eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Over the past year, the yen has been moving lower against the dollar mainly because of the overall USD strength. But there’s more behind the weakness of the JPY, including the global economic downturn, monetary policy decisions, and the deflationary model of Japan. How low could the currency go, and what drives USDJPY? Here’s what we’ve got.

First of all, the USD has been bullish for more than a year. The US dollar index has gained almost 19% since May 2021, pushing all other currencies lower against it. Over a period of 16 months, the index rose from 89.570 to 110.785. Some analysts still believe the greenback will soar even more to the 20-year high of 120.500.

I’ll discuss the monetary policy that resulted in the USD strength later in this article. What’s important is that no matter what currency we are talking about, they all suffered from the USD strength, and the JPY isn’t an exclusion. The yen lost 34.5% over the same period, moving from 107.63 to almost 145.00 yen per US dollar.

However, if to look at the EURJPY chart, the yen lost only 8% over the last 16 months, indicating that the reason isn’t confined to the USD. The JPY itself is weakening comparably fast. Thus, the fundamental reasons behind the movement should be substantial.

The first reason is Japanese monetary policy. In contrast to the US Federal Reserve, which has been hiking interest rates more aggressively to control inflation, the Bank of Japan (BOJ) has chosen a more dovish and loose policy after many years of deflation.

Deflation is a decrease in the general price level of goods and services.

Deflation occurs when the inflation rate falls below 0%.

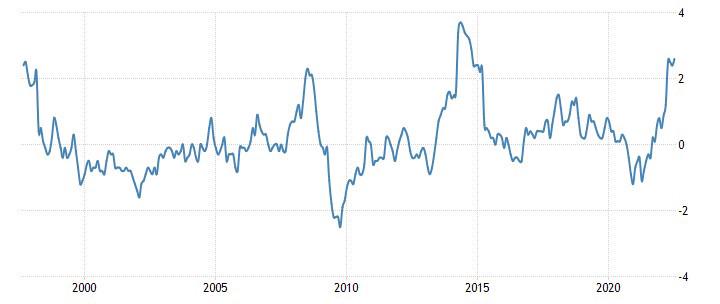

Japan is more often a deflationary country. Source: tradingeconomics.com

Because of deflation and Japan’s current account surlus, the yen is considered a safe-haven asset. This currency is primarily safe from unexpected volatile movements and provides a place for institutional investors to hold their funds. There’s a flip side, however. A deflationary economy often lacks growth because people don’t want to send their funds and prefer to accumulate them instead. And Japan isn’t an exclusion.

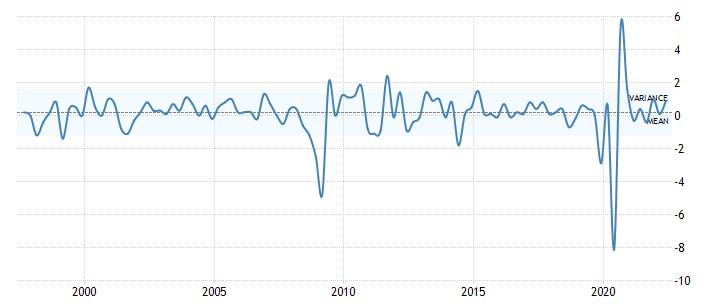

GDP change in Japan. Source: tradingeconomics.com

Over the last 25 years, the Japanese economy has grown by an average of 1.6% per year. This result is one of the worst in the world (Japan is 158 out of 193 countries). Governments try to maintain a low-but-positive inflation rate to speed up the economy. For example, the Fed aims at long-term inflation to be 2%.

Rising prices stimulate people to spend more money, boosting the economy and making everyone happier. The bank’s final target is to reach a 2% inflation (a little above 2.5% now) to “facilitate higher corporate profits and improved labor market conditions, and thereby generate a virtuous cycle in which wages and prices are sustained increases.” That’s why the Bank of Japan doesn’t want to lower inflation.

