The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Crude oil had a rough time during the past few weeks. What let the commodity down and what should we expect in the future?

Staggering demand

Fears about the global economic growth slowdown represent a major hurdle for oil. When economies experience problems, their demand for the commodity slides together with their production. The World Bank lowered 2019 forecast for global GDP growth from 2.9% to 2.6% and emphasized problems in the world's key economic powerhouses.

The source of most evil is in trade conflicts. The United States is the main participant of those. President Donald Trump has already increased tariffs on Chinese imports. As a result, investors started to have serious worries about the potential recession in America. On the upside, we can’t say that US economic figures are totally bad, plus the Federal Reserve has let the market know that it will lower rates if the American economy keeps faltering. In addition, Mexico was able to strike an immigration deal with the United States, so at least we won’t get a new battlefield in the trade war. On the downside, even if it is possible to avoid the worst-case scenario, we definitely won't see the best-case one. The odds that global growth improves and beats forecasts this year are low. As a result, demand won't create a positive factor for oil prices anytime soon.

Plentiful supply?

America is storing and producing more and more oil. According to the most recent data from the Energy Information Administration (EIA), US crude inventories increased on a weekly basis by 6.8 million barrels. Gasoline inventories also showed a big increase. Moreover, US oil production keeps accelerating towards new highs. The analytical company Rystad Energy says that US crude output will rise to 13.4 million barrels per day (bpd) by December 2019 after averaging 12.5 million bpd in May 2019. The EIA forecasts that US output could rise to 13.38 million bpd in 2020. That is a significant input to the overall market.

At the same time, we shouldn’t forget about the geopolitical factors that may tighten global oil supply. First of all, there are the US sanctions on Venezuela and Iran. Secondly, there’s a resurgence of fighting in Libya since the start of April. The country’s been producing 1.176 MMbpd recently and analysts say that continued violence could wipe-out 95% of the country’s oil sector. Although the market has forgotten about these things for now, they may resurface in the upcoming months.

OPEC is losing its grip

A deal by the Organization of the Petroleum Exporting Countries and other producers including Russia to reduce output by 1.2 million barrels per day runs out at the end of June. The long-awaited bi-annual OPEC meeting will take place on June 25. There’s some uncertainty ahead of this event. While OPEC’s leader, Saudi Arabia, remains committed to production cuts, we can’t be that sure about the bloc’s allies. Russian President Vladimir Putin has recently said that Russia does not need higher crude oil prices and it was quite satisfied with Brent at $60-65 per barrel. If OPEC is left alone in its efforts to support the price, investors' confidence in production cuts will plummet and so will oil prices.

Summary. All in all, if we combine the fundamental factors all together we can make the following conclusion: during the next two weeks, there will be more negative than positive factors in play for oil. Trade war, abundant US supply and worries about OPEC will keep the commodity under pressure. The future direction largely depends on OPEC & Co., but if they manage to prolong cuts as they were before, then oil prices will have a fairly good chance to stabilize and finish the year at higher levels, such as the level of $70 for Brent. If they won't, Brent oil will be vulnerable to a slide to 2018 lows below $55.

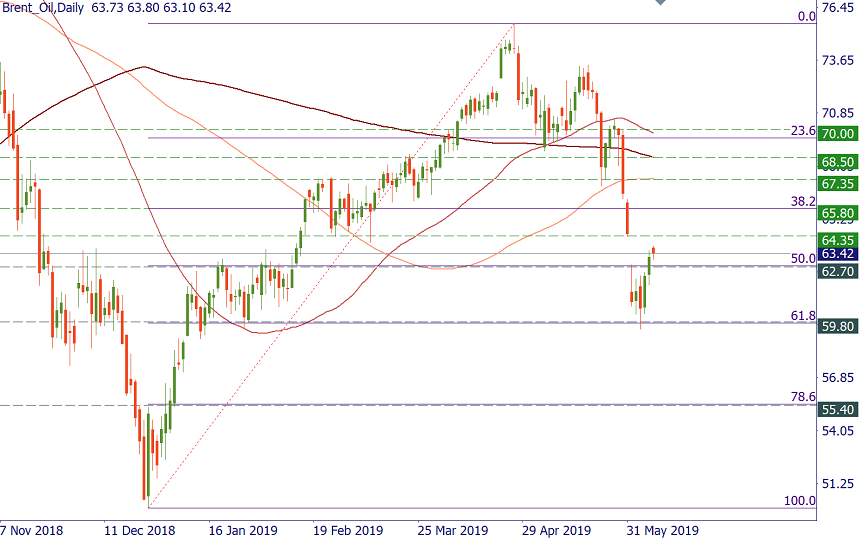

Technical picture

Brent oil managed to regain some ground by the end of last week and close above $63. There are plenty of levels which will provide resistance on the upside: $64.35, $65.80, and $67.30. The decline below $62 will open the way down to $60 and $55.40.

Brent oil, daily chart

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later