The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

In December 2019, when the FBS Analytical department wrote the forecasts for the upcoming year, no one could predict what would happen in just a month. Covid-19 appeared out of sudden and took the main stage from the endless US-China trade dispute, Brexit worries, and other "less important" stuff. That’s the nature of a black swan – you never know about it until it appears and affects your profit, future, and possibly even your mental health. As today is the last day of the first quarter, let’s look at the performance of the major currency pairs and analyze what may come next for them.

At the beginning of the quarter, when the virus only started its deadly journey in China, the spikes of the risk-off sentiment resulted in the weakness of commodity-linked and other risky currencies. The US dollar, alongside with the Japanese yen, took the lead. However, the situation changed last week, after the US government approved the $3 billion bill to support the economy amid the coronavirus crisis.

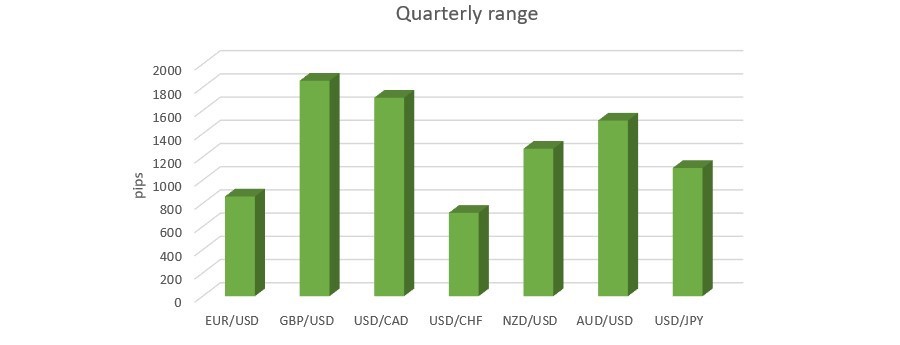

In the picture above we can see the change between highs and lows of major currency pairs. We can notice that the most volatile performance was by GBP/USD and USD/CAD. Let's look at both of them.

While the cable continued moving within the long-term downtrend under the 50-month MA, a combination of negative factors managed to pull it to the lowest levels since 1985. Here we can mention coronavirus shock, liquidation of longs after the Parliamentary election, and the late reaction to the pandemic by the British government. As the USD continued to serve as a safe haven for many investors, the British pound dropped against it to 1.1409. Now bulls are trying to push it back to the borders of the descending trendline. On the daily chart, the pair is trading near the 1.24 level.

New quarter’s opportunities: traders need to pay attention to the moves of the USD. The US is a leader in coronavirus cases, so the USD may get weaker on the new measures by the US government and the Fed and disappointing economic data. As a result, the British pound may strengthen.

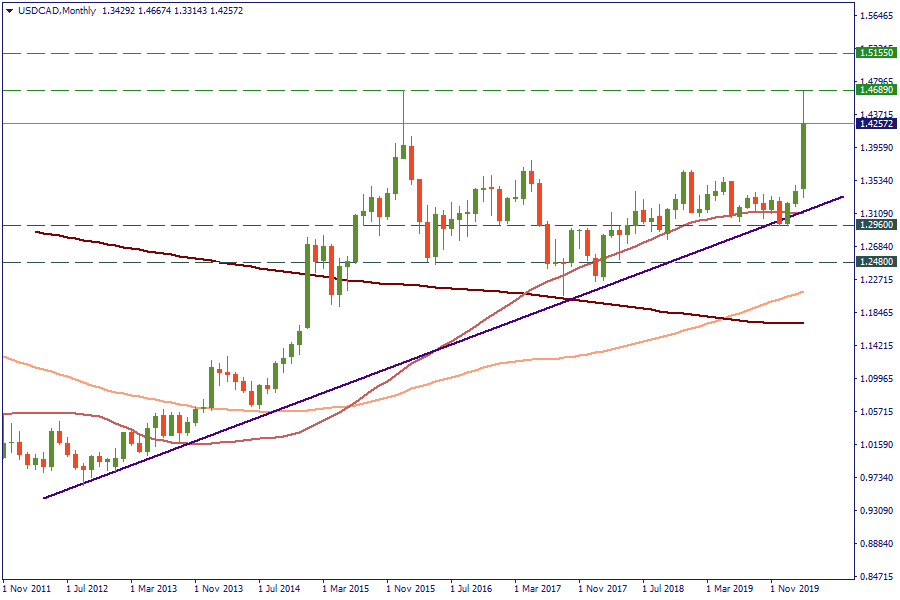

The Canadian dollar stays under pressure as the oil prices fall. Thus, USD/CAD retested the long-term resistance at 1.4689. On the monthly chart, the pair is well-supported by the 50-day MA and the 1.2960 level.

New quarter’s opportunities: Oil, oil, and oil. The most important driver of the Canadian dollar is the situation in the oil market. Even the recent rate cut by the Bank of Canada did little to the performance of the loonie. Read more about the analysis of oil prices on our website.

In the chart below, we highlighted the quarterly performance of the major currencies. No surprises, the USD/CAD pair was a big winner, while GBP/USD – a heavy loser. It is interesting to look at the "battle of safe havens". Both USD/JPY and USD/CHF did not change a lot, as investors preferred putting capital to the American currency at first. However, the USD rally ended last week with a downside correction, providing opportunities to the Swiss franc and Japanese yen.

We are entering the second quarter of this year with a lot of uncertainties. The pandemic continues, and governments try their best to fight the consequences and to smooth the negative effect of it. However, there is still a ray of hope. We are talking here about the Chinese example. Today, China reported a better-than-expected manufacturing PMI (52 vs. 44.9). Things are getting better there, and production is restored. Let's see how the situation will develop from here in Europe and the USA.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later