China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

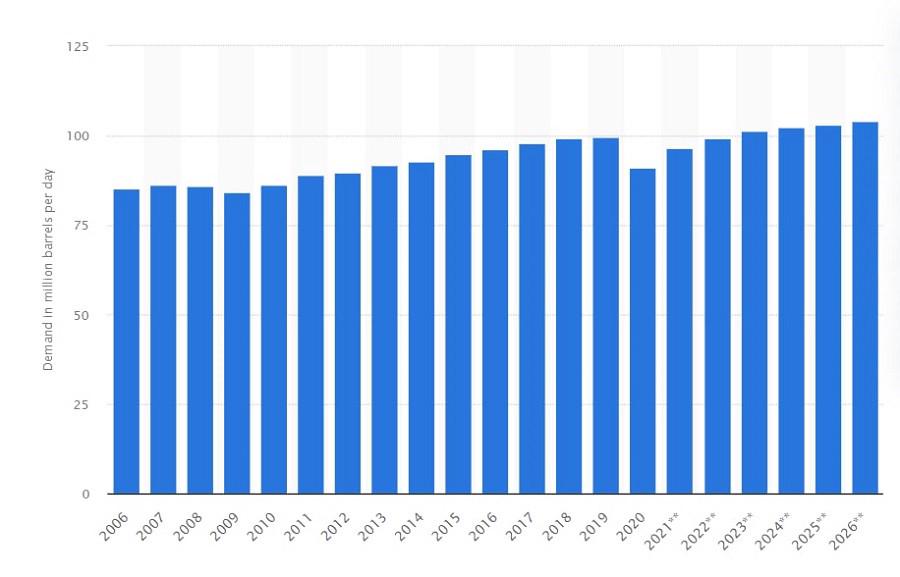

The oil prices rally and world central banks’ dovish monetary policy caused by the Covid-19 pandemic were the main reasons for current inflation growth. Oil has been the primary energy source for a long time, and this trend is far from the end, even though some countries try to replace it with renewable energy sources. This fact is confirmed by the IEA (International Energy Agency) data that the world oil demand will reach 101.6 mb/d in 2023, driven by the recovery of the Chinese economy.

Demand in million barrels per day

However, oil demand recovery might cause an imbalance in the supply and demand ratio. On Saturday, July 16, Saudi Arabia's Crown Prince Mohammed bin Salman said more investments are needed in fossil fuel and clean energy technologies to meet the global demand.

The Prince stated that Saudi Arabia, the third major oil producer, will raise its production capacity to 13 million barrels per day by 2027 from a capacity of 12 million now, and "after that, the Kingdom will not have any more capacity to increase production."

Moreover, the Prince added that adopting unrealistic policies to reduce emissions by excluding main energy sources will lead in coming years to unprecedented inflation, increase in energy prices, rising unemployment, and worsening of serious social and security problems.

Oil market watchers are balancing the fears of economic recession and the feeling of impending physical shortages.

The Federal Reserve might cause a recession by ultra-hawkish monetary policy that will send the global production and oil demand down. On the other hand, the Fed might also increase its inflation target to a 3-5% range and turn on the "printing machine" by 2024 to save the markets. In this case, the growing oil demand and the issues with further supply increases might push oil prices to historic highs.

Fortunately, the Federal Reserve provides markets with clear hints regarding its future monetary policy. At June's meeting, Jerome Powell stated the Fed might decrease the interest rate by 2024. However, June's CPI posted on July 13 added fuel to the fire. The actual numbers overperformed expectations sending the US inflation to new records. As a result, Citigroup Inc. economists announced they expect a 100 basis-point rate hike as the most likely outcome when the Federal Reserve meets in late July. But lately, Atlanta Fed President Raphael Bostic and Cleveland's Loretta Mester commented that the Federal Reserve doesn't consider raising key rates by 100 points and prefers to stick with a 75-basis points hike as planned.

To sum up, both facts highlight the Fed's intentions to avoid the recession in the US. That's why we might expect the oil market rally to continue.

The major importers' economies will get under a heavy pressure due to the oil markets extreme rally.

As we can see, the main oil exporters are China, the United States, and India. The United States is the number one oil producer in the world, while China and India get Russian oil at a great discount.

At the same time, such countries as Germany, Netherlands, Italy, Spain, United Kingdom, France, Belgium, and Japan are not even in the top 15 list of oil producers. Thus, these countries' economies are highly dependent on oil prices. The current situation proved it again as USDJPY gained 34% since January 2021, and EURUSD lost 17% during the same period. Another wave of oil price increase might push EUR and JPY even lower against the basket of major currencies.

XBRUSD, H4 timeframe

Locally, the price declined to 96.00 and bounced right after. On the daily timeframe, the price has formed the descending channel. We expect a breakout and a pump to the 115.00 – 125.00 range in the short term.

XBRUSD, monthly chart

If buyers close the monthly candle above the 125.00 – 126.00 range, the global oil market downtrend will be broken. In this case, the closest target for the “black gold” will be 140.00.

On the other hand, if sellers protect this level, the price will form a “double-top” with the target at 85.00.

USDJPY, monthly chart

On the bigger timeframe, the area between 145.00 and 160.00 looks like the first critical resistance zone for the pair. Until then, corrections might be considered a perfect buy opportunity.

EURUSD, monthly chart

EURUSD broke the global uptrend with the decline to the parity level. With a bounce or not, the price will head towards the 0.8500 support.

European Union and Japan need more time and resources to cool down the inflation and stop the downtrend of their local currencies due to the high dependence on the oil market, which might surprise investors and traders one more time this year.

China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

The US dollar index has lost around 12% since October 2022 till its local low at the end of January 2023.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later