FBS Trader app or Metatrader 5.

Bottom Line

Rising energy costs, inflation above 2%, and pressures on the Japanese bond yields due to tightening Fed monetary policy are problematic for Japan's policymakers to avoid. If the yen keeps sliding further, the most unsurprising central bank may be the last to react to the fast-changing conditions.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later