In addition, Japanese Prime Minister Fumio Kishida is considering printing more money to inject into the financial system. Although the primary goal of the stimulus is to fight inflation (as the bank said), printing money is a way to speed up the economy.

Printing money is a standard measure to help the economy in the present, but in the future it’ll result in even higher inflation and possible recession. As for me, this strategy has failed several times, and this time is no different. However, Japan may have to do its best to help people in times of worldwide recession.

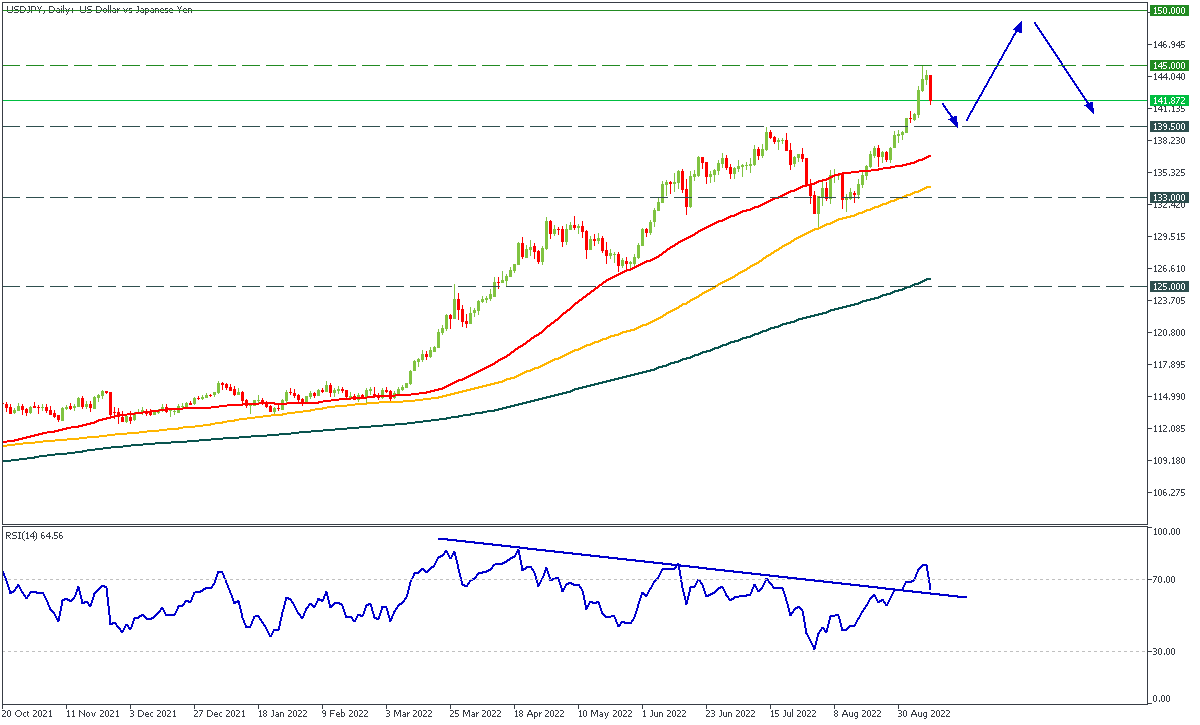

The BOJ governor Kuroda is discussing possible interventions into the JPY price to support the currency. I think these interventions will be either weak or short-term. Thus, they won’t affect the currency enough to stop it from falling. However, we may see a correction of USDJPY to the 139.50 support line. After that, I expect a consolidation with fake breakouts in both directions.

If nothing changes, monetary measures from the BOJ will weaken the yen further, pushing the USDJPY pair to the resistance of 150.00. It may happen over the next several weeks, so I consider this a mid-term trade worth trying. However, the level of 150.00 is a robust resistance line. The BOJ will likely take more serious measures to stop the yen;s depreciation. Thus, consolidation will likely occur at the 150.00 resistance, with a possible trend change.

USDJPY daily chart

Resistance: 145.00, 150.00

Support: 139.50, 133.00, 125.00

We’ll be looking deeper into the Japanese economy.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later