The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Stocks of tech and auto sectors are in the focus of traders these days due to the global chip shortage. Let’s find out what is going on with chips and why it’s important for traders.

Semiconductors are tiny conductors of electricity also known as chips. They are the key elements of many devices around us: electric vehicles, computers, smartphones, etc. As a cyclical industry, the semiconductor sector goes through periods of ups and downs. But overall, the long-term trend is to the upside as technologies are rapidly developing. Thus, stocks that are closely linked with the semiconductor industry are going to rise and rise no matter what.

Besides, the Covid-19 long lockdowns have speeded up digitalization, raising the already high demand for devices dependent on chips. And at the same time, most chip factories were shut amid coronavirus restrictions that led to the misbalance between demand and supply and resulted in the chip shortage. It’s widely expected that this shortage will last at least through the end of the year. Obviously, the current shortage will result in higher prices of semiconductors. While it would create difficulties for consumers to buy PlayStation 5 or Xbox, chip companies will benefit!

This company is the best among semiconductors. It offers the most efficient chips for gaming and personal computers. It has also special chips for cryptocurrency mining. In the past 12 months, NVIDIA is up about 116%. After a massive drop during late February – early March, NVIDIA has managed to recover the major part of that loss. When it jumps above the resistance of $590.00, the way up further to the all-time high of February 16 at $612.50 will be open. Sooner or later, the price will get to these highs and set fresh records. Support levels are the 50- and 200-day moving averages of $540.00 and $510, respectively.

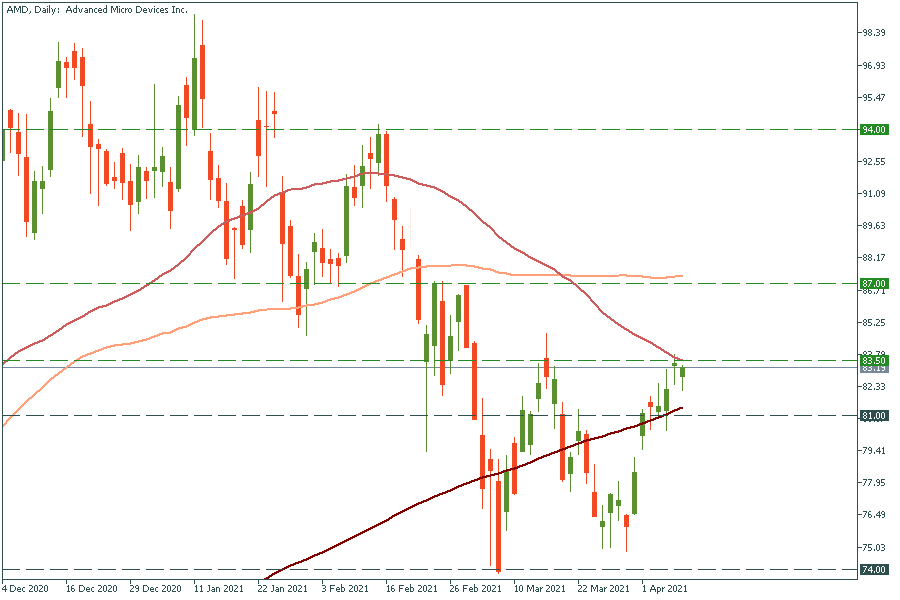

AMD, a CPU producer, is eating into Intel's market share in 2021! While 71% belongs to Intel, AMD controls 29%. And AMD is developing really fast. Besides, AMD outruns Intel with its revolutionary Ryzen 5000 – the best gaming CPU. Thus, AMD has a high potential to grow further. Let’s look at the chart! AMD is just below the 50-period moving average of $83.50. The move above this level will drive the pair to the 100-period moving average of $87.00. Support levels are the 200-day MA of $81.00 and the March low of $74.00.

You may wonder why we included Microsoft in this list as it doesn’t produce chips. However, the company has recently announced it would start developing its own chips so that it could become more independent from Intel. Besides, Microsoft has recently claimed it has secured a massive Pentagon contract worth over $20 billion! Investors were encouraged. Microsoft has been rallying up during the last few days. If it jumps above the key psychological mark of $260, the way to new highs will be open! Support levels are $240 (just above the 50-day MA) and March lows of $230.

Don't know how to trade stocks? Here are some simple steps.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later