eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

In the middle of September 2022, the Canadian dollar has fallen to a 2-year low against the USD. What are the reasons behind this performance? On the one hand, we have rising inflation in the United States, recession fears, and anticipation of more aggressive Fed monetary policy decisions. On the other hand, softer economic data for August in Canada hints at a possible pause in the Bank of Canada's rate hikes. As a result, traders may see the Canadian dollar’s weakness in the upcoming months. Let’s look at the situation in detail.

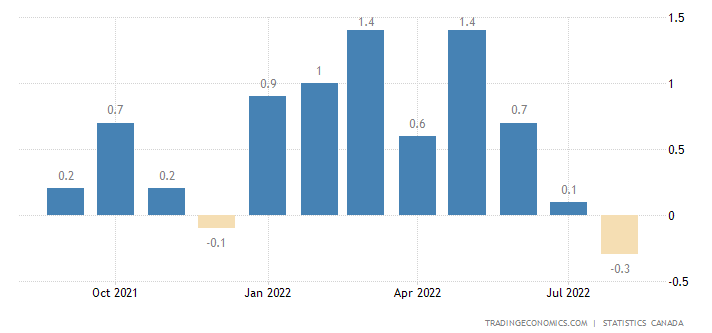

The economic data for August showed the first results of the Bank of Canada’s tight monetary policy. In August, the employment fell by 39.7K (vs. the forecast of +15K), and the unemployment rate was higher than the consensus (5.4% vs. 5.0%). At the same time, the headline CPI growth declined by 0.3%, lower than the expectations by two basis points.

Meanwhile, the Bank of Canada unveiled a massive rate hike by 75 basis points on September 7, pushing the rate to 3.25%. One may expect that the shift in the employment and inflation trends to the downside will push the Canadian regulator towards softer policy decisions. However, certain moments require attention. First, the losses in the labor market mainly were contributed by the education sector (50 000 jobs lost). That happens because the teachers' contracts expire before autumn. As a result, the figures might have returned to normal once the school year started.

As for the slowdown in inflation, at least three months of consecutive declines should happen to confirm the trend. It's essential to remember that the risks of higher inflation add to the uncertainty around energy prices amid the crisis in Europe and drought in China, the US, and Europe that can push global food prices higher.

Given the above, it's doubtful that the Bank of Canada will start monetary policy easing in the next few months. According to the BOC statement, the outlook for short-term inflation remains high. If the BOC shifts its inflation outlook to the downside, it will signal changes in its policy. For now, the market is pricing in the 50-basis-point rate hike by the Canadian regulator during the meeting on October 26. More interest rate increases are expected up until August 2023.

Despite the fact that the Canadian regulator will stick to the hawkish stance, there’s another dominant power that presses the CAD and other currencies. Of course, we are talking about the American currency. The hawkish Fed policy and global instability in the markets push investors, businesses, and households to turn to a more flexible and liquid USD. This way, they are hedging their capital against global risks.

On September 26, the US Dollar index broke above the upper border of the ascending trading channel and tested the 114 level.

As for USDCAD, the pair tested the resistance zone of June 2020 on September 26. Looking at the weekly timeframe, we can see that the pair has almost tested the weekly pivot resistance line near 1.3700. After the breakout of this level, we may expect a further rise towards 1.38. Here, we can see a pullback towards the recent border of the channel at 1.3350. However, if the breakout of the 1.3800 level happens, the next target for buyers will lie at 1.4100. On the downside, the support lies at 1.3500.

So, USDCAD is set to rise. But what about other currency pairs? Apparently, the current economic situation in Canada, compared to the unstable situation in Europe and Great Britain, supports the loonie in crosses. The charts below will provide you with a mid-term outlook for the most famous cross pairs.

The pair lost more than 4.5% on Monday with a long squeeze due to the GBP weakness. We can expect it to restore its positions and move higher towards the resistance lines at 1.5000 and 1.5260 (38.2 Fibo level). Here we may see a retest of the ground below 1.4710 or a prolonged consolidation, given the pound's weakness. If the Canadian dollar softens, the breakout of the 1.5260 level with a further rise towards 1.5760 (50 Fibo level) will be in focus.

The pair has been moving within the descending channel. After consolidating 1.3320 and 1.3000 levels, we may expect a further plunge to the support zone at 1.3000-1.2830. The next support will lie at 1.2450. However, RSI shows a bullish divergence, so the breakout of the resistance at 1.3320 will confirm the strengthening of the pair towards 1.37 (50-week SMA).

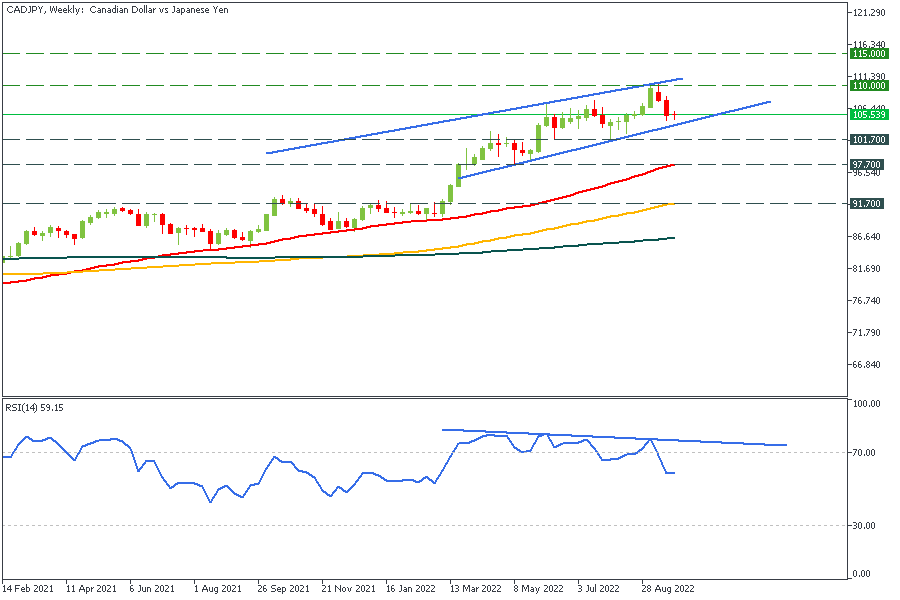

The pair has formed a bearish divergence with RSI. If it breaks the lower border of the channel and the support at 101.70, the support at 97.70 will be in focus. On the contrary, a strike above 110 will push the pair to 115.

The Canadian dollar seems like a good “buy” option for cross pairs’ traders these days as Canada’s economy remains relatively strong compared to European and British ones. Still, you must follow the employment and inflation updates and the BOC monetary policy decisions, which will be the primary determinants of the loonie's mood. The CAD will go lower if the BOC changes its attitude towards rate hikes.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later